The Russian invasion of Ukraine, in its seventh day on March 2, has not only spooked equity markets but also sent oil, natural gas and some metals, of which Russia is a major exporter, zooming, raising corporate earnings and economic growth concerns.

Crude oil is trading well above $100 a barrel, rising more than 40 percent in the past two months. The coordinated sanctions slapped on Russia by the US and its allies have added to the pressure.

Also read: Russian forces shell Ukraine's No. 2 city and menace Kyiv

“The stabilisation of crude or relatively milder sanctions, in our view, will be the key driver for global equities recovery in the short term," ICICI Direct has said in a note.

The correction, however, is a buying opportunity for investors as the long-term fundamentals remain intact with continuing economic recovery and expectations of robust earnings growth, it said.

ICICI Direct said higher dependency for utilities and trade on one country is now at the forefront. "Thus ‘Plus one’ policy push will accelerate globally, largely benefitting economies such as India, which is in a sweet spot amid PLI and other initiatives by the government," it said.

The note was referring to the production-linked incentives announced by the government for various sectors to boost manufacturing.

Also read: Economists trim FY22 growth forecasts after disappointing Q3 GDP number

"We continue to see this correction as an opportunity for investors to add companies with sustainable growth visibility," it said.

Technically, the low of 16,200 touched in the week gone by, is expected to act as a support for the Nifty, while 16,800-17,000 and the 200-day simple moving average (16,900) would be critical hurdles.

Also read: 12 stocks Motilal Oswal Financial recommends buying during ongoing market turmoil

"A decisive close above 16,800 along with cool off in VIX and crude oil prices will add fuel to the ongoing pullback rally towards 17,200," ICICI Direct said.

India VIX, which was at 28.6 on February 28, needs to cool below the 20-mark for the market to stabilise.

It foresees a technical pullback rally in the coming weeks. The index has not corrected for more than three consecutive weeks since April 2020, the brokerage said.

Here are 8 techno-funda picks suggested by ICICI Direct for next three months:

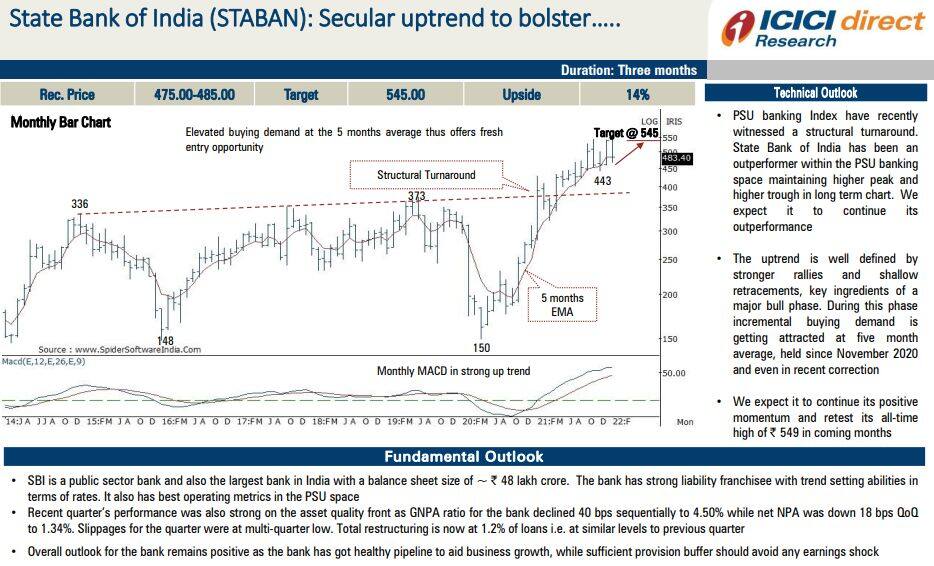

State Bank of India | Buying Range: Rs 475-485 | Target: Rs 545 | Return: 14 percent

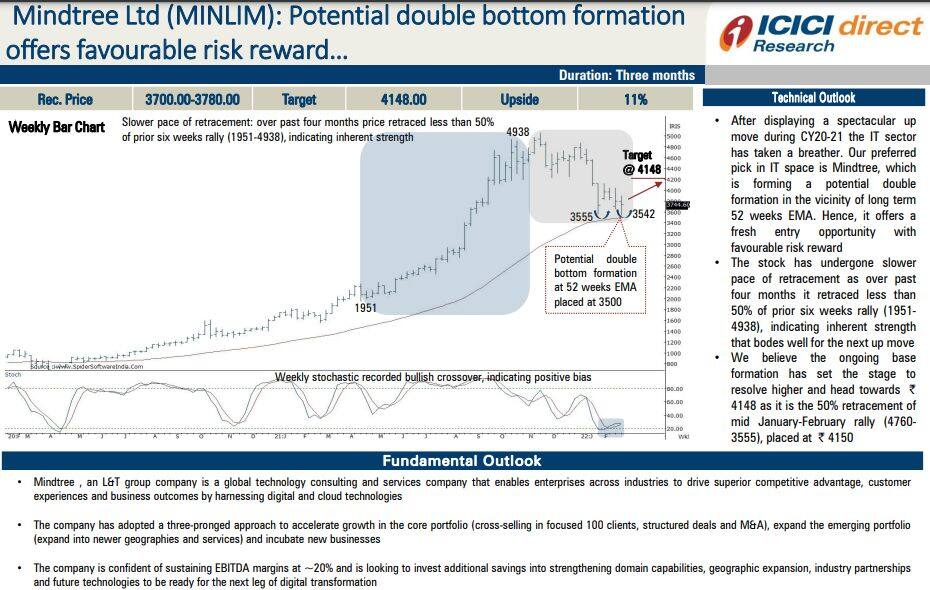

Mindtree | Buying Range: Rs 3,700-3,780 | Target: Rs 4,148 | Return: 11 percent

Ambuja Cements | Buying Range: Rs 295-310 | Target: Rs 348 | Return: 15 percent

Balkrishna Industries | Buying Range: Rs 1,720-1,790 | Target: Rs 2,010 | Return: 14 percent

Aditya Birla Fashion & Retail | Buying Range: Rs 258-268 | Target: Rs 305 | Return: 15 percent

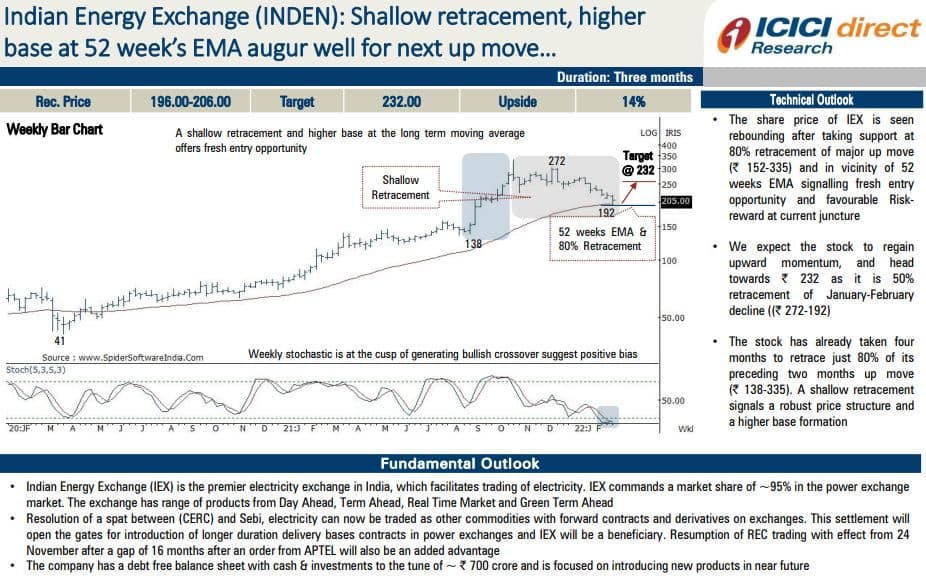

Indian Energy Exchange | Buying Range: Rs 196-206 | Target: Rs 232 | Return: 14 percent

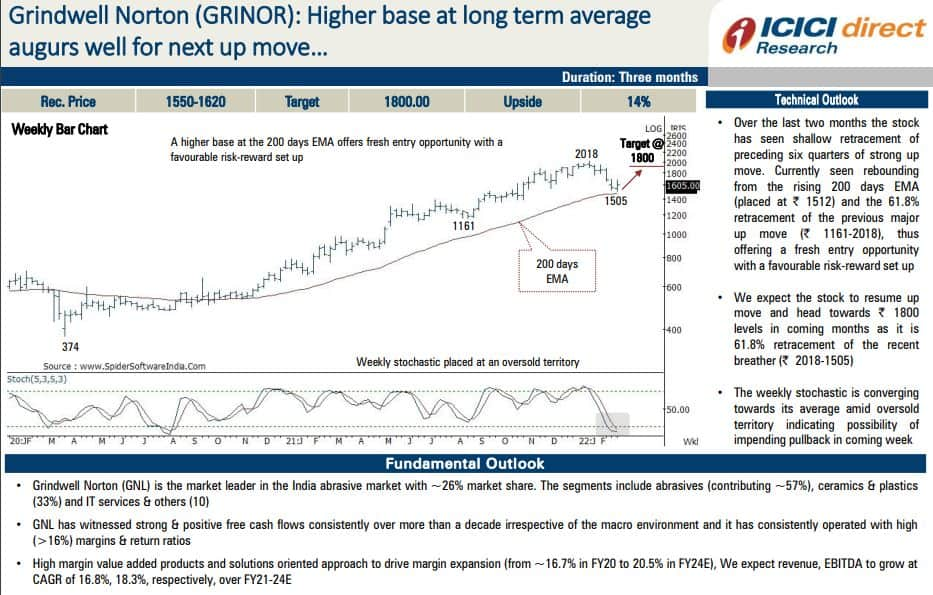

Grindwell Norton | Buying Range: Rs 1,550-1,620 | Target: Rs 1,800 | Return: 14 percent

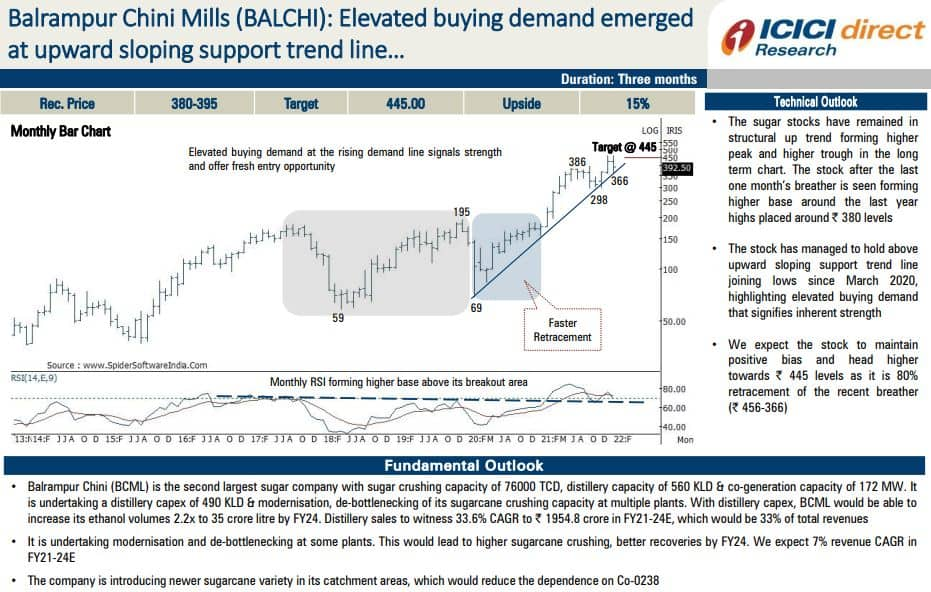

Balrampur Chini Mills | Buying Range: Rs 380-395 | Target: Rs 445 | Return: 15 percent

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.