Leisure, jewellery, out-of-home food and healthcare businesses, and particularly the premium brands from these businesses will benefit from the rising population of 'affluent' Indians, according to Goldman Sachs.

A report titled 'The Rise of Affluent India', authored by analysts in Goldman Sachs' Global Investment Research division said that several data points, including bank deposits, tax filings and credit card usage point to a fast-growing demographic of affluent Indians. The analysts defined affluent Indians as those earning an annual income of more than $10,000.

Also read: 'Affluent India' growing at 12% vs total population's 1%, divergence seen in stock performance: Goldman SachsSeveral stocks could benefit from the trend, but the analysts have picked out eight names within their coverage based on two factors. These eight stocks also have, according to the analysts, "high-quality businesses with strong competitive advantages, proven track records of past performance and market leadership within their segments".

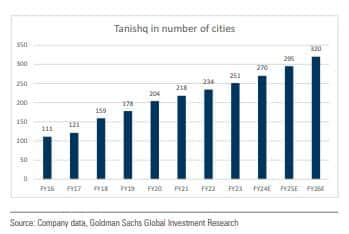

1. TitanTitan has a 7-8 percent market share in jewellery (FY22), which is largely the upper-income end of jewellery consumption given the higher mix of diamond jewellery and complex gold jewellery compared to other large organised jewellers and mom-and-pop stores. The brand is priced at a premium to most other jewellers in the market due to its aspirational brand, range of offerings and transparent policies around the exchange of old jewellery. As the analysts expect the cohort of ‘Affluent India’ consumers to grow by 12 percent CAGR, they also expect Titan to have a tailwind of increasing consumer footfall and rising market share. The brand is gaining market share by entering new cities, increasing its presence in wedding jewellery with more regional customisation, and international business expansion.

Store expansion will be a key growth driver for Tanishq.2. Apollo Hospitals

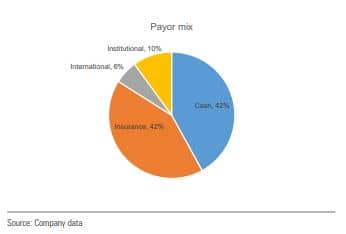

Store expansion will be a key growth driver for Tanishq.2. Apollo HospitalsWith the disease burden in the country shifting towards 'Lifestyle' versus communicable, Apollo’s ARPOB (Average revenue per occupied bed) is industry-leading in a combination of performing the largest number of tertiary/quaternary care procedures thanks to its brand capital and medical expertise from 13,200 practising doctors (both employed and service fee based). Also, the hospitals have been delivering clinical outcomes that are best in class, which are metrics that Affluent Indians will pay close attention to. As of FY23, 84 percent of Apollo Hospitals'payor mix comprised two segments of households — housesholds with higher per capital income and with a propensity to pay for high-end tertiary/quaternary care either out of pocket or houses that are sufficiently covered by health insurance — and the analysts expect the hospital brand to remain dominant going forward with further shifts towards insurance as awareness increases.

According to them, growth in health insurance has been one of the drivers of higher ARPOB.

he analysts believe Phoenix’s mall portfolio is poised for 25 percent EBITDA growth CAGR (FY23-FY27), driven by the rising cohort of ‘Affluent India’; in-mall tenant premiumisation and densification; and new mall additions. Beyond FY27, they expect its mall portfolio to deliver 10-12 percent annual organic consumption growth, in line with consumer discretionary growth. Also, they noted, that mature malls for Phoenix generate a post-tax ROCE of 15 percent, which provides cash flows to reinvest in the construction of new malls (with JV partners), without taking up leverage.

The report stated that 90 percent of consumption in Phoenix malls is in discretionary categories (see below, data as of H1FY24), which cater to the 'Affluent India' cohort.

Also, with Phoenix having established a track record amongst retailers, the analysts see lower earnings risk for Phoenix, compared to other malls, as typically any new mall announcement in a new city leads to at least 70 percent of the space being pre-leased with those retailers (based on historical trends).

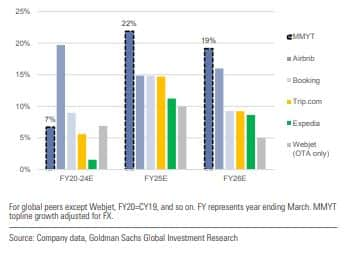

4. Makemytrip (MMYT)The Indian travel industry is expected to grow at 13 percent FY24E-27E CAGR (in line with growth in Affluent India), with online growth expected to grow faster at 15 percent CAGR over the same period. Within travel, the analysts expect relatively premium categories such as international travel and mid/high-end hotels to be the fastest growing segments (greater than 20 percent growth), driven by both a shift to online and rising income levels. MMYT is India’s largest online travel platform, with around 50 percent market share; and the analysts forecast 20 percent/34 percent FY24E-27E revenue/EBITDA CAGR, and view MMYT as a key beneficiary of double-digit growth in India’s ‘affluent’ income cohort, the core user base of the company. Also, the brand has exposure to under-penetrated segments of hotels and international travel, which will help the brand grow faster than the market; and the analysts don't see the competition dynamics in the Indian market changing much. With 5x the scale of its nearest competitor and a strong balance sheet, the analysts see limited risks to the company's market share.

The analysts forecast revenue growth for MMYT to be the highest among global peers.

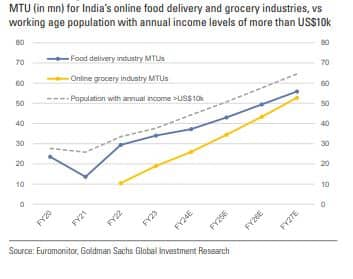

The analysts estimate the number of transacting users in India’s online grocery and food delivery industry (of 25-30 million monthly transacting users or MTUs) is a subset of the ‘Affluent India’ cohort, and expect growth in these segments to be indexed to the 13 percent population growth of this cohort. This is expected to be further aided by AOV (average order value) and frequency growth and shift to online, resulting in around 20-35 percent GOV (gross order value) CAGR across food delivery/online grocery industries over FY24E-27E. They forecast 22-45 percent FY24E-27E GOV (gross order value) CAGR for Zomato’s food delivery/online grocery, with MTUs being the biggest growth driver.

The analysts expect India’s food delivery and online grocery MTU base to track growth in income levels...

These are Yum India franchisees and the analysts are optimistic about KFC's growth prospects in India.

Quick service restaurants (QSRs) have been the fastest growing restaurant format in India with around 25 percent CAGR over FY10-20, the analysts noted and added that the QSR demand has come largely from the Affluent India cohort. The customer base of QSR in India at around 30 mn is a subset of their estimate of around 60 million ‘Affluent Indians’. Among QSR formats, the analysts preferred KFC in India because of its under-penetration — only 1,000 KFC outlets vs 3,000 pizza QSR outlets. The reason for this was the unattractive unit economics before FY19, which has since then been improved with initiatives such as lowering store sizes and higher share of delivery through food aggregators. The brand is also the dominant fried chicken player in the country.

Goldman Sachs' research team expects a cyclical recovery in KFC's average daily sales (ADS) per store, starting FY25.

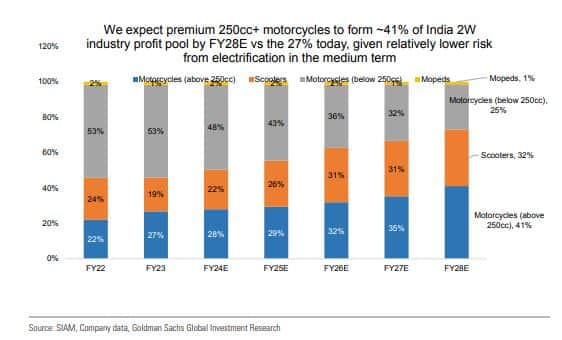

The brand is usually the second or third motorcycle in the customers' ownership journey, representing aspirational positioning. Royal Enfield's average selling price (ASP) is 3x the ASP of the average motorcycle. Also, the larger trend in the market is favourable for the brand. The analysts pointed to the 350cc+ market consistently outgrowing the 2W market — 11 percent CAGR vs flat growth of the broader 2W market over FY15 to FY23; and +15 percent vs +7 percent of the broader market in FY24. Therefore, the points in its favour are the company’s exposure to the premiumisation trend in automotive buying, lower near-term risk from electrification in premium motorcycling, strong pipeline of upcoming product launches (Shotgun 650 unveiled, 10 new models/refreshes expected over the next 3 years); ability to withstand multiple competitive threats even from Harley Davidson and Triumph, upside optionality from higher contribution by more profitable accessories/merchandising business.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.