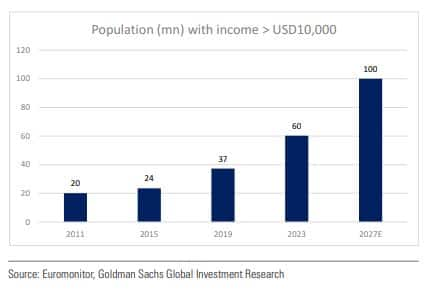

The segment of 'affluent' Indians, or those earning more than $10,000 a year, has grown at a much faster pace than the rest of India, according to a Goldman Sachs report.

"Corroborating data across tax filings, bank deposits, credit cards and broadband connections, we estimate that this consumer cohort (of affluent population) has grown at a 2019-23 CAGR of over 12 percent, compared to ~1 percent CAGR of India’s population," wrote the analysts.

Also read: Goldman Sachs predicts govt capex spend to decline to 10% in FY25, down from 30% in last 3 yearsAs of now, only four percent of the country's working age population--or 60 million--fall under this 'affluent' category. If they grow at the current pace, the analysts expect ‘Affluent India’ to grow to around 100 million by 2027.

This strong increase in wealth over the past four years have come from equities and gold, according to the report.

"India’s market cap has increased over 80 percent over the past 3 years with rising retail participation. Gold price also rose 65 percent over 2020-23. As a result, the total value of Indian holdings of equities and gold has increased from $1.8tn to $2.7tn. Property prices rose ~30 percent over FY19-23, compared to an increase of ~13 percent over FY15-19," the report elaborated.

Now this affluence is feeding back into the stock market, benefitting premium business categories in particular.

"In the past 12 months, our ‘Affluent India’ list of stocks has seen 7 percent upgrade in FY24 consensus revenue estimates, vs 3 percent downgrade for the broad-based consumption names," the report stated.

The biggest beneficiaries of this are expected to be categories such as leisure, jewellery, out of-home food and healthcare, and premium brands within all categories.

"While there are many stocks that are exposed to these segments, we prefer companies that also have a competitive moat," the analysts wrote, adding that their top ideas are Titan, Apollo, Phoenix, MakeMyTrip, Zomato, Devyani, Sapphire and Eicher. Their businesses derive their moat from strong brand (for example Titan, Eicher); entry barriers from high cost/gestation of creating new business (for example Apollo, Phoenix); and network effect (eg Zomato), the analysts wrote.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.