The monthly net inflows through SIPs may well have hit another record in May at Rs 20,904 crore – 11th successive month of a new high – but the SIP stoppage ratio has also hit an all time high – an alarming trend, according to industry players.

Latest data from the Association of Mutual Funds in India (AMFI), the industry body of mutual funds, shows that 49.74 lakh new SIP accounts were registered in May, compared with 63.65 lakh a month ago.

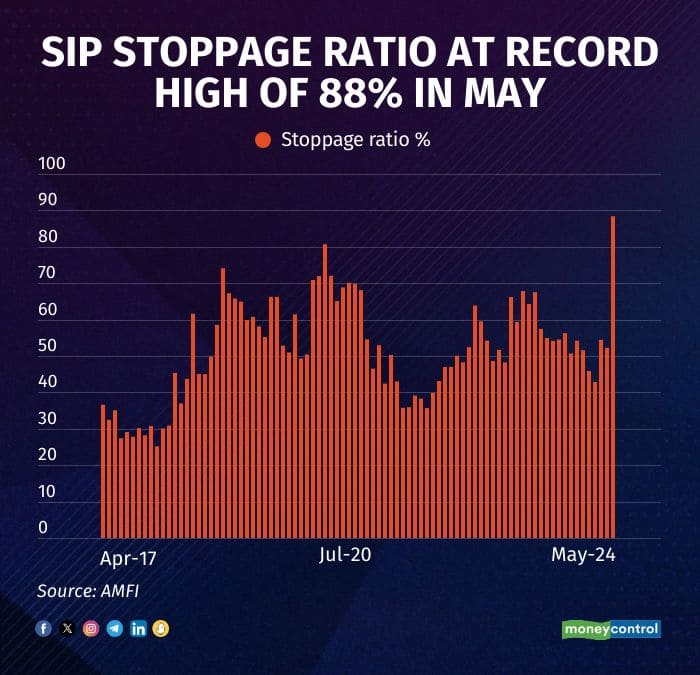

Further, discontinuations increased 32.21 percent during the period to 43.96 lakh from 33.25 lakh in the previous month. As a result, the ratio of SIPs stopped as a percentage of fresh SIPs registered – known as SIP stoppage or closure ratio in industry parlance – stood at 88.38 percent in May.

This has crossed May 2020 high when the ratio hit a record of 80.69 percent. The ratio, which measures the number of SIPs discontinued or expired as a percentage of fresh SIPs registered, comes amidst both new SIP registrations and discontinued ones hitting new highs in April and May.

markets

marketsAnalysts, meanwhile, believe that a combination of factors is fuelling this trend. Rupesh Bhansali, head of mutual funds at GEPL Capital, termed the trend as “alarming” and said that the ongoing KYC validation process could also be one of the reasons.

Many SIPs have been discontinued because KYC validations were not completed, he said while adding that the current market valuations that many find expensive is also acting as a catalyst as many investors are booking profits and discontinuing their SIPs.

Another factor, according to industry players, is that many banks and institutions have gone slow on SIP marketing on the back of uncertainty around the elections and the market direction.

A large section of investors is currently cautious in their approach and are waiting for a clearer market direction and this, in turn, has resulted in fewer SIP investments thereby impacting the numbers compared to the previous three to four months, they say.

Interestingly, even as the number of new SIP registrations is increasing, the rate of increase is lower than the previous months as bulk of the new registrations is being driven by new fund offerings. For instance, an NFO by HDFC – Manufacturing Fund -- collected around Rs 9,500 crore, including a significant commitment through SIPs.

“The all-time high stoppage ratio is definitely a cause for concern,” said Gautam Kalia, SVP and Head – Super Investor at Sharekhan by BNP Paribas.

“It suggests that people are trying to time the market, believing it to be overvalued. Some of them are waiting for the market to correct before re-entering. Another reason is that investors are looking at allocating lumpsum amounts given the large equity inflows and the collections from NFOs,” he said while adding that a lot of clients are also reallocating their existing SIPs across funds.

Meanwhile, Swarup Mohanty, Vice Chairman and CEO of Mirae Asset Investment Managers, believes that investors are behaving like long-term investors making short-term decisions.

He is of the view that SIPs should not be stopped due to market volatility, as discontinuing the monthly commitments indicates a lack of understanding of the concept. Investors need to embrace volatility, and more education is needed if they are stopping their SIPs, he says.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.