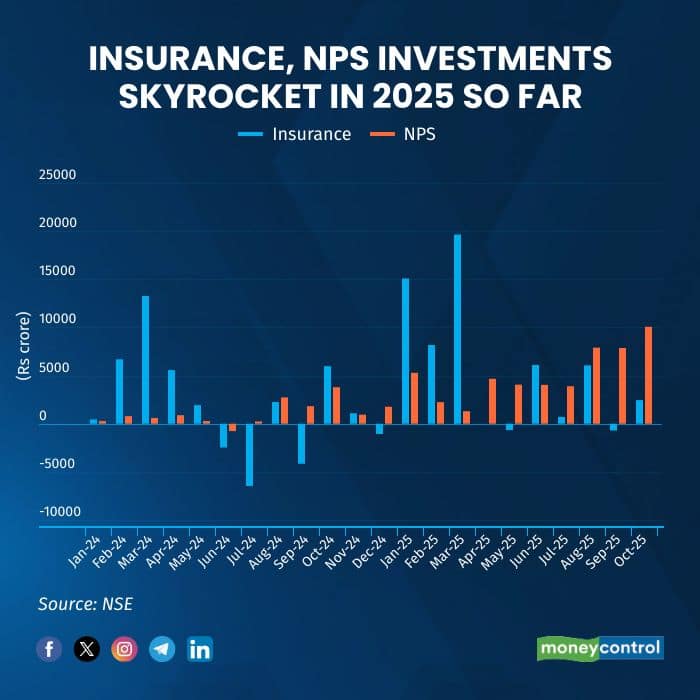

Insurance sector and the New Pension System (NPS) have emerged as key drivers of domestic liquidity in Indian equities, together investing over Rs 1 lakh crore so far in 2025 — the highest ever by these segments in a single year. The strong investment has continued despite muted stock market returns by India through the year.

Insurance firms have invested Rs 56,821 crore in equities in 2025 so far, while NPS has added Rs 51,308 crore, both marking record highs. These figures represent a sharp rise from their respective investments of Rs 23,062 crore and Rs 13,328 crore in 2024.

According to Saurabh Jain, Head of Fundamental Research, SMC Global Securities, the surge in investments from insurance and NPS is driven by regulatory flexibility, expanding assets under management, and the search for higher returns amid moderate debt yields.

Over recent years, the Pension Fund Regulatory and Development Authority (PFRDA) has allowed higher equity exposure—up to 75 percent in equities for Tier-I accounts and 100 percent for Tier-II—offering pension managers greater scope to benefit from India’s growth potential.

At the same time, the Insurance Regulatory and Development Authority of India (IRDAI) has permitted insurers to allocate a portion of their corpus to equities within prudential exposure limits, while maintaining a large share in government and approved securities.

Vineet Agarwal, Head of Insurance at PL Capital, said that liberalised norms, including higher FDI limits and stronger solvency positions, have enabled insurers to adopt more growth-oriented portfolios. Steady premium inflows, improved policyholder persistency, and economic resilience have encouraged long-term domestic institutions to position equities as a core asset class, marking a shift from conservative allocation toward more active market participation.

Under current norms, NPS permits up to 75 percent equity exposure under Active Choice for investors below 50, with allocations tapering as age increases. Auto Choice funds invest 25–75 percent in equities depending on the risk profile, while alternative assets are capped at 5 percent. Insurers, governed by IRDAI norms, follow exposure limits by sector and company, with recent relaxations allowing higher equity participation, particularly in BFSI and infrastructure sectors.

Akshat Garg, AVP, Choice Wealth, noted that domestic long-term institutions have become steady buyers as foreign investors turn cautious, reflecting rising confidence in India’s economic fundamentals. Growing household savings through insurance and pension channels and a structural shift toward market-linked products such as ULIPs and NPS schemes are sustaining strong inflows.

The surge in insurance and pension investments aligns with continued strength in mutual fund activity, which has seen Rs 4.44 lakh crore deployed in equities this year, compared with Rs 4.15 lakh crore in 2024.

In contrast, banks and domestic financial institutions have remained net sellers. Banks have sold equities worth Rs 16,941 crore, while financial institutions have offloaded Rs 158 crore so far in 2025, against net selling of Rs 10,132 crore and Rs 347 crore, respectively, a year earlier.

Overall, domestic institutional investors—including banks, financial institutions, insurance companies, and NPS—have together invested Rs 6.29 lakh crore in Indian equities so far in 2025, up from Rs 5.22 lakh crore in 2024.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.