The weightage of private sector banks in the Nifty Bank index has shrunk as these stocks traded lower than last year. The shares of public sector banks, in contrast, have seen a sharp rally in this period, raising their weightage in the index.

There are multiple reasons for this differential pattern in the trade of banking stocks. Public sector banks have better access to low-cost deposits because of a much bigger base of savers and a better network. This helps them keep their cost of funds low. On the other hand, private sector lenders find it increasingly challenging to collect deposits. As a result, they have been forced to raise the deposit rates and also borrow from the wholesale market where the cost of funds are much higher. This hurts net interest margins, which is the interest earned on borrowed funds minus the interest paid for them.

This apart, the perception of public sector banks has changed because the outlook on public sector undertakings as a whole, has turned bullish.

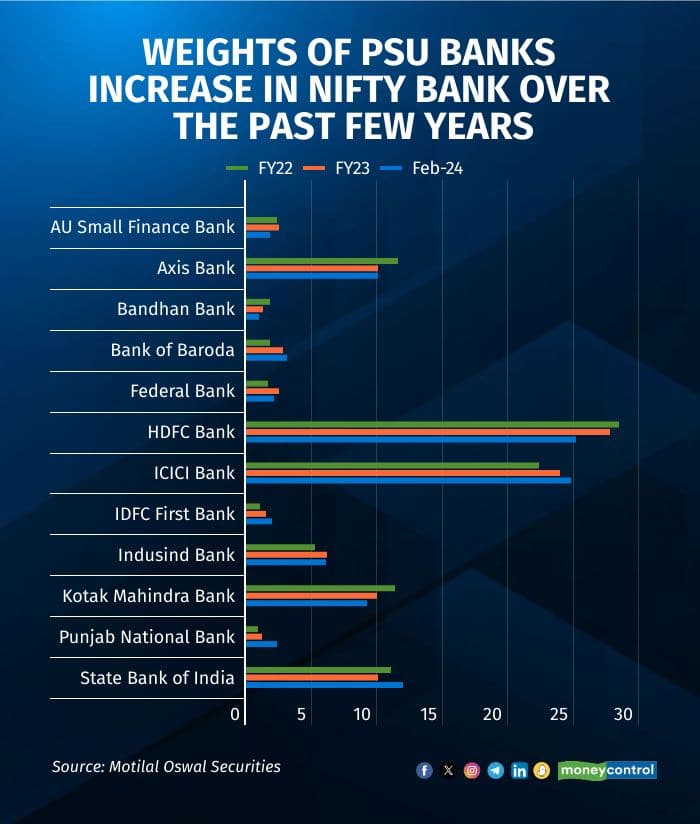

AU Small Finance Bank’s weight fell to 1.8 percent in February 2024 from 2.4 percent in March 2022. For Axis Bank, the weight dropped from 11.6 percent in March 2022 to 10.1 percent in February 2024, while for Bandhan Bank, it went down from 1.8 percent to 1 percent. HDFC Bank, the largest private lender, saw its weight erode to 25.2 percent in February 2024 from 27.8 percent in March 2023 and 28.5 percent in March 2022. Kotak Mahindra Bank's weight in Nifty Bank declined to 9.2 percent in February from 10 percent last March and 11.4 percent in the previous comparable month.

ICICI Bank's weight in Nifty Bank, however, went up by a notch to 24.8 percent in February 2024 from 24 percent in March 2023 and 22.4 percent in March 2022. And, IDFC First Bank nearly doubled its weight to 2 percent in February 2024 from 1 percent in March 2022.

PSU Banks, on the other hand, show a consistent rise in weight in Nifty Bank Index. SBI's weight rose to 12 percent in February 2024 from 10.1 percent in March 2023, for PNB it was 2.4 percent from 0.9 percent, and for Bank of Baroda to 3.1 percent in February 2024 from 1.8 percent in March 2022.

The collective surge in the state-run lenders has taken the PSU bank weight in Nifty50 index to a seven-year high of 3.1 percent in February from 2.6 percent last March. Analysts said improved operational performance has enabled the state-run banks to raise capital in public markets and generated substantial demand in recent QIPs, reducing government shareholding. This has increased their free float market capitalisation, contributing to a higher weight within the Nifty for PSBs.

PSU banks have staged a strong comeback, outperforming the Nifty Private Bank index with the Nifty PSU Bank Index delivering a remarkable 162 percent returns since March 2022, compared to 24 percent for private banks. Despite the sharp rally and re-rating, PSU stock valuations appear reasonable relative to business growth and profitability, analysts said.

According to Motilal Oswal Securities, with robust balance sheet liquidity, PSU banks are well-positioned for healthy growth and resilient margins, benefiting from MCLR repricing and favorable bond-yield trends. Capital raised from the market positions them for potential gains in corporate demand post general elections, supporting sustained performance and sector re-rating in a conducive macro-environment.

The weight of Banking and Financial Services and Insurance (BFSI) shares in Nifty has dropped to 32.1 percent, a significant decrease from 37.7 percent a year back. This marks a notable 5.6 percent decline in the index's banking weight. The BFSI weight last fell below 30 percent in March 2016.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.