IndusInd Bank dropped from the league of 10 most-valued lenders in terms of market capitalisation after its stock declined most since pandemic dragged by poor earnings in the September quarter.

The IndusInd Bank stock dropped 18 percent, making its steepest fall since March 2020, to hit over one-year low of Rs 1,065 a share. As the lender's m-cap went down to Rs 81,000 crore, it moved to the 12th spot on the list of most valued banks, while Canara Bank, IDBI Bank and Union Bank moved into the elite club.

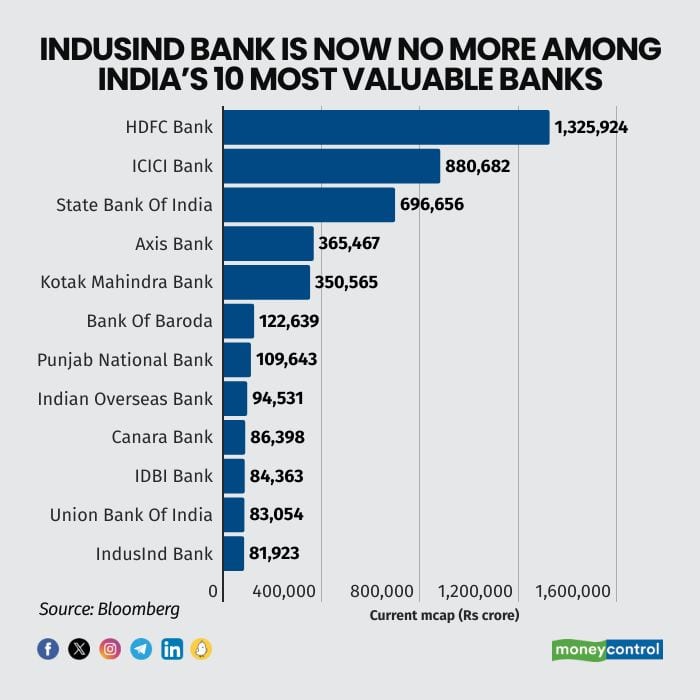

HDFC Bank, India’s most profitable lender, is the most valuable bank in India with a market cap of Rs 13.25 lakh crore, followed by ICICI Bank at Rs8.81 lakh crore and state-run State Bank of India at Rs6.97 lakh crore.

Axis Bank came fourth, followed by Kotak Mahindra Bank, Bank of Baroda, Punjab National Bank, Indian Overseas Bank, Canara Bank, IDBI Bank and Union Bank.

IndusInd Bank reported a weak quarter, marked by increased provisions, declining other income, and slower growth in higher-yielding loans. Several brokerages too have cut its target price.

The bank's deposit growth, however, remained robust, driven by term deposits. Its net interest margin (NIM) sharply contracted due to rising costs and sluggish growth in higher-yielding assets. Additionally, asset quality ratios slightly worsened as fresh slippages, mainly from the consumer finance segment, remained high.

In Q2FY25, the bank's consolidated net profit plummeted 40 percent on-year to Rs 1,331 crore, significantly missing expectations, primarily due to nearly doubling the loan loss provisions. Operating expenses, including finance costs, rose faster than income, further impacting profits. While net interest income (NII) grew 5 percent, the net interest margin (NIM) declined to 4.08 percent from 4.29 percent a year earlier. Provisions reached Rs 1,820 crore, up 87 percent from Rs 974 crore. Additionally, the gross non-performing asset (GNPA) ratio increased 9 basis points to 2.11 percent, and the net NPA ratio rose 7 basis points to 0.64 percent.

Several PSU banks, including Bank of Baroda, PNB, IOB, Union Bank of India, and Canara Bank, saw a significant surge since last one year, each crossing a market capitalisation of Rs 1 lakh crore. The rally in the PSU stocks was also after strong earnings, lower provisioning and drop in non-performing assets.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.