BUSINESS

Indraprastha Gas: Pricing power, volume to help offset higher input cost

Indraprastha Gas was the least affected among peers due to a higher share of CNG in its volume sold

BUSINESS

AGS Transact Tech: Future looks bright despite soft quarter

AGS is well placed to benefit from the next leg of ATM network expansion in India

BUSINESS

Gulf Oil: A flat quarter; EV penetration not a threat for now

Gulf Oil has multiple interaction points to the potentially rising EV-driven demand. The company has a product line-up of EV fluids and acquired two EV technology companies

BUSINESS

Zomato: Does correction create upside in this stock?

Zomato's unit economics is likely to improve as the company has tapered down on discounts

BUSINESS

CMS Info Systems: Growth at a reasonable price

CMS Info Systems has multiple growth drivers and has seen a good response to its recently launched technology solutions business.

BUSINESS

Can rising crude oil prices spoil the India revival story?

India's December 21 crude oil consumption stood at 4.65 MMBbl/d, close to the pre-COVID levels. As the Omicron impact recedes, oil consumption is bound to rise

BUSINESS

Zee Entertainment: Slow ad spend impacts quarter; still an attractive bet

Zee Entertainment's recovery has slowed due to the twin factors of weak ad spending environment and the delay in NTO 2.0 resolution.

BUSINESS

Shemaroo Entertainment: Underperformance doesn’t undermine business

Shemaroo Entertainment continues to invest in its two FTA channels (Shemaroo TV & Marathi Bana), along with its OTT offering Shemaroo Me

BUSINESS

Saregama: Dec quarter performance is music to the ears, but positives are priced in

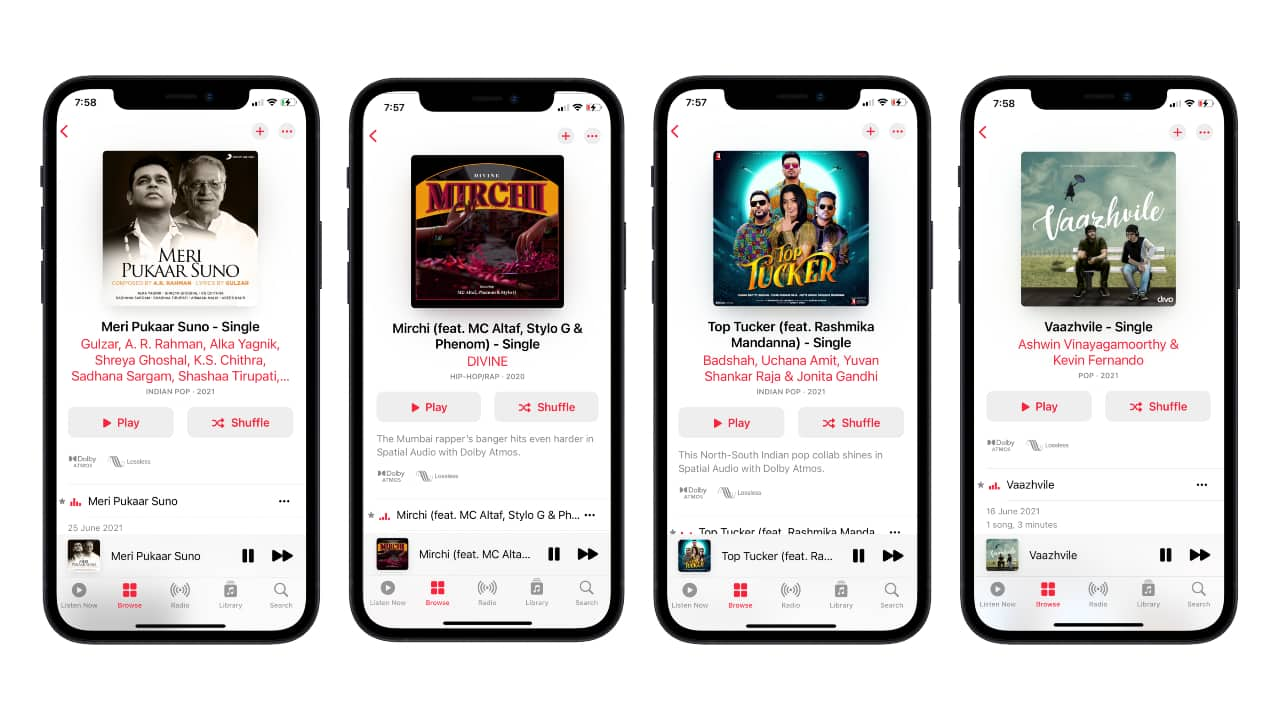

Saregama has been the biggest beneficiary of the galloping music streaming trend in India

BUSINESS

LTTS: Is the recent pullback a good entry point in this global player?

We expect LTTS to continue to see double-digit growth in the next 3-5 years on the rising penetration of ER&D services and higher spending on digital engineering

BUSINESS

AGS Transact Technology IPO: More to it than meets the eye

AGS is among the top 3 players in the ATM/CMS management business, and, unlike its peers, has a presence in the digital payment space

BUSINESS

GAIL India: Well placed to benefit from multiple tailwinds

GAIL, by controlling India's largest gas transmission network, is present across the value chain and will play an even bigger role in coming years

BUSINESS

Mahanagar Gas: Does the correction make it a worthy pick?

Mahanagar Gas saw strong growth in CNG/PNG volumes in second quarter

BUSINESS

Zee Entertainment: Value unlock hinges on merger completion

Zee Entertainment-Sony merged entity would be the biggest broadcasting company in India with 75+ channels, 2 OTT platforms and 25-30 percent market share

BUSINESS

CMS Info Systems IPO: Should investors subscribe to India's leading cash management business?

CMS Info Systems has a presence across every stage in the cash cycle and caters to large Indian banks.

BUSINESS

These lubricant makers can keep your stock portfolio well oiled

Castrol and Gulf Oil have underperformed the markets, with recovery picking up momentum, there is a good upside in both the stocks

BUSINESS

MapmyIndia IPO: Attractive business with a solid growth map

MapmyIndia enjoys leadership and profitability in a high-growth business, with significant barriers to entry

BUSINESS

Oil: Virus fear grips market, but OPEC+ is unfazed

Brent crude price has come down by 15 percent since November 25 on the fear that Omicron may bring back lockdowns, globally

BUSINESS

Matrimony.com: Is it the right match for your portfolio, post correction?

Matrimony's matchmaking segment grew faster than Jeevansathi in the second quarter

BUSINESS

Oil and gas: Price rally is not over

Global oil supply is yet to return to the pre-pandemic average of 100 million barrels a day

BUSINESS

Info Edge: Naukri in the driver's seat; will it run up more?

Info Edge should continue to see robust growth momentum in both billings and revenues through the recruitment segment and 99acres

BUSINESS

Zee Entertainment: Solid quarter, driven by ad revenue and Zee5

Zee Entertainment continues to do well as recovery picks up and it is likely to see good growth in the second half of this year

BUSINESS

Zomato: Record revenue comes with rising costs; valuation expensive

Zomato's sharp growth comes with rising losses and would only push the profitability timeline further

BUSINESS

Shemaroo: Stable Q2 numbers, attractive long-term investment

Shemaroo's strategy to generate revenue through multiple models helped it weather the tough macro environment