BUSINESS

Lemon Tree Hotels: Results beat estimates, quality stock to play industry upcycle

H2, being a seasonally strong quarter, would see a further uptick in demand. LMNT is witnessing strong gains in room rates (both corporate as well as retail) and favourable demand-supply dynamics would further strengthen pricing.

BUSINESS

Keystone Realtors IPO: A play on growth and quality

The company is a perfect blend of growth and quality which should help deliver good returns over the next few years

BUSINESS

Indian Hotels Company: Lower than expected results; outlook strong

IHCL, with a presence across segments, viz., luxury, semi-luxury, premium as well as economy, is the primary beneficiary of the upcycle in the hotel industry, which has just started to unfold.

BUSINESS

Jubilant Foodworks: Steady earnings growth to continue

We expect Jubilant Foodworks to deliver steady earnings growth led by robust store expansion in Domino's core brand and introduction of new products with focus on regional tastes

BUSINESS

Titan Company: Will the stock continue to shine?

Titan has stellar growth prospects in the jewellery segment, while the ramp-up of non-jewellery business will aid in maintaining robust growth momentum.

BUSINESS

Relaxo Footwear: Near-term weakness to persist

Earnings pressure is expected to sustain in the next two quarters, led by price cuts in the chappal category, liquidation of high-cost inventory and the longer duration to reflect the recent raw material price correction

BUSINESS

Bikaji Foods International IPO: Perfect taste for long-term investment

Bikaji Foods International is poised for an industry-leading growth, supported by increased capacity utilisation, higher distribution reach and huge scope for gains from the unorganised segment, in the next few years

BUSINESS

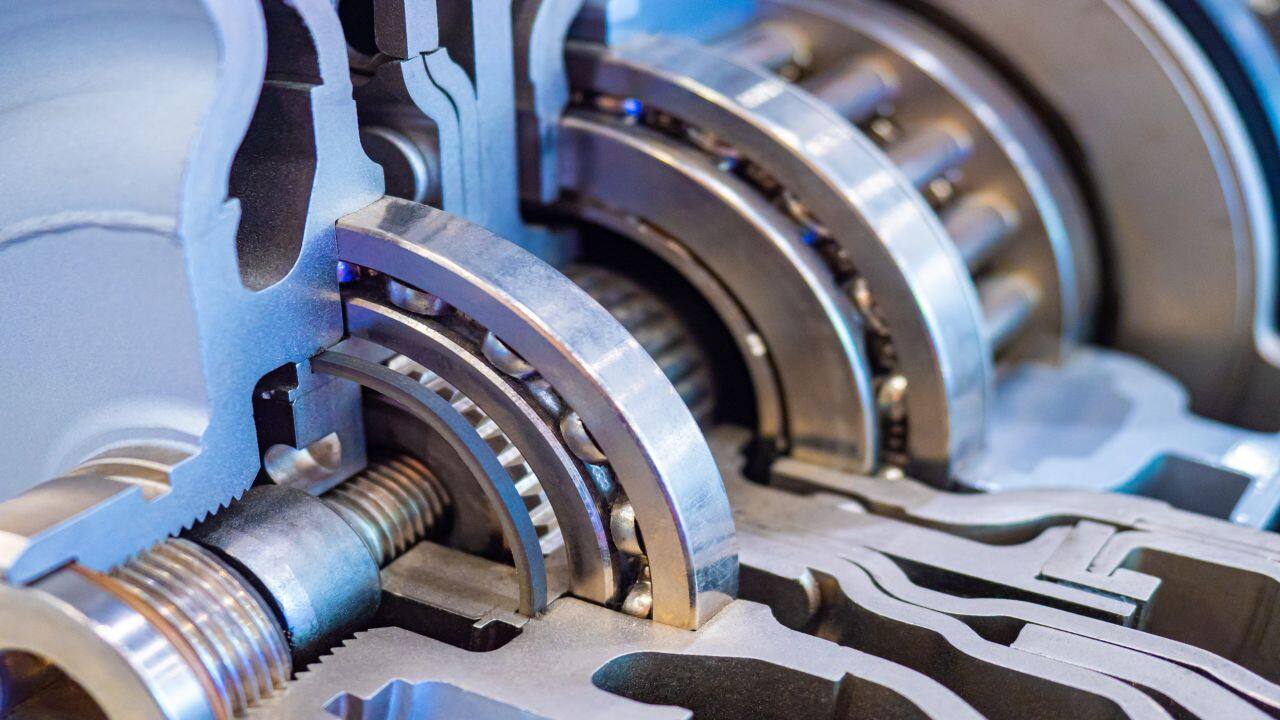

Larsen & Toubro: Second half could be even better; stock has more fuel to climb

With soft commodity prices, L&T earnings set to get better over the next few quarters

BUSINESS

Sumitomo Chemical India: Look beyond the glyphosate usage notification

Overall, SCIL has a strong growth potential owing to the healthy launches in the domestic market

BUSINESS

Sharda Cropchem: Why are we cautious on the stock despite a steep correction?

Given the currency trend, we expect margin pressure to sustain in the near term and have reduced our margin assumptions for FY23

BUSINESS

Metro Brands Ltd: Strong results, recent acquisition to add value

MBL has strong financial discipline and earnings growth trajectory. While recent acquisition of Cravatex Brands may impact financials in near term, it is expecetd to create value for MBL in the long run.

BUSINESS

RIL Q2: Retail, telecom shine, offset weakness in legacy business

With focus on financial services which can be offered in combination with digital services and retail, RIL is set to become a powerhouse in consumer businesses

BUSINESS

Rallis India: Will the stock rally in the long run?

BUSINESS

Thangamayil Jewellery: Weak results, but strong long-term growth prospects

Margins in H1FY23 are at historical lows and we expect improvement from the current levels. We expect healthy earnings growth hereon for TMJL

BUSINESS

Avenue Supermarts (D-Mart): Strong operating show with earnings visibility

D-Mart’s performance would improve as footfalls pick up (currently below pre-COVID levels) and inflationary pressures recede

BUSINESS

Campus Activewear: A sporty fit for your portfolio

Campus Activewear Limited is likely to deliver one of the fastest earnings growth stories, and has the highest return ratios in the listed footwear space

BUSINESS

Titan Company: Show set to take on more shine

Titan Company posted strong 18 percent topline growth in September 2022 quarter on a high base of the corresponding quarter last year led by strong consumer demand.

BUSINESS

Electronics Mart India: Will this consumer electronics IPO be a hit?

The scope for market share gains by organised players, rapid store expansion to be funded by IPO proceeds as well as the attractive valuation make us positive on this public issue

BUSINESS

Aditya Birla Fashion & Retail: This apparel player has huge re-rating potential

While ABFRL continues to build its core Lifestyle brands and Pantaloons business, the new segments of innerwear, ethnic as well as sportswear (through Reebok India) hold a lot of promise and provide the next growth leg

BUSINESS

Discovery Series | Royal Orchid Hotels: Will the stock fly to new highs?

A strong balance sheet owing to an asset-light approach makes the company well poised to reap the benefits of a demand surge. Also, attractive valuations provide potential for significant re-rating from current levels.

BUSINESS

Trent: Results take deep strides, huge growth highway ahead

Varied product offerings, rapid store expansion, and a strong brand pull will help the company expand customer base

BUSINESS

Discovery Series | Speciality Restaurants: Making a profitable recipe

With cost-control measures in place, SRL turned profitable last fiscal after a gap of six years. We expect profitability improvement, a key re-rating trigger, to sustain. Valuations provide scope for re-rating from the current levels.

BUSINESS

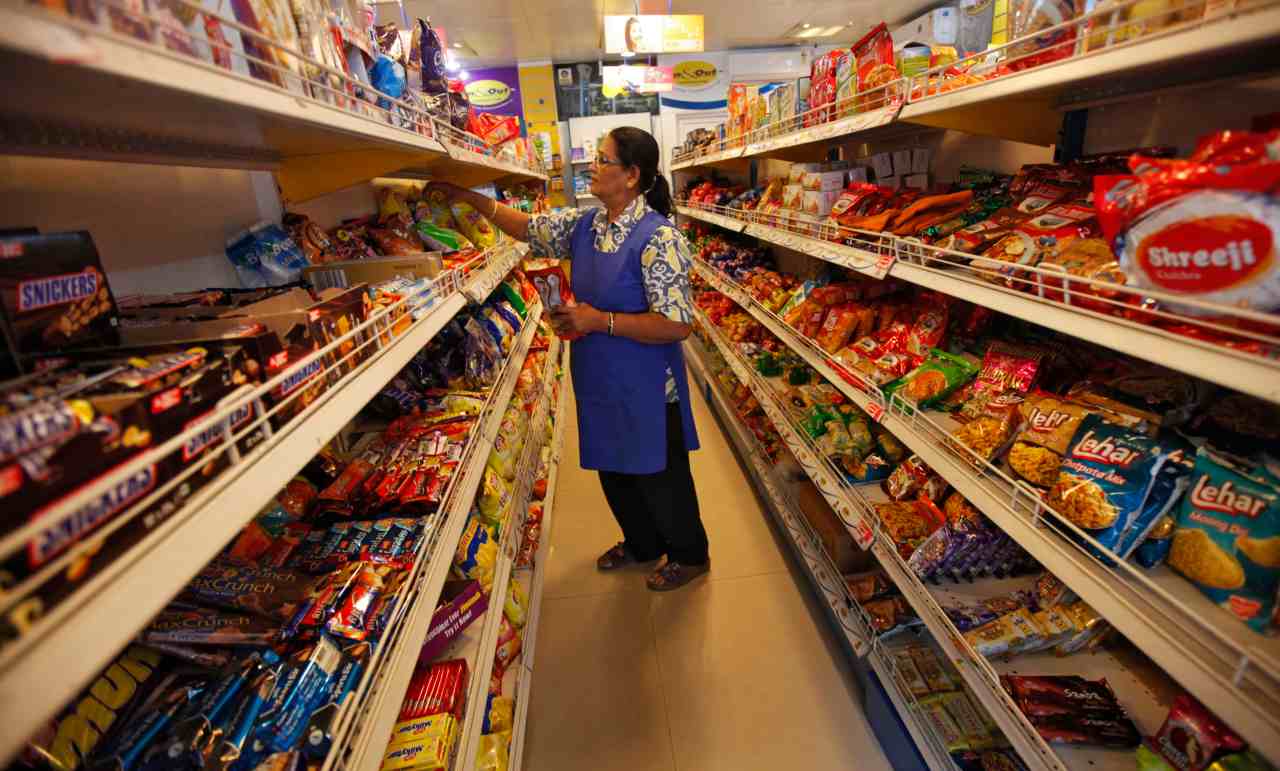

Reliance Retail: What does its aggressive expansion plan hold for the sector?

RRL’s aggressive expansion is unlikely to have major impact on listed players in many categories in the retail space. Some categories (apparel and footwear) may see impact but only in the long run. We continue to remain positive on the retail sector

BUSINESS

Restaurant Brands Asia: To emerge as a much stronger QSR player

RBA is on track for a strong restaurant (store) expansion in the India business