Hormesis is a phenomenon in which a harmful substance gives stimulating and beneficial effects to living organisms when the quantity of the harmful substance is small.

N N Taleb in his book — ’Antifragile’, illustrates that nature likes volatility. The absence of volatility or depriving natural structures of volatility is actually harmful.

This is a very interesting phenomenon which can be applied to Extremistan domains like Financial Markets. The key point however in Hormesis that the quantity of the harmful substance should be SMALL.

Otherwise, it may have lethal effects.

Volatility is one such parameter when it comes to investing: a small dose is essential however a large dose could be lethal.

What is volatility?Volatility in finance refers to the rate of fluctuations in the price of a security over time. It indicates the level of risk associated with the price changes of a security.

In simple terms Volatility gives an idea about how much Nifty 50 would fluctuate in a year.

Let us look at the historical data of Nifty 50 to understand more about the downside.

CAGR: 12 percent (yearly returns)

Volatility: 17 percent (range in which index fluctuates annually)

Maximum Drawdown: -38 percent (maximum fall from high point to low point in a year)

Worst Day Return: -13 percent (lowest return in a day)

Worst Month Return: -23 percent (lowest return in a month)

Worst Year Return: -4 percent (lowest return in a year)

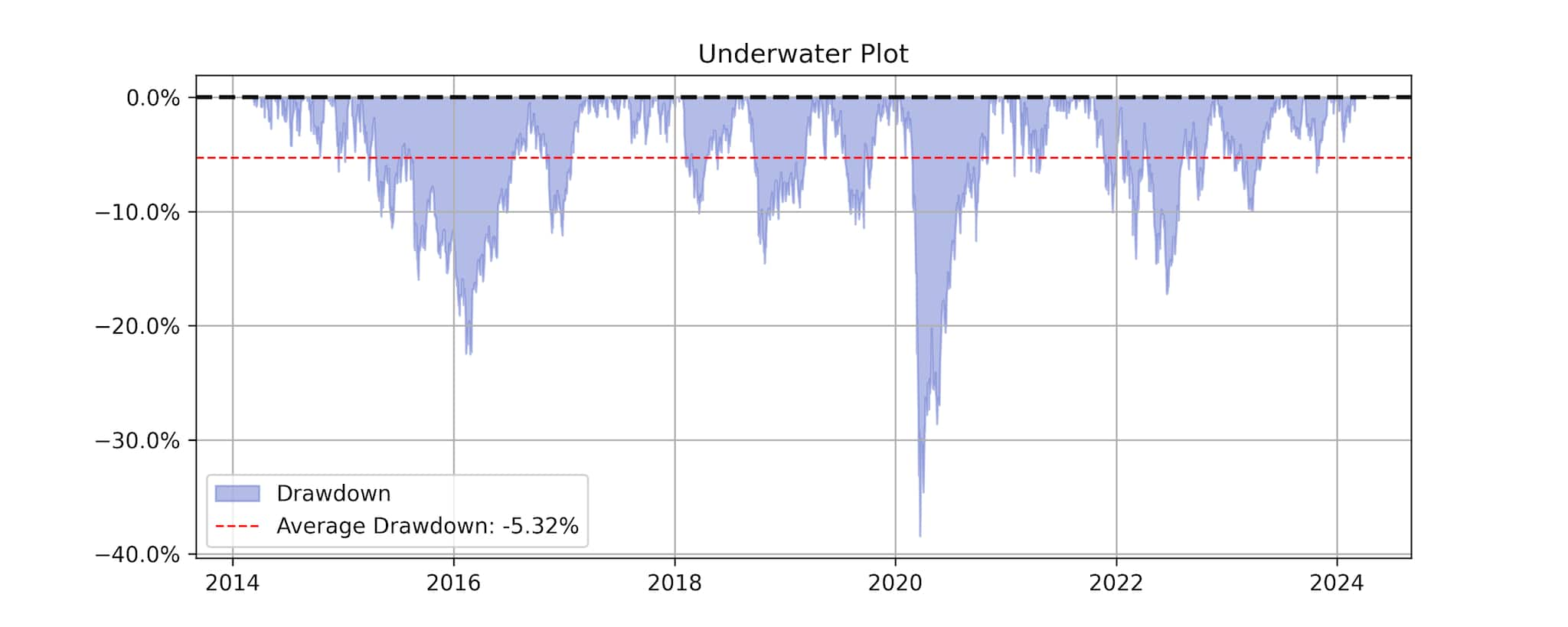

The underwater plot shows only periods when the portfolio values were negative.

This tells us that if an investor would have started investing just before a bearish period, then on average the loss would have been -5 percent and maximum -38 percent.

Now that we have an idea about the downside of Nifty 50, how can one benefit from this?

Invest every time Nifty 50 falls below 10 percentAssume an investor starts with a capital of Rs 5,00,000 and every time Nifty 50 falls below 10 percent from the starting reference point, he/she buys Nifty 50 worth Rs 50,000.

The reference point will be updated every time a new buy order is executed and every month this value will be calibrated to check if there is an opportunity to buy.

If you did this consistently over a period of 10+ years this how the returns would look like

This could be an alternative to a calendar-based SIP where an investor invests in Nifty 50 every month.

Note that in periods like the 2008 crisis the occurrences of this instance would be much frequent leading to a higher requirement of cash to top up. Such periods could contain a lethal dose of volatility.

This approach is straightforward however it is difficult to implement it because, as soon as the Index falls below a certain percentage level, bearish news starts flooding the market. During such times it is psychologically difficult to see an opportunity invest.

As the saying by Warren Buffet goes:

Be greedy when others are fearful and fearful when others are greedy.Rohan Borawake is Co-Founder & CEO, Sabir Jana is Co-Founder and Head of Quantitative Research, at FinSharpe Investment Advisors. Views are personal, and do not represent the stand of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.