Mutual fund (MF) houses continued pouring money into the healthcare sector in June, a trend that has been consistent in recent months.

Previously, the healthcare sector had grabbed the biggest chunk of mutual fund investments in May, at Rs 1,900 crore according to Emkay Alternative and Quantitative Research's Monthly Institutional Flow Tracker.

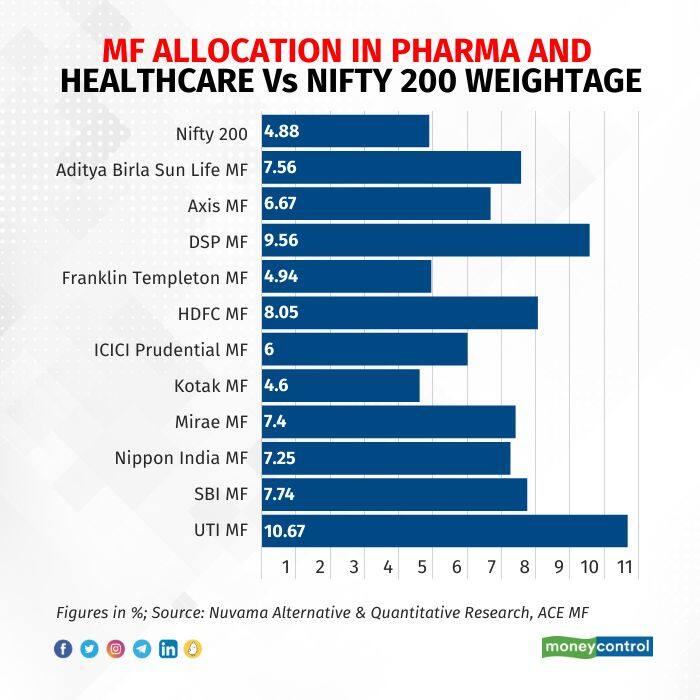

The interest in the sector has grown so big that 10 out of the 11 mutual fund houses covered by Nuvama Alternative & Quantitative Research have gone overweight on pharma and healthcare, as against their weightage in Nifty 200.

Pharma and healthcare commands a 4.88 percent weightage in Nifty 200 while 10 MF houses have allocated 4.97 percent to 10.67 percent of their total allocations to the sector as of June, Nuvama's report revealed.

Flavour of the season

Even within the vast spreading pharma and healthcare universe, it was small and mid-cap companies that witnessed the maximum traction in June.

Krishna Institute of Medical Sciences (KIMS) saw MF investments worth Rs 710 crore in June, the highest within the pharma and healthcare space. Alkem Laboratories was the second favourite, with investments worth Rs 300 crore, closely followed by Aurobindo Pharma, which witnessed MF inflows worth Rs 260 crore in June.

While optimism for KIMS is running high on the back of expectations of resilient demand and industry-leading margins, it was the anticipation of double-digit growth in the India pharma market that worked wonders for Ajanta Pharma, which happens to be a pure-play domestic pharma player, as per analysts.

The sentiment for Aurobindo Pharma is also upbeat as the company is the biggest player in the US generics market, a segment that is seeing signs of a turnaround.

Some mid-cap stocks in the sector that witnessed strong MF inflows were Dr Lal Pathlabs (Rs 180 crore), Biocon (Rs 170 crore), Fortis Health (Rs 160 crore), and Laurus Labs (Rs 120 crore). Among small-caps, Vijaya Diagnostic (Rs 190 crore), Orchid Pharma (Rs 180 crore), Thyrocare Tech (Rs 130 crore), Advance Enzyme (Rs 60 crore) and Granules India (Rs 60 crore) were among the hot stocks, as per the Nuvama report.

As far as large-caps are concerned, Sun Pharma emerged as the clear favourite, clinching a spot in the top 10 holdings of four MF houses -- Aditya Birla Sun Life MF, HSBC MF, ICICI Prudential MF and Nippon India MF -- as pointed in the report by Nuvama Alternative & Quantitative Research.

Analysts favour Sun Pharma for its strong specialty business, which stands largely affected by the headwinds that consistently disrupt the US generics space. Moreover, the company's plans to increase its research and development spends in FY24 were also cheered by the Street as it may aid the drug maker's long-term growth prospects.

Shining growth prospects

In recent months, market participants have turned bullish on various segments of the entire healthcare universe, comprising diagnostics, hospitals and drug makers.

Strong footfalls, improving margins, and growing ARPOBs (Average Revenue Per Occupied Beds) are carving a robust growth trajectory for hospitals while rising disposable incomes, expansion in unexplored geographies and increasing consumer focus on health are aiding the outlook for diagnostics players.

Also Read: Mankind, P&G and Alkem shine as healthcare stocks grab biggest pie of MF investments in May

Within drug makers, those focused on the Indian market are likely to gain from the growing domestic demand, while those in the US generics space are benefitting from the demand shortages for certain drugs, easing price erosion and new high-margin drug launches.

Enjoying the fruits of this robust outlook, the S&P BSE Healthcare index has surged 14 percent year-to-date while the Nifty Pharma index has soared around 11 percent in the same tenure. For comparison, the Nifty 50 and the Sensex have gained around 7 percent each in 2023 so far. In such a scenario, it is only normal for MFs to ramp up their exposure to the pharma and healthcare sector.

Some profits also booked

With such strong gains across most companies in the pharma and healthcare sector, MFs were also sitting on huge profits from their prior investments. This also gave them leeway to take some of those profits home.

Also Read: JPMorgan goes ‘overweight’ on Apollo, Fortis on compelling growth prospects

Among the top reductions, MFs offloaded 14 percent stake amounting to Rs 840 crore in Max Healthcare. The profit-booking in the counter came after the strong run in the stock in recent months stretched its valuations, even as the growth prospects remain strong. Even brokerage firm JP Morgan cautioned that Max Healthcare's expensive valuation leaves limited room for an upside, which had prompted the firm's neutral stance on the stock.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.