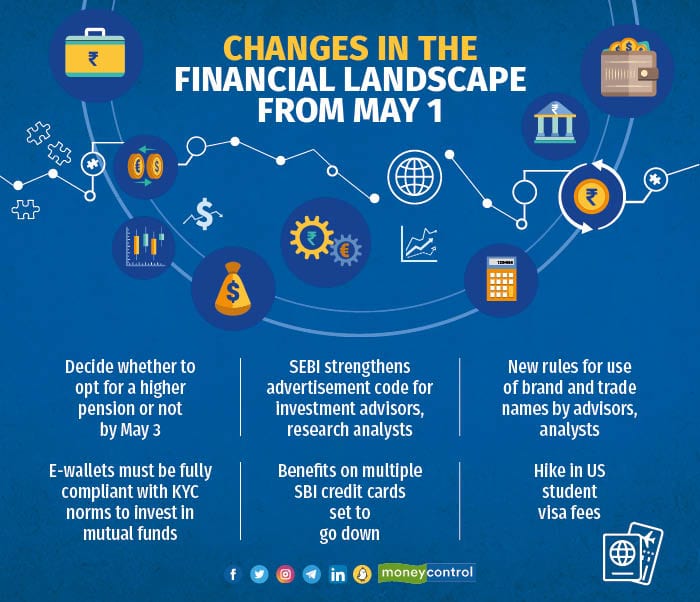

April 2023 was a busy month, being the beginning of the financial year when many financial rules and regulations came into force.

Its successor, May, should be a relatively calmer month. Yet, it will usher in several changes that can affect your moneybox.

Read on to know the key money changes you ought to be aware of this month and how it will affect your purse.

May 3 is the last date to opt for higher pension

The deadline for choosing the higher pension option is May 3. You will have to take a call on whether you want to opt for a higher pension on your actual salary or not.

The Supreme Court had ruled in November 2022 that those who were Employees’ Provident Fund Organisation (EPFO) members as on September 1, 2014 will now be eligible to opt for a higher pension by contributing on their actual basic wages instead of limiting the statutory wage ceiling (which currently is Rs 15,000 per month; a lower limit for many salaried employees). This is assuming that your actual wages are higher than the statutory wage ceiling and you have been contributing to provident fund (PF) on the entire basic wages.

Eligible employees, who would like to opt for higher pension contributions, will have to submit an application in the prescribed form on the EPFO portal, along with the necessary documentation. The link can be accessed at the UAN Member e-SEWA portal (https://unifiedportal-mem.epfindia.gov.in/memberInterfacePohw/).

Once the application is submitted, it will be validated by the employer. The EPFO officers would then verify the application form and come back to the member-employee and employer in case of any mismatch in data. Both the employee and the employer will have a month to respond to such queries.

Also read | Higher EPS pension choice by May 3: Your key questions answered

Advertisement code for investment advisors, research analysts

The Securities and Exchange Board of India (SEBI) has brought in an updated advertisement code to further strengthen the conduct of investment advisors (IA) and research analysts (RA) while issuing any advertisement.

As per the code, these entities would not be able to use superlative terms such as ‘Best’, ‘No. 1’, ‘Top Adviser/Research Analyst’, ‘Leading’, ‘One of the best amongst market leaders’, etc., so as to provide any endorsement of quality or standing of the IA/RA.

Further, IAs and RAs have been barred from using extensive technical/legal terminology or promising guarantee of assured return to the investors in their communications.

Additionally, IAs and RAs won’t be allowed to make any promise or guarantee of assured or risk-free return to the investors and refer to their past performance.

The provisions of the circular will be effective May 1.

New rules for use of brand/trade name by advisors, analysts

Effective May 1, SEBI has mandated that information such as the name of the IA/RA as registered with SEBI, its logo, registration number and complete address with telephone numbers should be prominently displayed on the website, if any, notice board, display boards, advertisements, publications, Know Your Client (KYC) forms, and client agreements.

SEBI has also mandated the usage of the disclaimer, “Registration granted by SEBI, membership of BSE Administration & Supervision Ltd (BASL) in case of IAs and certification from National Institute of Securities Market (NISM) in no way guarantee performance of the intermediary or provide any assurance of returns to investors”.

Also read: MC30 review – 90% of schemes outperform peers in 2022

E-wallets for mutual fund investments must be KYC-compliant

SEBI, in 2017, had permitted the use of e-wallets for investment in mutual funds within the umbrella limit of Rs 50,000 for investments by an investor through both e-wallet and/or cash, per mutual fund per financial year.

Now, the capital markets regulator has mandated that from May 1, all e-wallets must be fully compliant with KYC norms as prescribed by the Reserve Bank of India (RBI).

SBI card scales down benefits on credit cards

For Cashback SBI Card holders, there is a revision of the benefits on your credit card effective May 1. You will not earn a cashback for using this credit card for shopping jewellery, school fees, utility bills, paying insurance premiums, booking railway tickets, purchasing a gift card, etc. These categories are added by the bank apart from existing exclusions. Further, maximum cashback that can be earned on online and offline spends in a statement cycle will be capped at Rs 5,000. Also, complimentary domestic airport lounge benefit will be discontinued which will discourage frequent travellers.

On SimplyCLICK SBI Card and SimplyCLICK Advantage SBI Card, the bank has reduced the reward points for online rent payment using the credit card. For online rent payment transactions, the cardholder was earning 5X reward points till now; effective May 1 the cardholder will earn 1X reward points.

Also read | Planning your child's education abroad? Residency via investment can help

US hikes student visa fees

Are you planning to go to the US for higher studies this year? Then take into consideration the marginal hike in student visa fees. The US Department of State has announced the hike in the student visa fees by $25 (Rs 2,045) effective May 30. The student visa fees will increase to $185 (Rs 15,135) from $160 (Rs 13,090) now. According to the current exchange rate of USD/INR, Indian students will have to pay over Rs 15,000 as student visa fees after securing an admission in a US university.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.