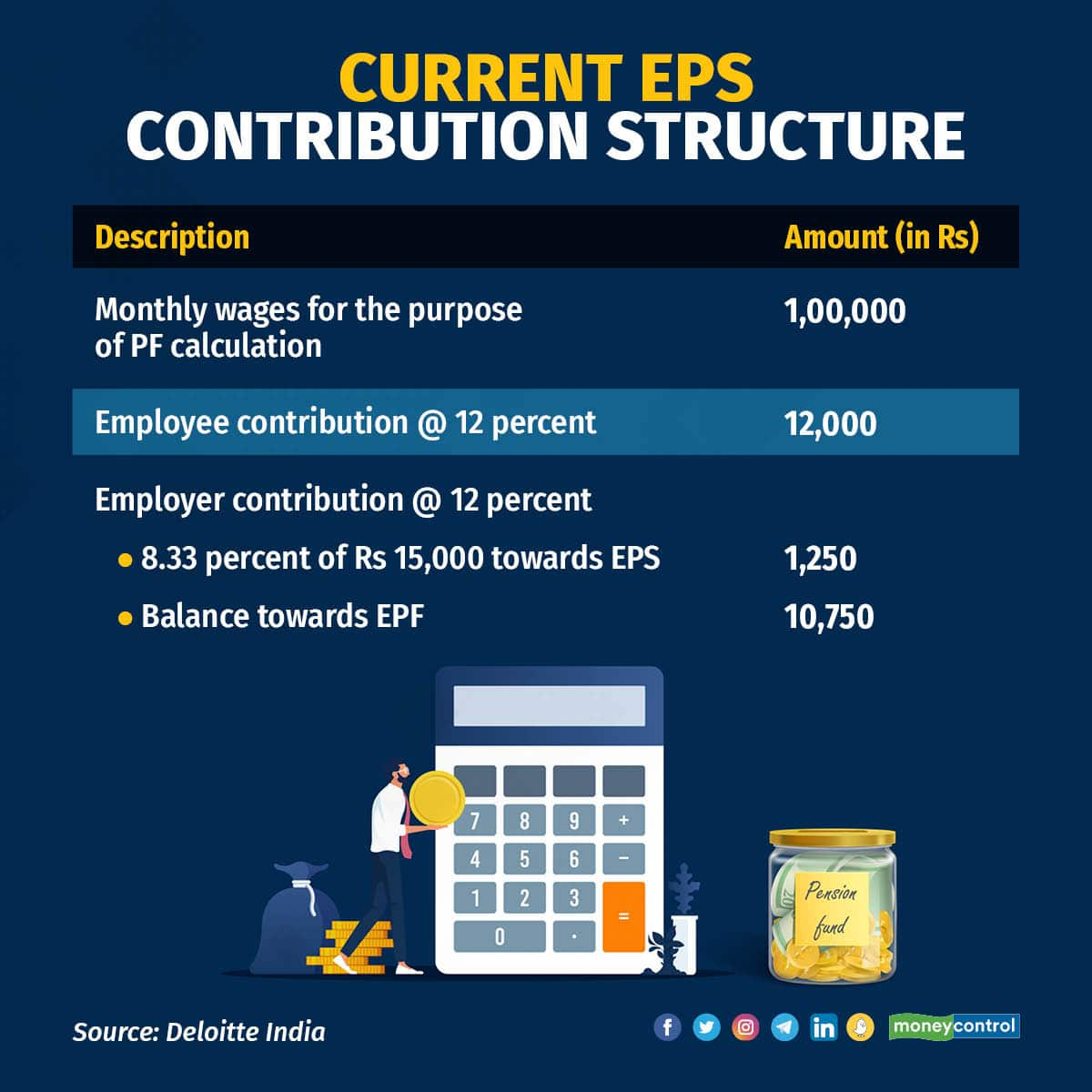

Every employee who draws a ‘pay’ of more than Rs 15,000 per month, contributes 12 percent of pay towards employer contribution and another 12 percent towards employee contribution.

Employees, who became members before September 1, 2014, out of the employer’s contribution, 8.33 percent of Rs 15,000 (i.e. Rs 1,250 per month) is diverted to the pension scheme and the remaining is contributed towards the provident fund.

Members who joined the provident fund scheme on or after September 2014, are not eligible to make any contribution towards pension.

To illustrate with an example:

An amendment was introduced in 1996, wherein an employee was given the option to contribute a higher amount towards pension (out of the employer’s contribution). Where such an option was exercised by an employee, then such higher salary would be considered a pensionable salary.

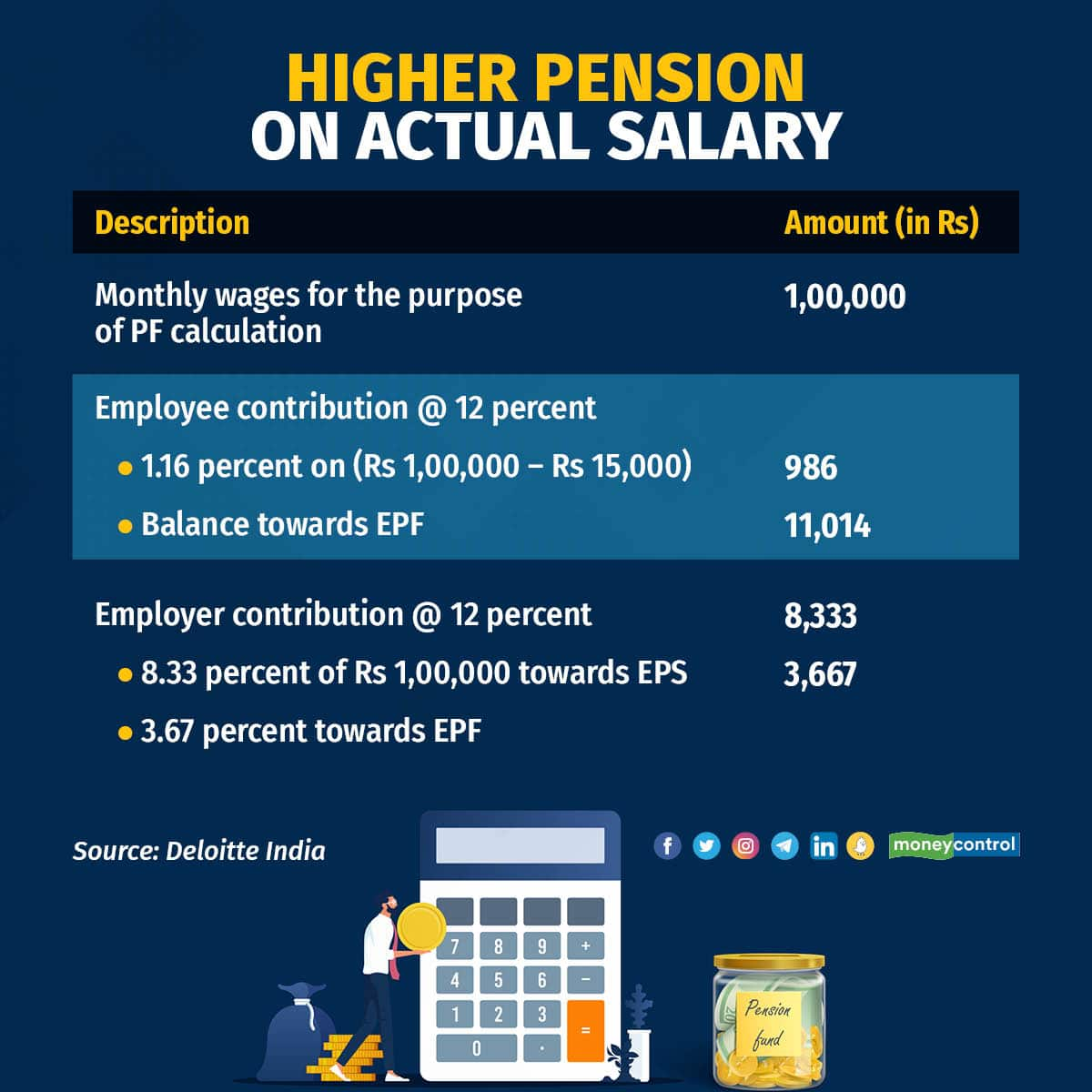

Hence, the employee could contribute Rs 8,333 (where pay is Rs 1,00,000) towards pension as against Rs 1,250 mentioned above. It would be worthwhile to note that the statutory wage ceiling was Rs 6,500 (prior to September 1, 2014).

It was seen that the above amendment was not within the knowledge of employees as it was not widely publicised. Also, provident fund authorities were rejecting the plea of employees who approached PF authorities to exercise this option mentioning that it was beyond the cut-off date.

In August 2014, a notification [No. GSR 609(E)] was issued by the government. The notification inter alia provided that employees who intend to make a higher contribution towards pension can do so by making a fresh application to the EPFO. Such fresh joint application had to be exercised within 6 months from September 1, 2014. It was observed that EPFO officers were not accepting some applications filed by employees for higher contributions to EPS and hence employees were unable to exercise this option.

In view of the above, in November 2022, the Supreme Court held that amendments made via notification in September 2014 were valid. Accordingly, we have highlighted below the impact of the ruling.

Impact of the rulingFollowing employees can exercise the option to contribute to pension on a higher salary -

- Employees who were contributing to PF on a higher salary (i.e. Rs 6,500/ Rs 15,000); and

- who retired from service on or after 1 September 2014 or who are still in service; and

- who did not exercise the option to contribute pension on a higher salary based on notification of 22 August 2014

1. For the past period contributions, employees can make a joint application along with the employer to divert the funds from EPF to EPS i.e. 8.33 percent of differential pay (i.e. in the above example Rs 100,000 – Rs 15,000) to be transferred from the provident fund to the pension scheme account.

2. Employees opting for a higher pension contribution will be required to make the additional contribution of 1.16 percent to be moved from the employee’s share of the provident fund to the pension scheme.

3. The timeline to make the joint application has now been extended to May 3, 2023.

4. The above provisions are applicable to private PF trusts as well.

5. Once the option is exercised the same is irrevocable.

Hence, if the employee opts for a higher pension, i.e. 8.33 percent of his salary, the following contribution would be made to EPS and EPF.

Also read: Applying for higher EPFO pension? Key factors you must consider

How to apply for higher contributionGiven that the deadline of May 3, 2023, is fast approaching, eligible employees, who would like to opt for higher pension contributions will have to submit an application in the prescribed form on the EPFO portal along with the necessary documentation. The link can be accessed at the UAN Member e-SEWA portal (https://unifiedportal-mem.epfindia.gov.in/memberinterface/).

Once the application is submitted, the application will be verified by the employer. The EPFO officer would then verify the application form and if all details are correct, then dues will be calculated and an order will be passed for transferring the dues. However, if there is a mismatch, the same will be informed to the employer and employee by EPFO and they will be given one month to complete the information.

(The writer is Partner with Deloitte India. With inputs from Niji Arora, Senior Manager, Tarika Agarwal, Manager and Ami Rathod, Assistant Manager with Deloitte Haskins & Sells LLP)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.