Getting your child into a world-class university can be very competitive, as the number of students wanting an international education continues to grow. Per a recent government estimate, over 7.7 lakh Indian students headed abroad in 2022 — a six-year high.

In the post-Covid world, more people are looking at geographical diversification as a way to secure the future for the next generation. Given this, there is a significant increase in enquiries from affluent Indian families looking to access premium international education opportunities for their children via investment migration.

Simply put, investment migration, alternative residency, or residency by investment is a way to immigrate to another country.

Some Indians who lost their jobs in the mass IT layoffs in the US are also looking at investment migration programmes to secure their stay.

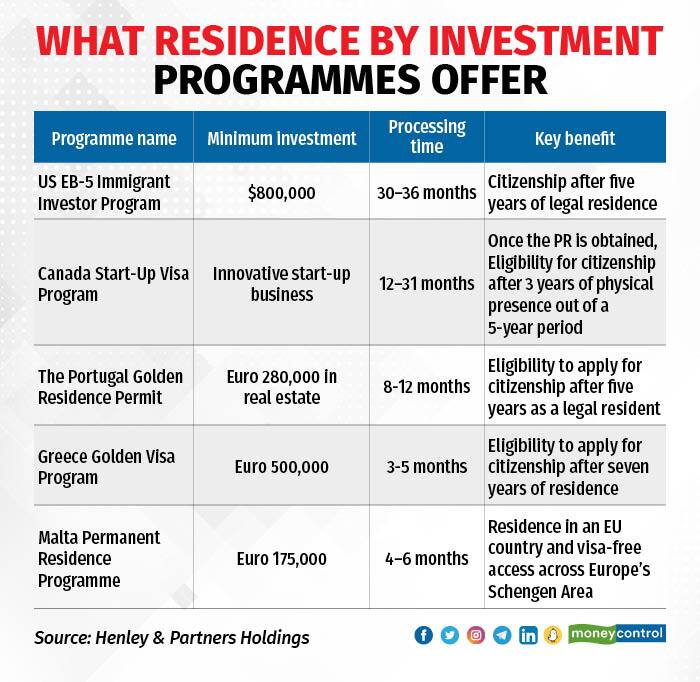

Up until a few years ago, India’s investment migration market was largely geared towards the US EB-5 (visa by investment) program. Now, the residence-by-investment migration programmes of Malta, Portugal, Greece, and other European countries are gaining traction.

Also Read | M-cap below Rs 200 crore: PMS love to hold these Nanocap multibagger stocks“If you take a European permanent residence (PR), you make an investment in an asset class that can give you multiple benefits. The first being the ROI (return on investment) on this asset; second — the ability to diversify your wealth by investing abroad; and finally — the residence permit. Families are starting to think how they can effectively utilise their disposable capital,” said Nirbhay Handa, Group Head of Business Development and Asia Head of Private Clients at Henley & Partners, an investment migration consultancy.

Keep in mind that residency by investment programmes are in no way cheap, therefore, it is preferred by business people, top corporate executives, entrepreneurs, and wealthy, retired Indians.

The US EB-5 visa requires a minimum investment of $800,000 (roughly Rs 6.60 crore as per April 20 forex rates), while the Portugal Golden Visa costs at least $280,000 (about Rs 2.3 crore).

Portugal has recently said that it plans to discontinue its Golden Visa programme, however, it has not set a date for the same.

As a parent you can plan for your child’s education abroad either by getting an investment migration visa for the family, or via the international student route. Each comes with their respective costs and benefits.

What does residency via investment offer?The EB-5 visa is one of the most sought-after residency-by-investment programmes among Indians for obvious reasons. The US is the biggest and the most stable economy in the world. Further, per the Times Higher Education World University Rankings 2023, the US is the most-represented country with 58 educational institutions among the top 200.

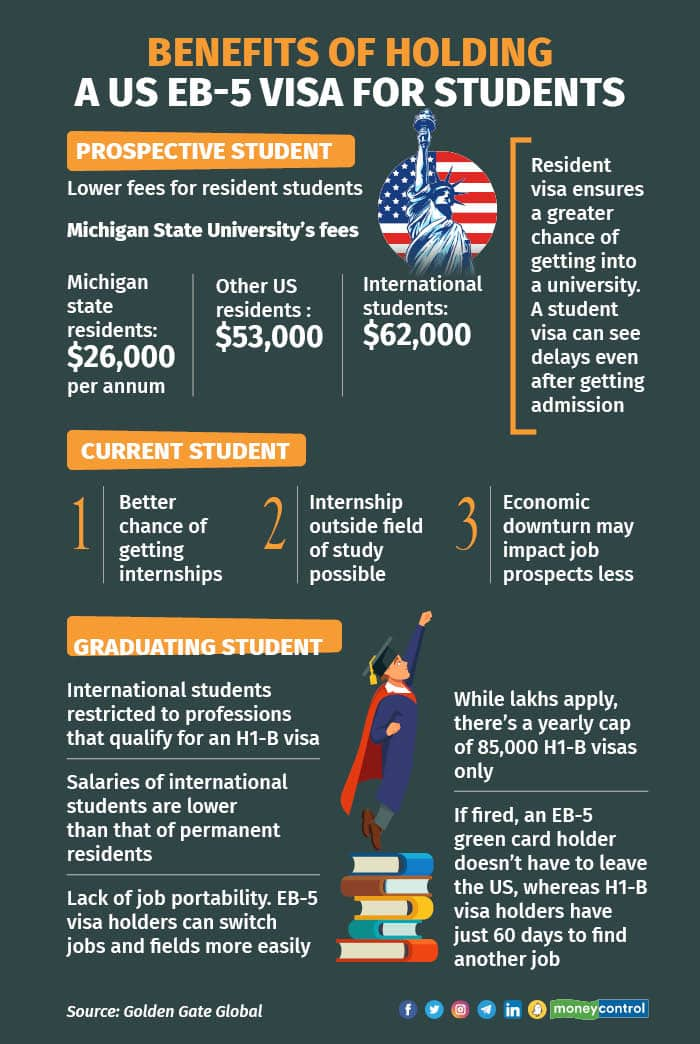

However, these benefits come at a cost. Tuition fees in the US are among the highest in the world. For example, fees for an international student at the University of California, Los Angeles (UCLA), could be upwards of $70,000 per annum (about Rs 57 lakh).

US universities have two tiers of fees: one for in-state students and another for out-of-state students. Fees for out-of-state and international students are the same. However, even if international students live in-state, they do not qualify for in-state tuition.

Also See | Curated list of investment-worthy mutual fund schemesFor in-state tuition fees, you need to be a permanent resident of the US or a citizen, and you need to live in the state in which the university is located.

“For example, if you're living in California, and you apply to UCLA, you will qualify for in-state tuition. If you're living in the US as a green card holder, or a citizen, but outside of California, you will qualify for out-of-state tuition. And if you're not a green card holder or a citizen, then you will be considered an international student. At UCLA, an international student has to pay about $70,000 per annum, whereas in-state fees are about $30,000,” said Abhinav Lohia, Chief Operating Officer at Golden Gate Global, an EB-5 investment fund.

Unlike the US, in countries such as Malta, Greece, Australia, or Portugal, holding a PR can give you access to local healthcare provisions, which are heavily subsidised.

Additionally, the Portugal Golden Residence programme offers visa-free travel in Europe’s Schengen area, and the right to live, work, and study in Portugal.

Better employability

“In some places, once the child graduates from university, a PR may mean that they don’t have to worry about an employment pass or a work permit to prolong their stay in the country. This can also make finding employment a lot easier as employers don’t want to go through the hassle of applying for work passes to hire a resource,” said Handa.

For prospective students, another big advantage of residency programmes is the certainty of getting into a university, as you're not dependent on a student visa.

In a lot of cases, students face difficulties in getting admission into their dream universities as there is either a delay in getting a student visa, or the student visa gets denied for some reason.

Further, if you are an international student, your likelihood of getting an internship is far less than a green card holder. As a result, your employability at the time of graduation also decreases as these internships usually end up being job opportunities.

“Also, if you're an international student, you cannot work outside the field of your study while you're in college. Even if you do get an internship, it's restricted to your areas of study, which is not the case with a green card holder,” said Lohia.

Additionally, when there is an economic downturn, a lot of firms stop giving internships to international students as they require sponsorship for a work visa in the future.

More job opportunitiesIn case of graduating students, non-green card holders are restricted to professions that qualify for an H1-B visa (non-immigrant work visa).

This means that an international student is stuck with a handful of professions, plus they are restricted to employers who sponsor H1-B visas.

“H1-B visa holders or international students generally lack the ability to negotiate a good salary because there is a restricted pool of employers. As a result, you will find that the salaries of international students are lower than permanent residents. There’s also a lack of job portability within the same company as well,” Lohia added.

Also Read | In your 40s, you don’t just need an emergency fund. You need a ‘confidence fund’International students primarily rely on H1-B visas to live and work in the US. The H-1B visa sees over three lakh applications per year, while allocations are capped at 85,000 visas, which are selected via a computerised lottery.

How to plan for investment migration?

There is no doubt that one must create a reasonable corpus if one plans to educate their child abroad. Starting as early as possible can help parents as they will have more time to build the corpus and their investment amount can be increased over the years.

It is always better to get some sense of the cost when you start accumulating, instead of keeping it open-ended.

“The investment plan for a child’s education can always be flexible based on what the child wants to pursue as she or he grows. Try to invest in equity, maybe through mutual funds, as equities have the maximum growth potential compared to any other asset class. Some allocation in gold will also help as gold tends to hold its value against every currency, which turns out to be quite beneficial,” said Harshad Chetanwala, Co-Founder, MyWealthGrowth.com.

Even if as a parent you have the required amount in place for an investment residency program, you must keep certain timelines in mind.

In the US, if you invest $800,000 today, it takes around two to three years to get a green card, while in case of Portugal’s Golden Visa, the most popular programme for Indians in Europe, the processing time is 8 to 12 months.

Bear in mind that planning for an investment residency program is a very individual undertaking, which people need to carefully consider.

“In case of the US, there are people who would want to have the visa in place even before their child goes to the university so that they won’t have to depend on a student or H1-B visa. Applicants should make sure that they have their EB-5 in place before they enter the job market,” said Peter Calabrese, Chief Executive Officer of CanAm Investor Services, a FINRA-registered broker-dealer.

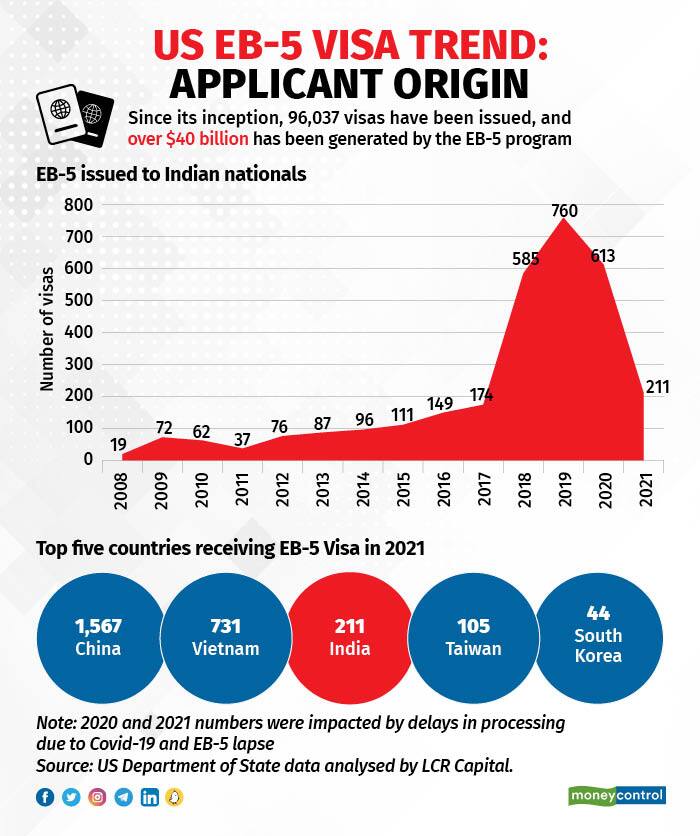

Also Read | Credit cards have much to offer than just credit; here are tips to get the best out of themShilpa Menon, Senior Director-India at LCR Capital Partners (an EB-5 investment firm), added, “The investment amounts for alternative residency programmes are large, and Indian residents are restricted by RBI's outward remittance restrictions ($250,000 per annum). Therefore, families often plan for these investments over several months or even years, so that they are able to create a nest egg abroad.”

Menon suggests that in order to evaluate a programme, parents should first look at how long the investment migration programme has been in existence, which could suggest stability.

For example, the US programme has been there since the 1990s, while the Portugal Golden Visa was launched only in 2012.

“Look at the eligibility criteria and investment requirements of each programme, as they can vary considerably. Some programmes may require investors to stay in the country for a specific period, while some may place other restrictions. For instance, some programs do not allow dependent children on the application to marry or take up a job during the investment period. You should also carefully assess the risks, as well as evaluate the credentials and track record of the service providers involved,” said Menon.

Understand the risksKeep in mind that golden visas are a risky investment, where the return on investment is usually in the range of 0.25-1 percent per annum.

The key reason behind residency by investment is that countries look to stimulate their economies through job creation and capital investment by foreign investors.

For example, the US EB-5 programme, which invests mostly in real estate and construction projects, must create at least 10 full-time jobs in the country.

“It is an $800,000 investment, usually in the form of a loan, on which an investor receives interest. So make sure that you are working with a really strong regional operator (one who structures the investment) on a really strong project, which is viable and sustainable,” said Calabrese.

Also Read | Looking to earn a fixed income? The best investment options for youBear in mind that there have been instances where the project has failed, leading to the loss of investment. However, while an EB-5 project may not come to fruition, it may still meet job creation and other government criteria to entitle the investors to green cards and related benefits.

Experts say that multiple factors need to be considered before one thinks of the residency program. Ideally, it should not be just for the education of one’s children, one should also look at it with regard to one’s own growth prospects, as well as other financial commitments.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.