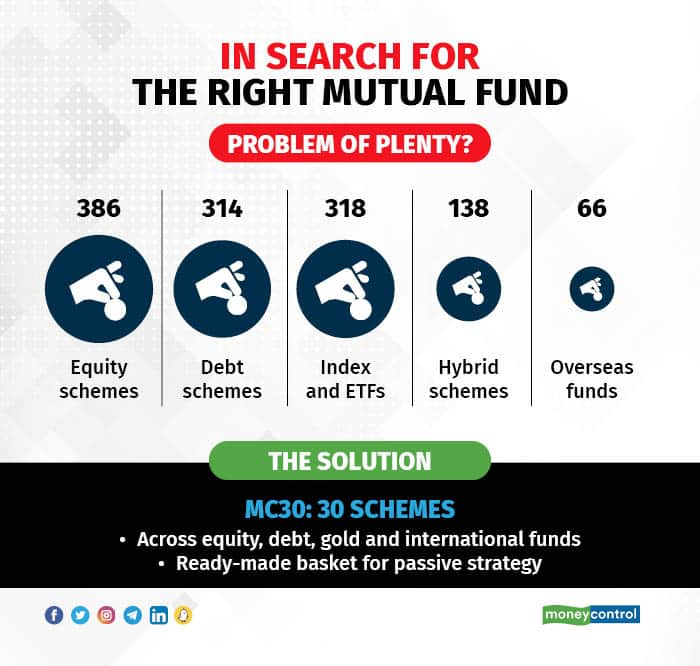

The Rs 40 lakh crore Indian mutual fund industry can no longer be considered a small basket of funds. There are 39 categories of MF schemes that offer 386 equity schemes, 314 debt schemes, and 138 hybrid funds. You are still left with 163 index funds, 155 exchange-traded funds, 39 gold, and silver-related funds, and 66 international funds.

In reality, all one needs are 7-12 MF schemes. How do you pick the most suitable ones?

Enter MC30 or Moneycontrol 30.

MC30 is a curated basket of 30 handpicked MF schemes. The rationale for MC30 is to give you a manageable number of MF schemes from over 1,000 schemes and asset classes to invest in.

The schemes in MC30 are culled from a carefully designed internally built ranking and rating system with multiple hoops of risk and return criteria.

MC30 was started in August 2021. As promised, every year, in the first quarter of the calendar year, we come to you with an update on the MC30. Let’s take a look at how MC30 did in 2022.

Read here: The complete MC30 basket of mutual fund schemes

Last year brought gloom for many asset classes. The equity markets fell in the first half of 2022 due to inflationary pressure, fears of a global recession, and the onset of the Russia-Ukraine war.

But the Indian equity market showed a strong upward move in the second half as the domestic economy proved to be more resilient than its global peers. Largecap and midcap stock universes gained momentum and rallied, while smallcap counterparts failed to enthuse investors.

Actively managed equity diversified schemes ended 2022 as a mixed bag as one-fourth of them delivered negative returns. There was cautious stock picking because a large number of fund managers felt that Indian equities were richly valued throughout 2022. Growth-styled-oriented equity funds struggled to perform. Value stocks did well as did schemes focused on value strategy.

Many hybrid funds reduced their equity exposure.

The attention slowly turned toward debt funds in 2022. Short-term debt funds turned attractive, thanks to the Reserve Bank of India’s successive rate increases that led to a spike in the short end of the yield curve. International funds were severely impacted in 2022 due to high inflation and fears of recession. US technology funds especially took a heavy beating. The freeze on limits on how much domestic funds could invest abroad made matters worse.

Gold as an investment asset class managed to gain about 14 percent in 2022.

Read: New champions - schemes that made a fresh entry into the best MF list in 2023

MC30 in 2022: An auditNinety percent of our actively managed schemes outperformed their category averages over the five-year period that ended December 31, 2022. Sixty-six percent of actively managed schemes outperformed their respective benchmark indices over the same period. When comparing with the benchmark indices, we don’t account for focused funds as it is not appropriate to compare funds with only 30 holdings in their portfolio with indices constituting 500 stocks (The Nifty 500/BSE 500 are the benchmarks for these focused funds).

Also see: The methodology behind the curated basket of mutual fund schemes

Our aim is to keep the churn in MC30 to a bare minimum. After all, if we advise our readers to hold schemes for the long term, it’s only logical that we do the same. However, some schemes are bound to fall by the wayside. Either the fund manager calls go drastically wrong or their strategies underperform for longer periods that don’t justify their continuance in MC30.

Or, quite simply, some schemes outside the MC30 become screaming buys, especially in light of their long-term performance. Here, change is inevitable, but as promised, our aim is to keep this change to a bare minimum.

In this edition, five equity schemes go out and are replaced with five new ones.

Also read: Why five schemes are out of Moneycontrol’s handpicked list of top-performing mutual funds?

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.