Spotting value in equity markets is hard and even tougher when markets begin to fall from highs. Some stocks fall less when markets correct and gain more when markets start to trend upwards – analysts might call such stocks as safe or quality picks.

We looked at two cycles when market surged from 9800 to 10,000 levels and then fell to 9,800 and then rallied again towards 10,000. Today, we are at the same crossroads again when Nifty50 took support at 9,800 and has bounced back to reclaim Mount 10K.

The Nifty50 rose from 9800 to 10,000 for the first time from July 12 to 2nd of August. In the first leg, Nifty recorded its first peak of 10,137. After making an intermediate top, Nifty slipped hit a low of 9686 before bouncing back.

In the second leg, Nifty reclaimed 9,800 around 23rd August and went higher to make a fresh record high of 10,178 and again drifted lower towards 9,800. The Nifty made a low of 9,813 on Tuesday before bouncing back towards 9,850.

Multiple factors have contributed towards the fall which brought Nifty from 10,178 levels to levels closer to 9,800. Apart from geopolitical uncertainty, rising concerns over economic growth, valuations, and unemployment.

“The bad has been done or negligible is being left, one should start accumulating good quality and cheap valuations steps available in the market. This is the time when investors should start pumping there idle cash lying in bank accounts to investments which can yield much higher,” Dyaneshwar Padwal – AVP – Technical Analysis, KIFS Trade Capital to Moneycontrol.

“Overall we are bullish on market and to make markets healthier corrections are bound to come. This is a positive sign to climb to new upside levels,” he said.

In both legs of the rally, as many as 30 stocks rose up to 36 percent and proved their metal. Stocks which rose in both leg 1 and leg 2 of the rally in the Nifty50 include names like Yes Bank, Vedanta, Hindalco Industries, Reliance Industries, Eicher Motors, Adani Ports, Kotak Mahindra Bank, IndusInd Bank, HDFC Bank, and Tech Mahindra.

Yes Bank which rose up to 20 percent in the first leg of the rally, rallied 8 percent in the second leg. RIL gave nearly 8 percent gains in the first led and rose 6 percent in the second leg of the rally. (Refer chart)

Disclosure: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

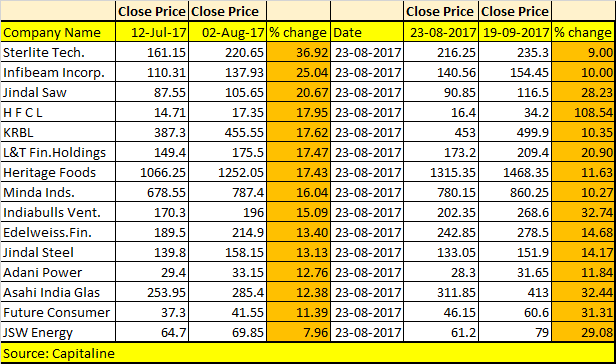

In the S&P BSE 500 index, as many as 15 stocks which gave almost double-digit returns in both legs of the rally include names like Sterlite Technologies, Jindal Saw, Bajaj Finance, Welspun Corp, KRBL, L&T Finance Holdings, Heritage Foods, Edelweiss Financial, Jindal Steel, Adani Power, JSW Energy, and Asahi India Glass etc. among others.

Sterlite Technologies rose 36 percent in the first leg of the rally while in the second leg it rose by 9 percent, followed by Jindal Saw which gained 20 percent in the first leg of the rally and rose 28 percent in the second leg, and HFCL which rose 18 percent in the first leg, more than doubled in the second leg of the rally.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!