In Budget 2020, Finance Minister Nirmala Sitharaman didn’t lower the tax rates as many had hoped. Instead, she introduced new, optional tax regime that promised to levy lower tax rates, but with a condition. The taxpayer had to give up on many income-tax deductions and exemptions that were part of the existing regime. Alternatively, you could choose to hold on to the existing, or old, tax regime that provides a plethora of tax deductions and exemptions.

Mumbai-based business development executive Tejashree Kandhare, 26, was among the tax-payers enthused by the idea of not having to invest in tax-saver instruments with long lock-in periods, besides at lower rates. “I have some financial responsibilities and need liquidity. Hence, I cannot lock my money into tax-saving schemes for the long term. So, I feel the new regime suits me better,” she says. Her tax payable will be lower in the new regime, as she was unable to utilise tax breaks of up to Rs 1.5 lakh under section 80C. Her current needs and goals being of the short-term nature, 80C tax-savers were a drag on her financial plan.

Tejashree Kandhare, Mumbai. I have some financial responsibilities and need liquidity. Hence, I cannot lock my money intro tax-saving schemes for the long-term. So, I feel the new regime suits me better.

Tejashree Kandhare, Mumbai. I have some financial responsibilities and need liquidity. Hence, I cannot lock my money intro tax-saving schemes for the long-term. So, I feel the new regime suits me better.

When does the new tax regime work?

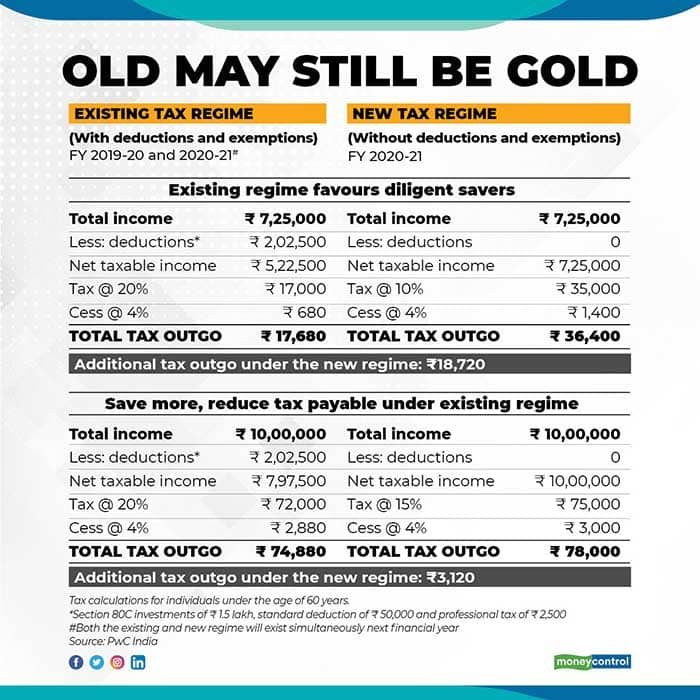

Apart from tax-payers such as Tejashree, those just starting to work, with lower income and minimal savings, too, could move to the new regime. It will not be difficult to let go of lower eligible deductions – for instance, employees’ provident fund contribution deducted every month, which can be claimed as deduction under section 80C. Not only will they be left with more money in their hands (see graphic), but will also be able to avoid cumbersome paperwork.

“The new tax regime could also work for retirees who need liquidity and do not want to lock their funds into tax-saver instruments. However, this is applicable to those with limited income. If you earn over Rs 10 lakh, you should not shy away from tax-saving instruments,” says Karan Batra, Founder and CEO, Chartered Club.

Put simply, the new income-tax regime is likely to work for a select few categories. If you plan to settle abroad soon, again, you could switch to the new system. “If you plan to stay in India only for the short term, you wouldn’t want to make long-term investment commitments. You will need cash in hand. Your focus will be on current requirements and not future financial goals,” says Sudhir Kaushik, Co-founder and CEO, Taxspanner.com.

Why the older regime holds an edge

Most financial advisors, however, advise against any switchover to the new regime. They believe the existing tax regime will be beneficial for a majority of the taxpayers. “The tax structure with deductions will work in favour of most. The New regime will appeal only to those who are unable to utilise the available tax breaks due to higher expenses or did not make efforts to optimise them,” says Pankaj Mathpal, Founder, Optima Money Managers.

If you have been claiming at least Rs 2.5 lakh as deductions, including the standard deduction of Rs 50,000, your tax outgo is likely to be lower in the older regime (see graphic). “Many deductions are of a recurring nature. Why would you want to stop availing of these benefits by switching to the new regime,” asks Mathpal.

Also listen: Simply Save podcast: Choose wisely between old and new income-tax regime

Raman Batra, an IT professional from Delhi, sees huge value in claiming tax concessions. “The older regime provides the option to claim deductions and exemptions such as house rent allowance, leave travel allowance, provident fund and equity-linked saving scheme (ELSS), which is not the case with the new regime. These lower the taxable income and, thus, the overall tax payable,” he says. He has decided to stick with the old regime despite having to submit expense and investment proofs every time. “While maintaining these documents and properly entering the information in ITR-2 is a hassle, it is worth the effort,” he says.

Raman Batra, New Delhi. While maintaining documents (for claiming tax deductions) and properly entering the information in ITR-2 is a hassle, it is worth the effort.

Raman Batra, New Delhi. While maintaining documents (for claiming tax deductions) and properly entering the information in ITR-2 is a hassle, it is worth the effort.

Financial planners, too, recommend adhering to the old tax regime because the old regime nudges you to save for a rainy day ahead. “You should always strive to save first and then spend. Tax-saving instruments don’t just reduce your taxes; they also help you accumulate wealth,” says Batra.

Moreover, tax-savings are not restricted just to section 80C. You can also avail of several other tax benefits as well. For example, HRA exemption under section 10, deduction on housing loan interest under section 24 and health insurance premium payment under section 80D.

“An adequate health insurance cover is critical now, given that many COVID-19 patients and their families suffered financially too, due to the cost of treatment. Tax deductions provide an incentive to buy heath insurance,” says Kaushik. Likewise, if you have daughters under the age of 10: Sukanya Samriddhi Account, which yields 7.6 percent and is part of the 80C basket, is a lucrative instrument. Other tax-saver small saving instruments such as public provident fund (PPF) and senior citizen’s saving scheme (SCSS) are remunerative too, besides offering tax concessions. Then, there is the additional Rs 50,000 deduction under section 80CCD (1B) on contribution to the National Pension System (NPS). “In the case of EPF, you needn’t even make any effort. The employer will simply deduct your contribution – which entitles you to deduction under section 80C – from your salary and deposit it. You get to earn tax-free returns at investment, accumulation and maturity stages (EEE status),” adds Kaushik.

Putting the process into motion

If you are a salaried individual, you are likely to have already declared your choice of tax regimes in July this year. However, you can change your stance when you file your tax returns in July 2021.

Also, you can modify your choice next financial year – and every year, depending upon your estimation of the tax impact. If higher expenses are your sole reason for switching to the new regime, think again. “Do not sacrifice your future goals merely to ensure present comfort. Be guided by logic rather than impulse,” says Kaushik. Curtail expenses if large household budget is the only obstacle to saving more under the existing tax regime. And, claim tax benefits instead of taking the easy way out and moving to the new regime.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.