Now that the New Year celebrations are behind us, it’s time to focus on another annual ritual that stirs contrasting emotions: making tax-saving investments. It is a tedious, yet unavoidable task. The months of January and February are especially crucial for salaried employees, given that they have to submit proofs of their tax-saving investments to their employers. While you can make these investments by March 31 and claim a refund, missing your employer’s deadline will result in disproportionate tax deduction during the next three months.

Ideally, your tax planning should start in April, right at the beginning of the financial year. If you haven’t been able to do so, do not fret. A bit of homework can help you maximise the tax breaks, while minimising the strain on your finances.

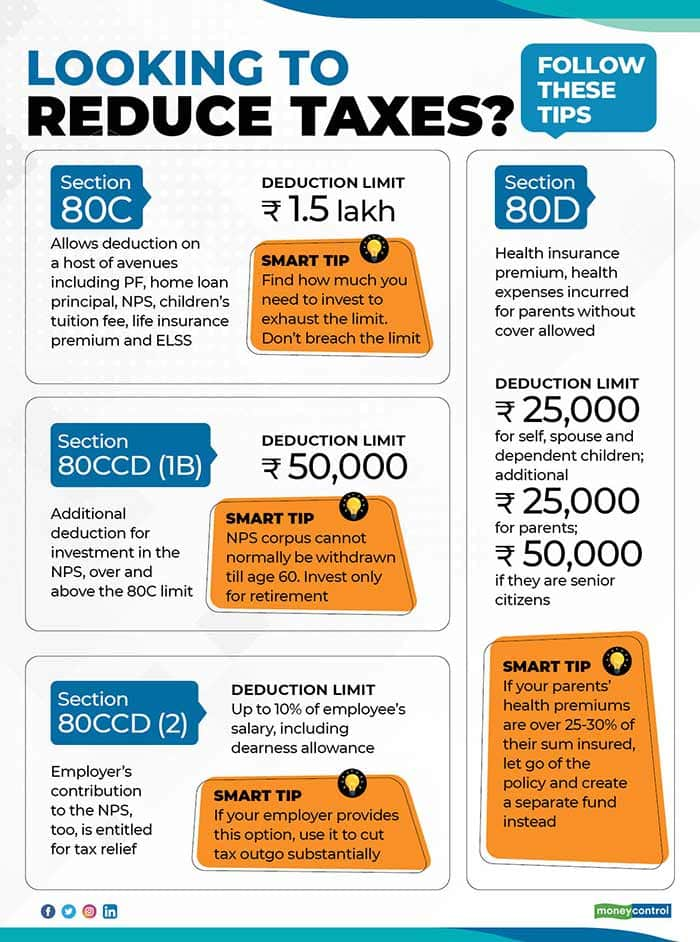

This is particularly important for tax-payers whose gross income is just over Rs 5 lakh. The Interim Budget 2019-20 announced a rebate on tax paid for those earning up to Rs 5 lakh. However, even those whose income levels are a slightly above Rs 5 lakh can escape the tax net by fully utilising the tax benefits. For example, an individual with a total income of Rs 7.5 lakh can exhaust the Rs 1.5 lakh investment limit under section 80C and make a contribution of Rs 50,000 to National Pension System (NPS) to reduce her taxable income to Rs 5.5 lakh. This, coupled with the new standard deduction limit of Rs 50,000, can bring her actual tax outgo down to zero.

Here are six measures to minimise your tax payable:

Consider contributing to VPF

Apart from the mandatory deduction of 12 per cent of your basic salary as employees’ provident fund (EPF) contribution, you can voluntarily earmark a higher amount. This amount will be eligible for deductions under section 80C, just like your compulsorily deducted contribution. Currently, EPF fetches 8.65 per cent tax-free return annually, which is applicable to VPF contributions too. The rate of return is declared by the Employees’ Provident Fund Organisation (EPFO) every year. “On this front, it scores over other debt instruments in the 80C basket offering fixed returns such as the public provident fund (PPF), five-year tax-saver fixed deposits and national savings certificates (NSC),” says Kuldip Kumar, Tax Partner, PwC.

The drawback? The funds will be locked in till your retirement, though partial withdrawals are permitted for purposes such as funding medical treatment, house acquisition and financing higher education. Therefore, choose this option only as part of your larger retirement planning strategy. Also, evaluate your finances and goals to ensure that you will not need these funds to meet liquidity needs in the short-term.

Partly prepay your housing loan

Partly prepaying your housing loan, particularly if the interest rate is high, could be a better option than making additional investments, assuming your PF and current principal repaid cannot exhaust the 80C limit.

While most banks have reduced interest rates recently, many older borrowers whose loans are linked to erstwhile internal benchmarking regimes, continue to pay much higher interest rates. Such borrowers can look at making part-prepayments to exhaust the Rs 1.5-lakh limit. Remember, the deduction on annual home loan interest paid is restricted to Rs 2 lakh. Often, the loan amounts are in excess of Rs 25 lakh.

Assuming an interest rate of 8.25 per cent and a 20-year tenure, the annual interest outgo on a Rs 30-lakh loan is well over Rs 2 lakh in the first seven years. “Such individuals can consider housing loan prepayment as a smart deduction under section 80C. Apart from the tax deduction, they can also save on the annual interest on the amount repaid,” says Pune-based chartered accountant Parixit Mishra. Small amounts prepaid, particularly in the initial years, can go a long way in maximising the benefits and reducing the overall interest outgo.

Invest in NPS

You can look at investing in the NPS (national pension system) even if you are already an EPFO subscriber. The scheme has become more investor-friendly over the years and continues to evolve. Now, the Pension Fund Regulatory and Development Authority of India (PFRDA) is considering a proposal to allow systematic withdrawals from NPS at maturity (when the subscriber turns 60) as an option. At present, 60 per cent of lump-sum withdrawal at maturity is tax-free but the rest has to be compulsorily used to buy annuities. Annuity income is taxable.

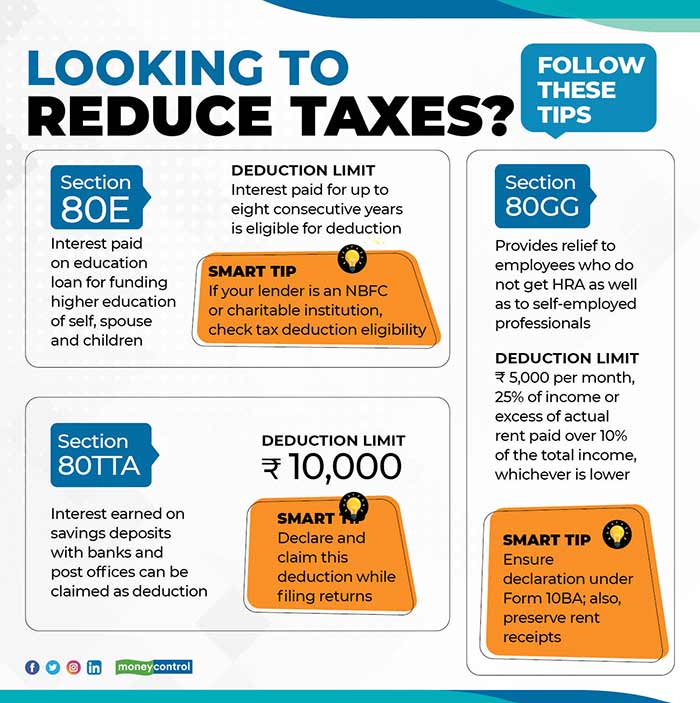

There are three ways of claiming deductions on NPS contribution made. For one, you can take the benefits under section 80C [that is, 80CCD(1)], as part of the overall Rs 1.5-lakh limit on investments made by you. Second, you can make an additional investment of up to Rs 50,000 under section 80CCD(1B). This apart, if your employer contributes up to 10 per cent of your basic salary to the NPS, the amount will be eligible for deduction under section 80CCD(2). However, choose this avenue only if you intend to invest towards your retirement, and will not need the money in the short term. The NPS corpus will get locked in till you turn 60, with premature part-withdrawal being permitted after three years for reasons such as critical illnesses, children’s education and marriage and house acquisition.

Claim deductions on group top-up premium

Several employers today allow their employees to add a top-up health cover to the base policy offered. They also facilitate health covers for parents that employees can voluntarily opt for, as many employers restrict the coverage to employees’ spouse and children. In both cases, the premium amount is typically deducted from the salary every month. “Go through your organisation’s policies carefully. If your Form-16 does not factor it in, you can claim deduction under section 80D on the amount paid by you,” informs Mishra. Under section 80D, you can claim a deduction of up to Rs 25,000 on health insurance premium paid for self, spouse and dependent children. If you are paying premiums for your parents, too, you will be eligible for an additional deduction up to Rs 25,000, which can go up to Rs 50,000 in case they happen to be senior citizens. So, total tax benefit for individuals over the age of 60 who are also servicing their parents’ health premiums, can be as high as Rs 1 lakh.

Pay for parents’ medical expenses

Health expenses, particularly for the elderly, have been mounting over the years. And, many senior citizens do not have a health insurance policy to cover these bills. Such individuals and their children, who are taking care of the expenses, are provided tax breaks under section 80D. “Such amounts should be incurred on the health of the assessee, her spouse, dependent children or parents, whose age is 60 years or more,” explains Sandeep Sehgal, Director, Tax & Regulatory, Ashok Maheshwary & Associates LLP. However, these exemptions cannot be claimed if they do not have a health policy. “If a senior citizen assessee has incurred medical expenditure of over Rs 50,000 for himself as well as for senior citizen parents, then deduction of Rs 1 lakh can be claimed.”

Bought an electric car? Get rewarded

Union Budget 2019-20 announced some tax incentives for the purchase of electric vehicles. If you had taken a loan to buy one this year, you will be entitled to tax deduction under section 80EEB on interest paid of up to Rs 1.5 lakh per annum. “The loan should be sanctioned during the period between April 1, 2019 and March 31, 2023. This is subject to the condition that no other electric vehicle should be owned on the date of sanction of such loan,” says Parizad Sirwalla, Partner and Head, Global Mobility Services, Tax, KPMG.

Finally, in the rush to meet the deadline, do not blindly make tax-saving investments of Rs 1.5 lakh. Always ascertain the quantum of your compulsory EPF contribution, children’s tuition fee paid as well as ongoing life insurance premium commitments before making fresh investments.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.