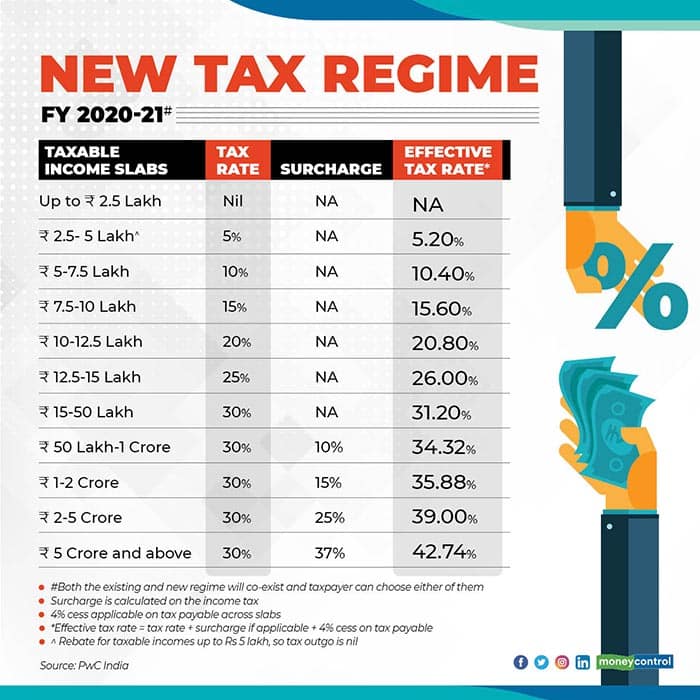

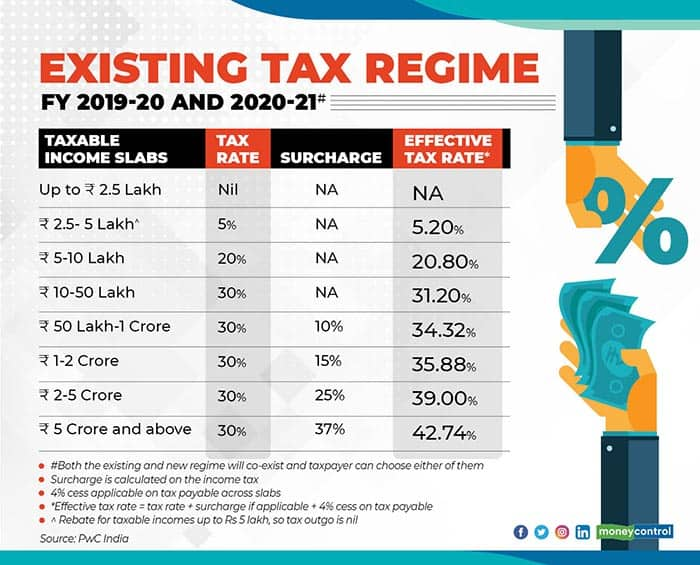

Should you shift to the new personal income tax announced in Budget 2020? Will it benefit taxpayers across the board? Seems unlikely. Calculations suggest that higher-income earners may find the old regime with exemptions a better option. Those in the lower tax brackets, however, may benefit from the new income tax slabs.

Only those who forgo exemptions and deductions will be offered the option of switching to a new regime with revised lower rates. “It shall be optional for the taxpayers. An individual who is currently availing more deductions and exemption under the Income Tax Act may choose to avail them and continue to pay tax in the old regime,” the finance minister said.

Also Read: Budget 2020: FM announces new income tax slabs and rates, tweaks exemption structureHowever, the cheer will not spread beyond a few select segments, say tax experts.

“For many, the older regime will still result in lower tax outgo compared to the new regime with lower rates. Also, the actual decision will have to be based on your respective situation, taking into account the deductions that you are claiming so far,” says Kuldip Kumar, Tax Partner, PwC India.

In the beginning of financial year 2020-21, therefore, you will be forced to implement the advice that financial advisors often dispense: start your tax planning process right at the beginning of the year. You will need to take a call on which regime to choose while filing your proposed investment declarations in April. “Salaried employees may have to make the choice between old and new regime every year,” says Homi Mistry, Partner, Deloitte India.

Several tax deductions and exemptions – section 80C investments of up to Rs 1.5 lakh, section 80CCD (1B) that offers an additional deduction of Rs 50,000 on NPS contribution, house rent allowance, housing loan interest paid, and so on – will be redundant in the new regime.

However, the National Pension System (NPS) tax break under section 80CCD(2) will continue. Even if you switch to the new regime, the deduction can help you save significantly if your employer offers the option. Employer’s contribution of up to 10 per cent of your salary (basic pay plus dearness allowance) is eligible for tax relief under section 80CCD(2). For government employees, this limit is 14 per cent.

This could especially be the case with individuals who are availing tax breaks of recurring expenses or contributions. For example, if your provident fund contribution, eligible for a tax break under section 80C, is a mandatory deduction made from your salary every month. Similarly, any life insurance premium will have to be paid every year until the end of the policy tenure. If you claim deduction under section 24 (b) on housing loan interest paid, you will be incurring this expense over the home loan tenure, which could extend to 30 years.

Those at the beginning of their careers, starting on a clean state, but keen on a simple process, can consider making the switch. Moreover, they are unlikely to have committed to section 80C investments or taken home loans. “Even such individuals might find claiming HRA more attractive if, say, they have relocated to a different city and are paying rent. It will finally boil down to your salary structure,” explains Kumar.

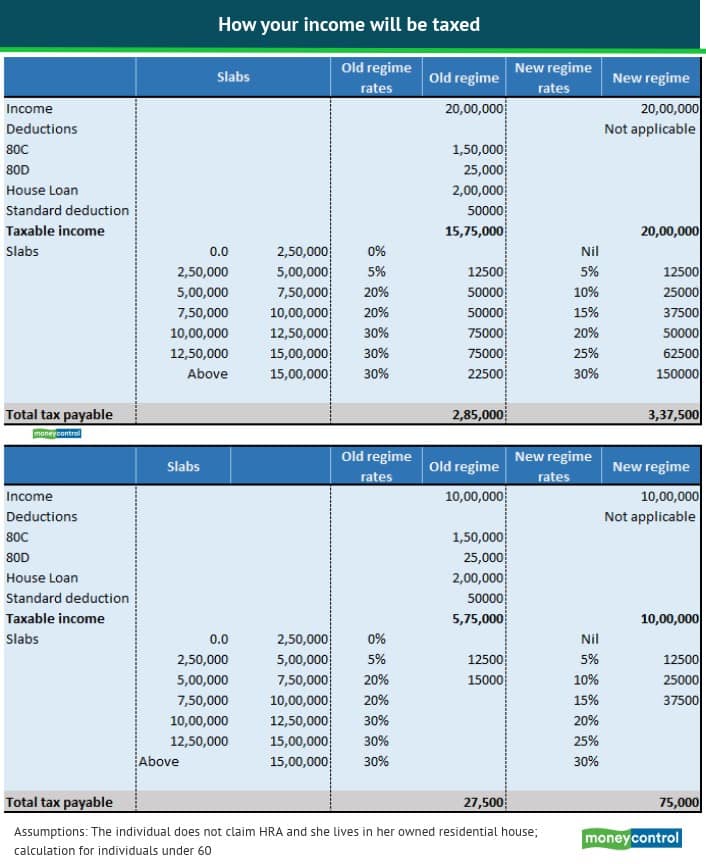

Also Read: Know your new tax rate as per Budget 2020 slabsAccording to Moneycontrol’s calculations (see table; cess is not included in the calculation), salaried employees across income slabs are unlikely to save more if they switch to the new regime. The calculation takes into account some common exemptions and deductions claimed by salaried tax-payers. The new regime will kick in from the financial year 2020-21.

For example, if your deductions claimed are confined to section 80C investments, you are likely to be better off in the new regime. As per tax consultancy firm PwC India’s calculations, those earning Rs 15 lakh will have to shell out Rs 14,820 less as tax under the new regime, factoring in only standard deductions, professional tax paid and 80C investments.

However, typically, most individuals either claim the House Rent Allowance exemption or deduction on housing loan interest paid, besides tax benefits on health insurance premium paid. So, if your exemptions total to Rs 3,00,000, you will have to pay Rs 15,600 'more' in the new regime.

Check out the tax calculator below. (Or Click here if you can't see the calculator below.)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.