India is getting younger. Forty is the new sixty and twenty is the new forty. Young India wants to shop till they drop. A February 2019 Deloitte report says that at 400 million, millennials in India form 34 percent of India’s population. This share is among the highest vis-à-vis major economies of the world. Big dreams, fat salaries and a good life are what they are after. According to the Deloitte Global Millennial Survey 2019, 57 percent want to see and travel the world on a priority basis. Around 52 percent want to earn high salaries and be wealthy.

Our parents were happy with investing their money in humble post offices where postmasters were hesitant to adapt to computerisation at one point. In the first article of this two-part series, we had discussed how small-saving schemes still retain their charm among investors. This concluding part highlights how the going is not easy for these schemes, given the marketing onslaught of mutual funds and insurance products.

The big challenge for small saving schemes is to get young India into its fold. But that’s just one of the worries of the National Small Savings Fund (NSSF); a pool worth nearly Rs 17.78 trillion, administered by the government of India. Collections made through all small-savings schemes land up in the NSSF pool.

Rate cuts hurt senior citizensFor one, the large rate cut has come at a time when individuals are already facing the prospect of shrinking, unstable incomes. Economists and industry-watchers agree that the rate cut was in order. “The sharp revision in small savings rate by the government for first quarter of FY-21 is timely and appropriate. We can expect a better transmission and coordinated policy actions. This move will reduce the divergence between bank and small savings rates,” said Soumya Kanti Ghosh, Group Chief Economic Adviser, SBI, in a report. However, many small depositors’ interest will be adversely affected.

“The change in rates was imperative. However, the time of cut is not good, as all the residents are facing the COVID-19 (crisis),” said Ghosh. The hardest hit will be senior citizens. According to SBI’s estimates, there are around 4.1 crore senior citizen term deposit accounts in the country totalling to Rs 14 lakh crore. “Hence it is imperative that the government exempts interest income from taxes, particularly for SCSS, for which the government has reduced interest rate from 8.6 per cent to 7.4 per cent, a whopping 120 bps decline,” Ghosh said in the report. Pradeep Sali, 60, a Mumbai-based depositor who has consistently invested in small-saving schemes to plan for his retirement, agrees. Small depositors apart, the reduction will also lead to the NSSF coming under pressure. “Thus, the efficacy of small savings for financing fiscal deficit becomes questionable,” Ghosh said.

Bad service standardsBut perhaps the worst aspect of small savings is its dismal track record in customer service. Unkept post offices and bureaucratic staff with no sense of punctuality or empathy, especially towards senior citizens, have been pain points for many customers. “The infrastructure and service standards at many post offices are not up to the mark. They have less-than-required hands at counters and lag behind on technology adoption. Even in cities, some post offices are dingy and very little effort is made to attract customers,” laments a postal agent for small saving schemes who spoke on condition of anonymity.

Clearly, despite the vantage position they continue to be in at present, NSSF and its collection entities, particularly India Post, will have to improve their service standards to retain customers. “It is not easy to make withdrawals as the ATM card issuance is not streamlined. You have to wait in a queue and the seating arrangements are not up to the mark in some post offices,” says Sali, who had attempted to get an ATM card issued recently, only to be told that the process would take time. Likewise, visiting post offices to make investments every month or year is a tedious task. "The staff efficiency also needs improvement. Often, there is just one staff member to man the counters," complains Sali.

Those that opened small savings accounts through banks such as State Bank of India (SBI) and ICICI Bank, on the other hand, have it relatively easier as they can make investments online. On its part, India Post, too, has gone tech-savvy recently. It launched mobile banking in October last year, while internet banking was introduced in 2018. “We are taking the necessary steps to provide all facilities to our customers. This will also appeal to our younger customers. Once you register for the internet banking service, you can make deposits and transfer funds online,” says HC Agrawal, Chief Postmaster General, Maharashtra Circle.

Lack of publicity for small saving schemes has also held them back. In March 2017, trade body Association of Mutual Funds of India launched a campaign called Mutual Funds Sahi Hai. A war chest of Rs 270 crore (0.01 percent of the industry’s assets) is available to AMFI for spending towards investor education. From close to Rs 4,000 crore that investors used to plough into mutual funds through systematic investment plans in January 2017, they now pump in more than Rs 8,500 crore every month. Likewise, the Life Insurance Council launched a nearly Rs 100-crore campaign with the tagline ‘Sabse Pehle Life Insurance’ last year to underscore the importance of buying life policies. A similar awareness campaign – ‘Faayde Ki Baat’ – rolled out of the stables of the general insurance sector in March this year.

Banks rely on the might of their relationship managers to push various banking products, including fixed deposits.

Post offices, on the other hand, seldom talk. This has worked to their disadvantage. There are many benefits that even small saving schemes offer to their potential investors. “On one hand, the level of promotion of these schemes by post offices is not at the desired level. On the other hand, banks do not put in adequate effort to push these schemes. Rarely will you come across bank officials proactively advising their customers to invest in these schemes, which are a must-have in every individual’s portfolio,” adds the postal agent.

Ahmedabad-based Ashish Shah, Co-founder of WealthFirst Portfolio Managers believes that the reduction in incentives given to postal agents has created hurdles for the promotion of these schemes. “The withdrawal of the one per cent commission to agents drove them to mutual funds. Some started recommending debt funds to their customers, without explaining that there would be no guarantee on returns, unlike small-saving schemes. This led to investors getting into products they did not understand. The government is actually doing a disservice by stopping commissions, which serve the needs of a large section of small investors,” he says.

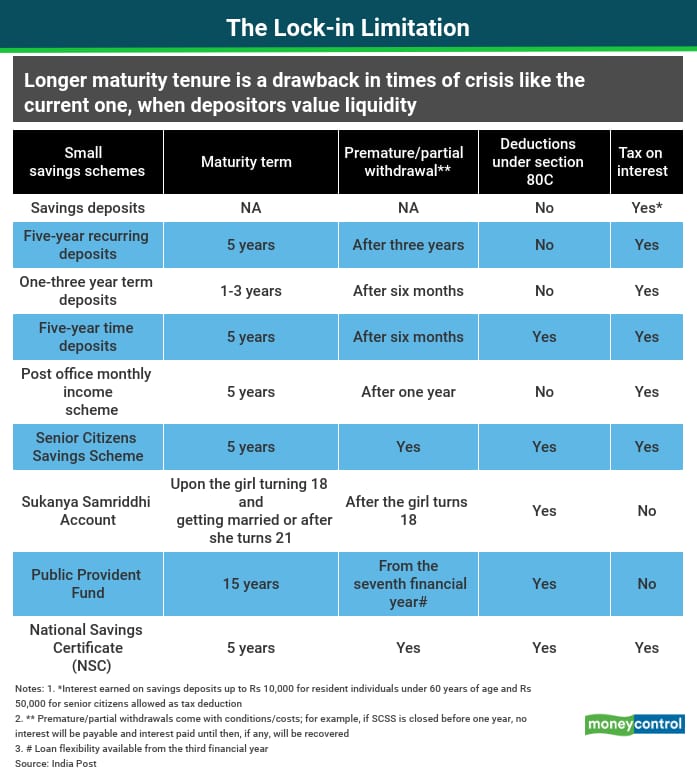

For investors, small-saving schemes come with another drawback: limited liquidity, which could be restrictive in times of a COVID-driven financial crunch. Most quality schemes such as the five-year recurring deposit, public provident fund (PPF), Sukanya Samriddhi Account (SSA) and Senior Citizens’ Saving Schemes (SCSS) come with multi-year lock-in periods and restrictions on premature withdrawals.

Also, interest earned on SCSS, five-year time deposits and national savings certificates (NSC) are taxable. “Small savings schemes can be a good fit in your fixed income portfolio, subject to your overall allocation strategy. On the flipside, you will not have easy access to funds when you need them due to the lock-in periods,” explains financial planner Gaurav Mashruwala. For instance, even the one-year time deposit, which yields 5.5 per cent per annum, does not permit premature withdrawal before six months. If the account is closed between sixth months and one year of opening, you will only be entitled to the savings account rate of 4 per cent.

Looking aheadIndia Post has begun to take some remedial measures. Of late, it has been actively deploying its backbone – the massive network of postmen and women – to promote these schemes and other products, including postal insurance, at malls, outside railway stations and near busy junctions. “We have started periodically conducting local camps across cities and towns to raise awareness. The idea is to acquaint people with the multiple benefits that our schemes offer,” says Agrawal. These efforts, if persisted with, can make a difference, given India’s sagging gross domestic savings rate, which slipped to a low of 30 per cent of the country’s GDP in financial year 2018-19, from 35 per cent in 2011-12.

For now though, and particularly in the current environment, these schemes will continue to thrive. “These schemes have inherent merits and serve real needs beyond mere tax-saving. For instance, PPF that offers 7.1 per cent tax-free return is a great investment vehicle for retirement. At present, no other avenue are capable of replacing these schemes, irrespective of whether the investor avails of the tax benefits. So, they are here to stay,” sums up Suresh Sadagopan.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.