The 40 bps hike in repo rate and policy rate by major central banks around the world confirms the return of the rising interest rate regime.

Home loan borrowers should expect a steady increase in their EMIs and overall interest cost in the near term. Those not opting for higher EMIs would see their tenure increased, which would incur even higher interest cost for them.

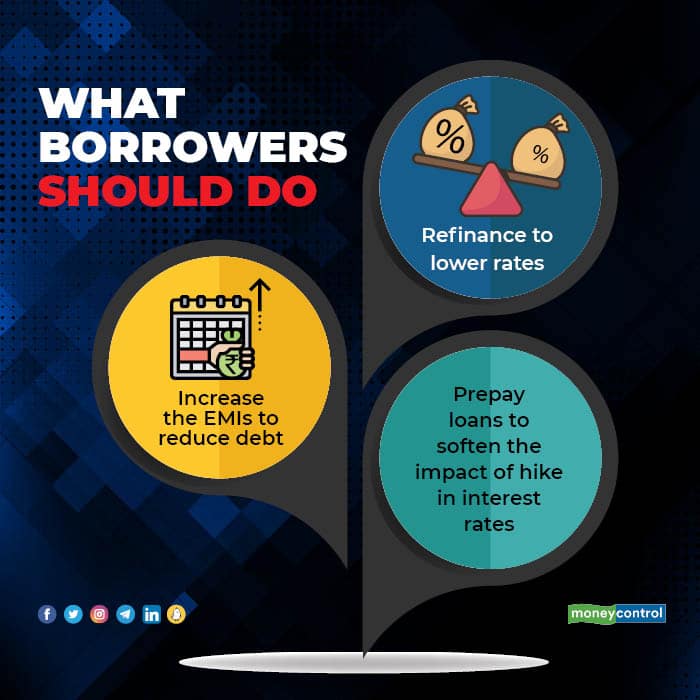

Here are some tips for home loan borrowers, both new and existing, to reduce their EMI burden and/or home loan interest cost.

For new home loan borrowers

Lower Loan-to-Value ratio

RBI allows lenders to finance up to 90 percent of the cost of properties in the form of home loans, depending on the loan amount. The proportion of the home property cost financed through loan is known as Loan-to-Value (LTV) ratio.

Borrowers have to contribute the remaining amount on their own in the form of downpayment or margin contribution. While borrowers usually prefer higher LTV ratios, opting for lower LTV ratios has its advantages.

A lower LTV ratio for the same tenure would result in lower interest cost as well as lower EMI. Moreover, lower LTV ratio reduces the credit risk for the lender, which increases the chances of home loan approval. However, home loan applicants should avoid using emergency funds or existing investments for crucial financial goals for making higher down payments.

Also read: How to cushion yourself against the RBI’s sudden rate hike and a high EMI burden

Longer tenure

Opting for a longer home loan tenure would reduce the EMI burden for the borrower. Additionally, it can increase one’s home loan eligibility due to the reduced EMI/NMI (Net Monthly Income) ratio. However, as longer tenure increases the total interest cost, borrowers should consider making prepayments as and when they have surpluses in the future.

Compare loan offers among prospective lenders

Home loan features like interest rate, processing fee, tenure and loan amount can vary widely across lenders, depending on the cost of funds and the credit risk assessment of the applicants.

Hence, one should compare the home loan features offered by as many lenders as possible before applying for a loan. One of the best ways to do so is to visit online financial marketplaces, which provide various home loan offers available from various lenders, based on the applicant’s monthly income, credit score, job profile and other eligibility criteria.

Also read: With home loan rates going up, is it time to move to fixed-interest-rate loans?

For existing home loan borrowers

Make prepayments

Home loan lenders allow borrowers to prepay their entire outstanding balance or part of it. The primary objective of prepayment is to reduce the overall interest cost for the borrowers. On making prepayments, borrowers can either opt for EMI reduction or tenure reduction.

The tenure reduction option would result in higher interest cost savings than the former. Opt for EMI reduction, if increasing EMIs adversely impact your financial position. Else, go for tenure reduction.

Borrowers should not sacrifice their monthly contributions or existing investments meant for crucial financial goals. Doing so may force them to avail loans at higher rates later for achieving those goals.

Home saver option

Many lenders offer home loan overdraft facility, branded as home saver, home loan advantage etc. But they require higher liquidity. Under this facility, an additional overdraft account is opened in the form of a savings or current account. The borrower can park his surpluses in the overdraft account and withdraw from it as per his cash flow requirements.

The lender would calculate the interest cost after deducting the surplus in the savings/current account from the outstanding home loan amount. Thus, borrowers would derive the benefit of making prepayments without sacrificing liquidity.

Home loan balance transfer

This option allows an existing borrower to transfer his entire outstanding balance to another lender at lower interest rates. The new lender would pay the outstanding home loan amount to the original lender, and, in return, the borrower would be sanctioned a new home loan at lower interest rate and/or for longer tenure.

This option is especially suitable for borrowers who have availed home loans at higher interest rates due to a poor credit profile in the past but are now eligible for loans at lower interest rates. Borrowers should opt for this option if their existing lenders refuse to reduce the interest rate.

Note that increasing the loan tenure with the existing lender is considered as loan restructuring, which adversely impacts the borrower’s credit score and future loan eligibility.

Hence, borrowers wishing to increase tenures for reducing EMIs can opt for the balance transfer option. However, an existing borrower should conduct a thorough cost-benefit analysis as it would require fresh documentation, and he may incur various costs while availing a fresh loan. Borrowers should opt for balance transfer only if the savings in the interest cost and/or other benefits accruing from the transfer exceeds the cost and efforts involved in transferring the loan.

Increase your EMI

Another way of reducing your interest cost is to request your lender to increase the EMI. This option should be ideal for those left with sufficient surpluses after factoring in their EMIs and unavoidable expenses.

Usually, lenders prefer the EMI/NMI ratio, i.e., the total monthly repayment obligation for all loans should be within 50-55 percent of their NMI.

Hence, lenders may require borrowers to submit income proofs and bank statements to reassess their repayment capacity, before approving increased EMIs. However, borrowers should not sacrifice their monthly contributions to unavoidable financial goals while opting for increased EMIs. Doing so may force them to avail loans at higher interest rates to fulfil their unavoidable financial goals.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.