All of a sudden-and entirely unexpected-the Reserve Bank of India (RBI) on May 4 increased the repo rate by 40 basis points to 4.4 percent for the first time in almost two years since the start of the pandemic in 2020. One basis point is one-hundredth of a percentage point. This comes when inflation has been rising to an 18-month high amidst a rebound in domestic economic activity.

“From a real estate point of view, this hike in policy rate is not welcome and will have a negative impact as home loan rates will increase immediately,” says Dr Samantak Das, Chief Economist, and Head Research and REIS, India, JLL.

Let’s go into the finer details of this announcement and its impact on the borrowers and depositors.

What are repo-linked loans?From October 1, 2019, all banks had to mandatorily link their floating-rate retail loans to an external benchmark – RBI’s repo rate, three/six-month treasury bill yields or any other benchmark prescribed by Financial Benchmark India Private Ltd (FBIL). Most banks had chosen the repo rate as their benchmark. For such retail borrowers, the effective interest rate is the repo rate plus a spread specified by the bank, which includes operating cost and credit risk premium.

While the repo rate is at the RBI’s discretion, banks change the credit risk premium as and when the borrower’s credit profile changes during the loan’s tenure. Other components, including operating cost, can be altered once in three years, as per the central bank’s circular mandating an external benchmark.

Will the repo rate hike affect all categories of loans?Yes, the implication of the repo rate hike would be felt across all categories of loans, both secured and unsecured.

“All the loans that come under the repo-linked lending rate (RLLR), especially the home loan and the loan against property will now cost higher and there can be a subsequent increase in other loans EMI as most of the banks have already started increasing the marginal cost of funds based lending rate (MCLR) since the beginning of this fiscal year, " says V Swaminathan, Executive Chairman, Andromeda and Apnapaisa.

“Generally, the car loans are given at fixed rates, which will not be affected by this increase. The car loans with floating rate will certainly see the impact next month or next quarter as per their respective terms,” says Ashish Pahariya, Partner, DSK Legal.

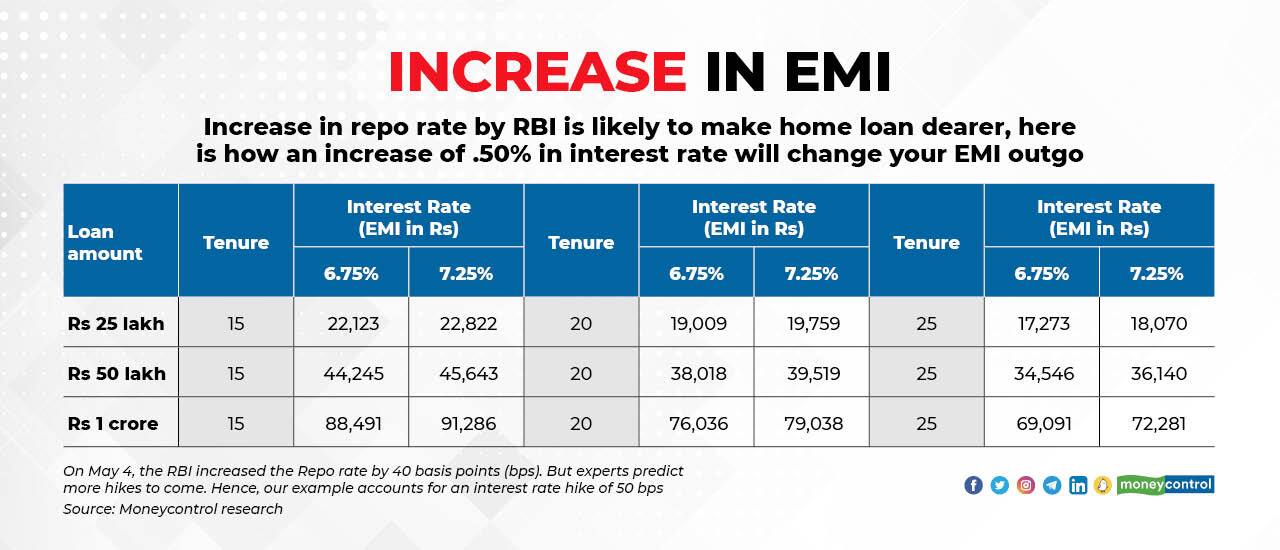

According to experts, close to 40 percent of loans are linked to the external benchmark, and this increase will translate into a more expensive loan for new and existing borrowers alike in a very short time. “The existing borrowers will see their tenor go up,” says Adhil Shetty, CEO, BankBazaar.com.

He explains that a home loan borrower with an outstanding principal of Rs 40 lakh and tenor of 20 years at 7 percent interest could see their tenor extend by 15-18 months when interest moves up to 7.4 percent.

In floating rate loans rate hike will be immediate.

“For fixed rate home loans, it will take some time as banks have to hike their deposit rates and MCLR. That will happen over a longer period," says Joydeep Sen, a corporate trainer-Debt.

What should home loan borrowers do to reduce the impact of repo rate hike?Long-term loans like home loans allow you to make prepayments. So a good alternative is to prepay your home loan. “While prepaying 5 percent of your outstanding every year would be an optimal solution, even a small prepayment of one EMI per year can bring substantial savings,” says Shetty. You can also increase the EMIs to reduce the debt.

Prepaying your home loan is anyway a good financial planning practice, irrespective of whether interest rates go up, down or remain steady. This is because it is always better to be debt-free as soon as you can, in your life.

“Alternately, in the increasing rate scenario, the borrowers will have to look for loan transfer with a new lender with low rates,” says, Pahariya.

Will depositors gain despite a repo rate hike announced?This is the good news. A rate hike translates into higher returns on fixed deposits, eventually. “However, despite the increase in repo rates, the deposit rate may not go up immediately, as it takes time to pass on this benefit to deposit holders,’ says Pahariya.

“We can expect to see higher returns even in other small savings schemes over the next few months,” says Shetty. But, it is important to remember that with inflation touching seven percent, most small savings cannot provide inflation-proof returns.

(Ashwini Kumar Sharma has contributed to the story)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!