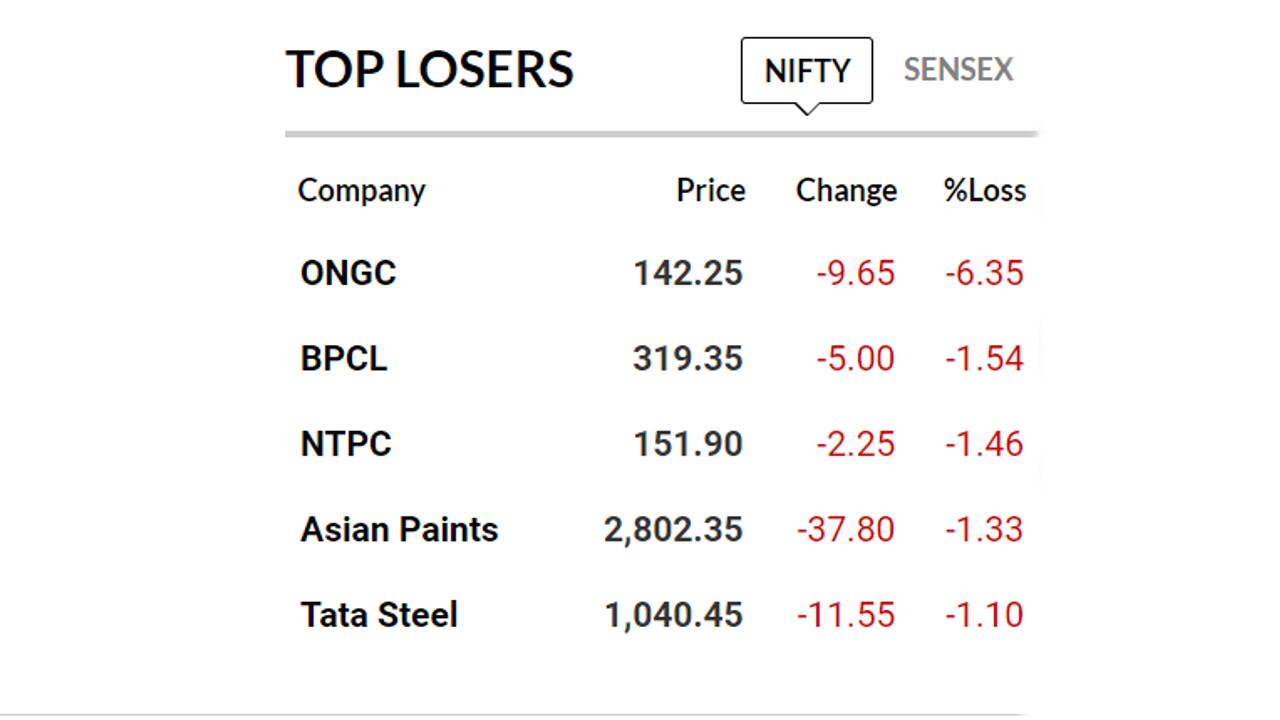

Oil company stocks were trading deep in the red at noon on May 27, with ONGC down 9 percent and BPCL 5 percent after reports claimed that the government was considering a windfall tax on state-owned and private oil and gas (O&G) giants.

ONGC and BPCL were in the red as of 12.10 pm on May 27

ONGC and BPCL were in the red as of 12.10 pm on May 27

The government was looking to offset inflation impact and increased public expenditure on fertiliser, fuel and food subsidies, sources told Hindustan Times. They added that the tax could be one way to manage finances.

Moneycontrol couldn't verify the story independently.

The windfall tax would likely be applied when oil prices cross a certain level. It is usually imposed on companies whose financials receive unexpected “lucky” boosts due to uncontrolled factors.

A final decision was expected “by the competent authority in an appropriate time”, sources told HT. Finance and petroleum ministries did not respond to queries, the report said.

Follow our Market LIVE blog coverage here

Precedent abroad

The UK on May 26 announced it would impose a 25 percent windfall tax on the profits of oil and gas companies to raise around £5 billion ($6.3 billion) to finance one-off grants of £650 to more than 8 million of the poorest households in the UK, Bloomberg reported.

The UK is also mulling a similar levy on power-generating companies. The UK’s energy aid bills have, so far, touched £37 billion.

Besides the UK, Italy, Hungary and Spain have also moved to impose some kind of windfall tax on companies.

Hungary said it would tax windfall on additional profits earned by various sectors, including oil and gas companies for a period of two years, to fund subsidies. While Italy announced a one-time 25 percent levy on energy companies to subsidise energy costs for consumers and businesses.

Oil prices

A source told Hindustan Times that the government could also consider seeking higher dividend from oil PSUs but private sector companies would then “get a free pass”. A second source noted that even developed countries were taxing windfall gains to foot subsidy bills.

ONCG and OIL are expected to announce their financial results this weekend.

Global conditions, too, are favourable for oil companies as the Russia- Ukraine war pushed prices to all-time highs. As of early Asian trade on May 27, oil eased slightly after a two-month high.

Benchmark Brent crude futures were down 11 cents to $117.29 a barrel and WTI crude futures for July delivery fell 19 cents to $113.90 a barrel. Overall, prices have, however, gained about 50 percent so far this year.

Other factors are also playing a part. The OPEC+ is set to stick to last year's production deal at its June 2 meeting and raise July output targets by 432,000 barrels a day, six OPEC+ sources told Reuters, rebuffing Western calls for a faster increase to lower surging prices.

Oil has hovered close to the two-month highs, with Brent crude on track for its biggest weekly jump in one and a half months, supported by the prospect of an EU ban on Russian oil and the coming summer driving season in the United States.

At 1.07 pm, ONGC was trading at Rs 144.20, down 5.07 percent, on NSE, while BPCL had recovered to Rs 324.3, down 0.031 percent. The Sensex was up 0.86 percent at 54,720.46 and the Nifty was trading 0.83 percent higher at 16,304.7

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!