Benchmark indices ended higher for the second consecutive day on Ma y27 with Nifty above 16300.

At close, the Sensex was up 632.13 points or 1.17% at 54,884.66, and the Nifty was up 182.30 points or 1.13% at 16,352.50. About 2152 shares have advanced, 1099 shares declined, and 119 shares are unchanged.

Apollo Hospitals, Tech Mahindra, HDFC Life, Hero MotoCorp and IndusInd Bank were among the top Nifty gainers, while losers included ONGC, NTPC, Bharti Airtel, Power Grid Corp and Tata Steel.

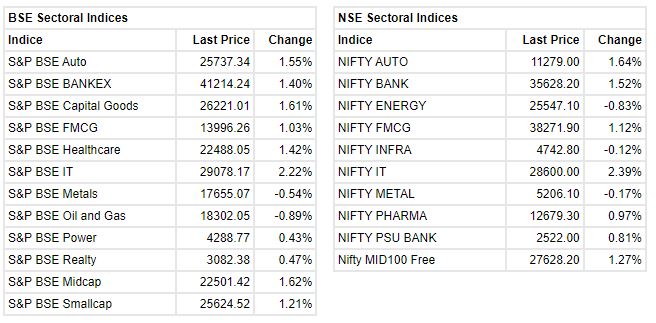

Except metal and oil & gas, all other sectoral indices ended in the green. BSE Midcap and Smallcap indices rose 1 percent each.