The benchmark indices corrected 1.6% on January 6, extending the downward move for the second consecutive session, with breadth strongly in favour of the bears. A total of 2,299 shares declined, while only 276 shares gained on the NSE. The bearish sentiment may persist as long as the market trades below all key moving averages. Below are some trading ideas for the near term:

Jigar S Patel, Senior Manager - Equity Research at Anand Rathi

Tata Consumer Products | CMP: Rs 946.9

Tata Consumer Products has corrected 30% from its Rs 1,253.7 peak and recently formed a reversal candlestick pattern near its previous breakout zone, now a strong demand area. The stock reversed precisely at the 161.8% Fibonacci retracement of its prior move, indicating a potential rebound in the coming weeks. This confluence of technical factors points to a favourable risk-reward setup, presenting an attractive opportunity. Traders may consider entering long positions in the Rs 925-950 zone, with an upside target around Rs 1,040.

Strategy: Buy

Target: Rs 1,040

Stop-Loss: Rs 885

Oil India | CMP: Rs 457.7

Oil India recently bounced from a crucial support level near Rs 420 and is now trading around Rs 460. This support aligns with the market profile's point of control, marking the highest trading activity between June and September 2024. On the daily timeframe, a bullish divergence suggests a potential upward move toward the Rs 505 level. Traders may consider entering long positions in the Rs 450-460 zone, with an upside target around Rs 505.

Strategy: Buy

Target: Rs 505

Stop-Loss: Rs 430

Reliance Industries | CMP: Rs 1,218

Reliance Industries is currently trading in a support zone defined by the channel created by its 2008 and 2009 highs, as seen on the chart. In the past four instances, the stock has rebounded from the channel's lower boundary. Currently, a bullish CRAB pattern with a reversal zone around Rs 1,200-1,220 is evident at the channel’s lower end. This reversal zone aligns with anchored VWAP (Volume Weighted Average Price) support and a bullish divergence on the daily RSI (Relative Strength Index). Additionally, the Fixed Range Volume Profile from 2021 to date shows significant volume activity in the Rs 1,160-1,235 zone, coinciding with the reversal area. Based on these confluences, a turnaround in Reliance's price is anticipated. Traders may consider entering long positions in the Rs 1,185-1,225 zone, with an upside target of Rs 1,350.

Strategy: Buy

Target: Rs 1,350

Stop-Loss: Rs 1,135

Jay Thakkar, Vice President & Head of Derivatives and Quant Research at ICICI Securities

Eicher Motors | CMP: Rs 5,250.1

Eicher Motors recently provided a huge breakout from a sideways consolidation with an increase in volumes as well as open interest, indicating clear buying interest and a price-volume breakout. The momentum indicator MACD (Moving Average Convergence Divergence) has also provided a bullish crossover on the daily charts, suggesting that the short-term trend is positive. The current dip should be utilized as a buy-on-dips opportunity.

From the derivatives perspective, the stock has witnessed long additions recently, and the options data suggest that as long as it is trading above Rs 5,000, the short-term trend remains positive, with targets of Rs 5,500 to Rs 5,650.

Strategy: Buy

Target: Rs 5,500, Rs 5,650

Stop-Loss: Below Rs 5,100

Jubilant Foodworks | CMP: Rs 766.6

Jubilant Foodworks has broken through its crucial swing resistance at Rs 715 and thereafter gained upward momentum. The stock has also witnessed significant long buildup in this series, and the options data indicates that there is no major hurdle until Rs 800. Therefore, the overall trend remains positive, and buying on dips is recommended.

Strategy: Buy

Target: Rs 790, Rs 800

Stop-Loss: Rs 740

HDFC Bank Futures | CMP: Rs 1,720.15

HDFC Bank has broken its uptrend line support with a clear sell crossover in its momentum indicator, MACD. The stock has failed the ascending triangle breakout and has also broken the uptrend line support, suggesting that the overall trend is negative.

From a derivatives point of view, the Rs 1,800 strike again has the highest Call open interest, which will act as a crucial hurdle for the stock going forward. Until these levels are surpassed, the short-term trend remains negative. The stock continues to witness long unwinding, indicating a lack of momentum on the upside.

Strategy: Sell

Target: Rs 1,675, Rs 1,650

Stop-Loss: Rs 1,767

Anshul Jain, Head of Research at Lakshmishree Investments

Zensar Technologies | CMP: Rs 771.7

Zensar is in the process of forming a 120-day long bullish Cup-and-Handle pattern on the daily chart. The rally towards the neckline has been accompanied by significantly higher volumes, highlighted by a 1381% surge in volume on January 2 compared to the 50-day average. This volume spike indicates institutional interest and signals that the stock is preparing for a breakout. With the structure formation having occurred on low volume, the current volume pickup suggests a strong move ahead. A breakout above Rs 820 would pave the way for a target of Rs 1,100, making Zensar Tech an attractive stock to monitor.

Strategy: Buy

Target: Rs 900

Stop-Loss: Rs 740

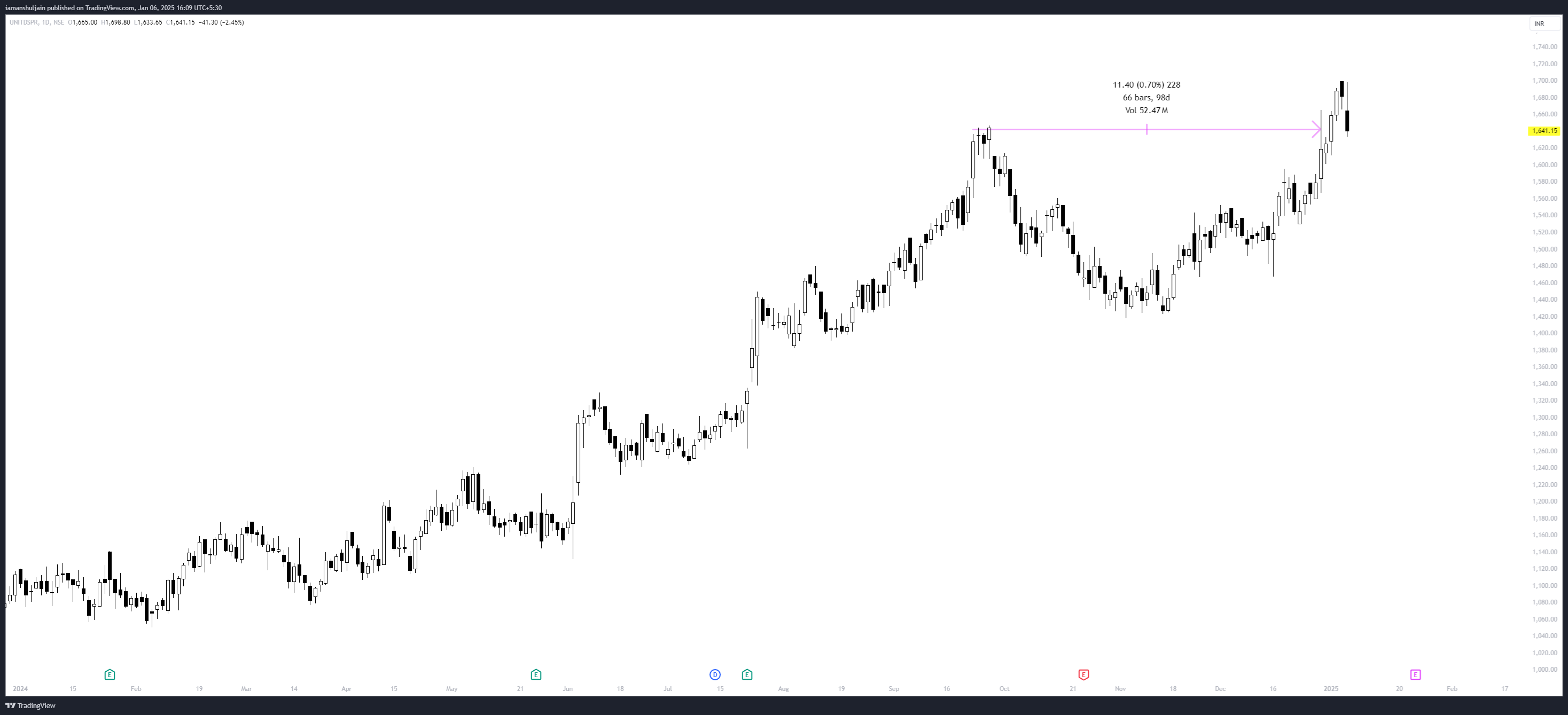

United Spirits | CMP: Rs 1,641.15

United Spirits has successfully broken out of a 65-day long bullish rounding bottom pattern on the daily chart, with the breakout occurring at Rs 1,640. This move was supported by a significant volume surge of 481% compared to the 50-day average on December 30. Following the breakout, the stock has retested the Rs 1,640 level, showing dried-up volumes during the retest—a typical sign of a strong support level being established. This pattern and the volume behaviour suggest that the stock is poised for further upside. A move above Rs 1,640 could lead to a potential rally towards Rs 1,740.

Strategy: Buy

Target: Rs 1,740

Stop-Loss: Rs 1,600

JK Cement | CMP: Rs 4,701.75

JK Cement has formed a bullish Cup-and-Handle pattern over 83 days, with the stock on the verge of a breakout. The right side of the pattern shows two inside candles, indicating consolidation before a potential upward move. A breakout above Rs 4,805 will likely drive the stock towards Rs 5,200 in the near term. The high volumes on the up candles and dried-up volumes on the down candles suggest a strong base formation, typical of a stock poised for a breakout. The technical setup indicates robust upside potential, making it a stock to watch for a significant move.

Strategy: Buy

Target: Rs 4,900

Stop-Loss: Rs 4,580

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.