The market saw profit booking on March 26, with the benchmark indices falling nearly 1 percent. The advance-decline ratio remained in favour of the bears for another session, as about 2,134 shares saw a correction compared to 485 rising shares on the NSE. The consolidation is expected to continue in the upcoming sessions until the benchmark indices give a decisive close above the February swing high. Below are some trading ideas for the near term:

Jatin Gedia, Technical Research Analyst at Mirae Asset Sharekhan

Mazagon Dock Shipbuilders | CMP: Rs 2,643.15

Mazagon Dock Shipbuilders has been consolidating for the last five trading sessions. The consolidation has taken the form of a triangle pattern. Currently, the stock is in the last leg of that pattern, and hence, one can buy the stock on a dip towards Rs 2,620 - Rs 2,610. Overall, the uptrend is intact, and we expect this consolidation to break out on the upside.

Strategy: Buy

Target: Rs 2,842

Stop-Loss: Rs 2,550

Mahindra and Mahindra April Futures | CMP: Rs 2,742.15

M&M has formed a bearish flag pattern on the hourly charts, and we expect it to break down. The hourly momentum indicator has completed its pullback cycle to the equilibrium line, suggesting that the counter-trend pullback has matured and the stock can now begin the next leg of the decline.

Strategy: Sell

Target: Rs 2,665

Stop-Loss: Rs 2,820

Lupin April Futures | CMP: Rs 2,058.8

Lupin has broken down from an upward-sloping channel, indicating a trend reversal from up to down. The hourly momentum indicator has shown a negative crossover, which is a sell signal. We expect the stock to witness a decline towards the support zone of Rs 2,020 - Rs 2,000.

Strategy: Sell

Target: Rs 2,020

Stop-Loss: Rs 2,110

Vidnyan S Sawant, Head of Research at GEPL Capital

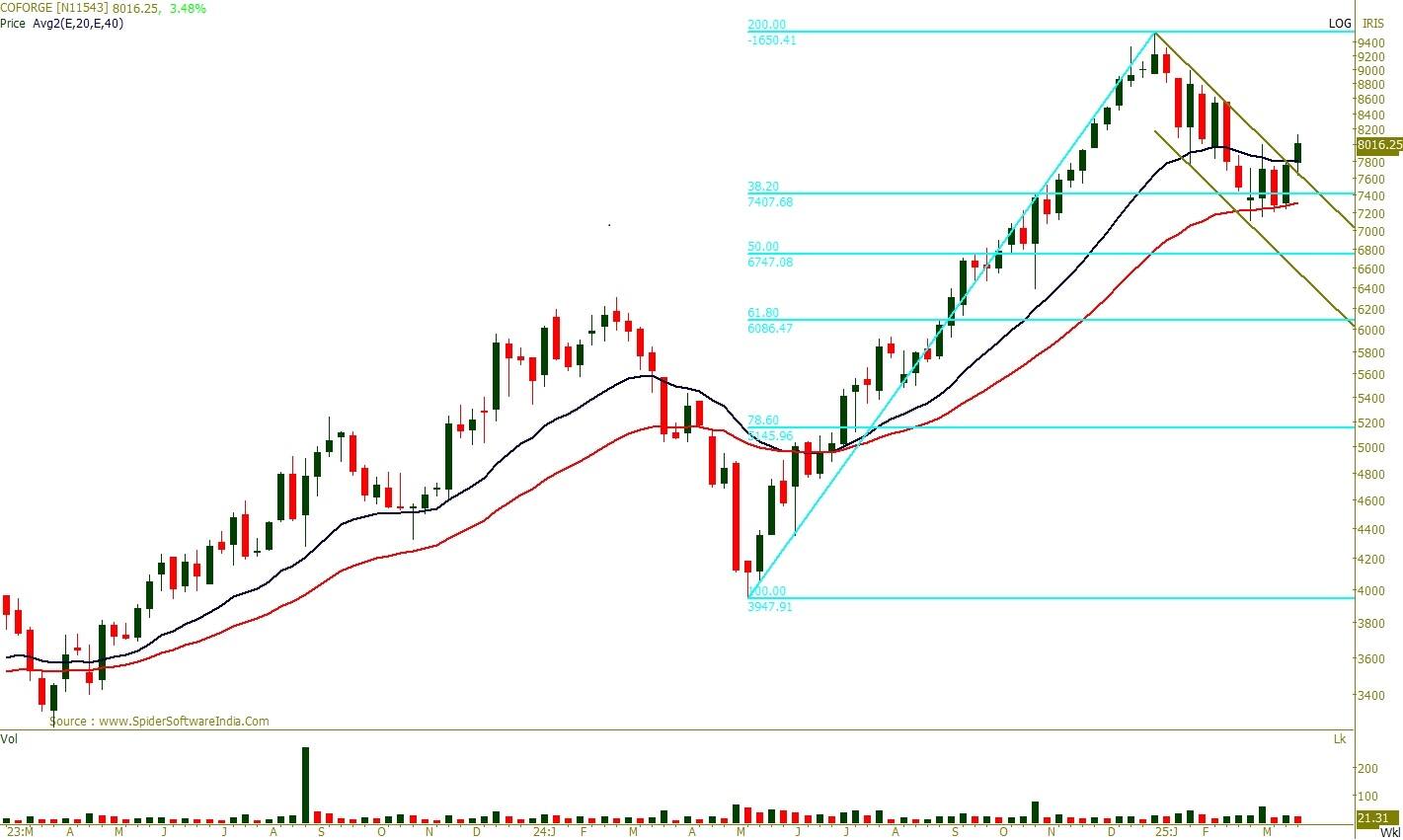

Coforge | CMP: Rs 8027.2

Coforge has maintained a strong bullish trend since 2020, consistently holding above its key 12- and 26-month EMAs, reaffirming its strength on a higher timeframe. On the weekly scale, the stock has garnered buying interest from its 38.2% Fibonacci retracement level while witnessing a bullish mean reversion from the 40-week EMA. Furthermore, a breakout from a falling channel this week adds to the positive outlook.

Strategy: Buy

Target: Rs 8,978

Stop-Loss: Rs 7,615

Hindustan Aeronautics | CMP: Rs 4128.3

On the monthly scale, Hindustan Aeronautics has exhibited a bullish mean reversion from its 26-month EMA. On the weekly scale, the stock has witnessed buying interest near the 61.8% Fibonacci retracement level of its prior uptrend from Rs 1,734 to Rs 5,618. Following this, the stock has formed a higher high and higher low, indicating a continuation of its upward trajectory. Additionally, the MACD (Moving Average Convergence Divergence) has shown a bullish crossover this week, reinforcing the stock's positive outlook.

Strategy: Buy

Target: Rs 4,755

Stop-Loss: Rs 3,887

Bajaj Finserv | CMP: Rs 1,943.4

On the monthly scale, Bajaj Finserv has been maintaining higher bottoms and sustaining its rising trendline. On the weekly scale, the stock is respecting its key moving averages, the 12-week EMA and 26-week EMA. Notably, this week has witnessed a breakout from a Cup and Handle pattern, reinforcing bullish sentiment. Additionally, the RSI (Relative Strength Index) is inching up and currently at 65, signaling strengthening momentum.

Strategy: Buy

Target: Rs 2,225

Stop-Loss: Rs 1,818

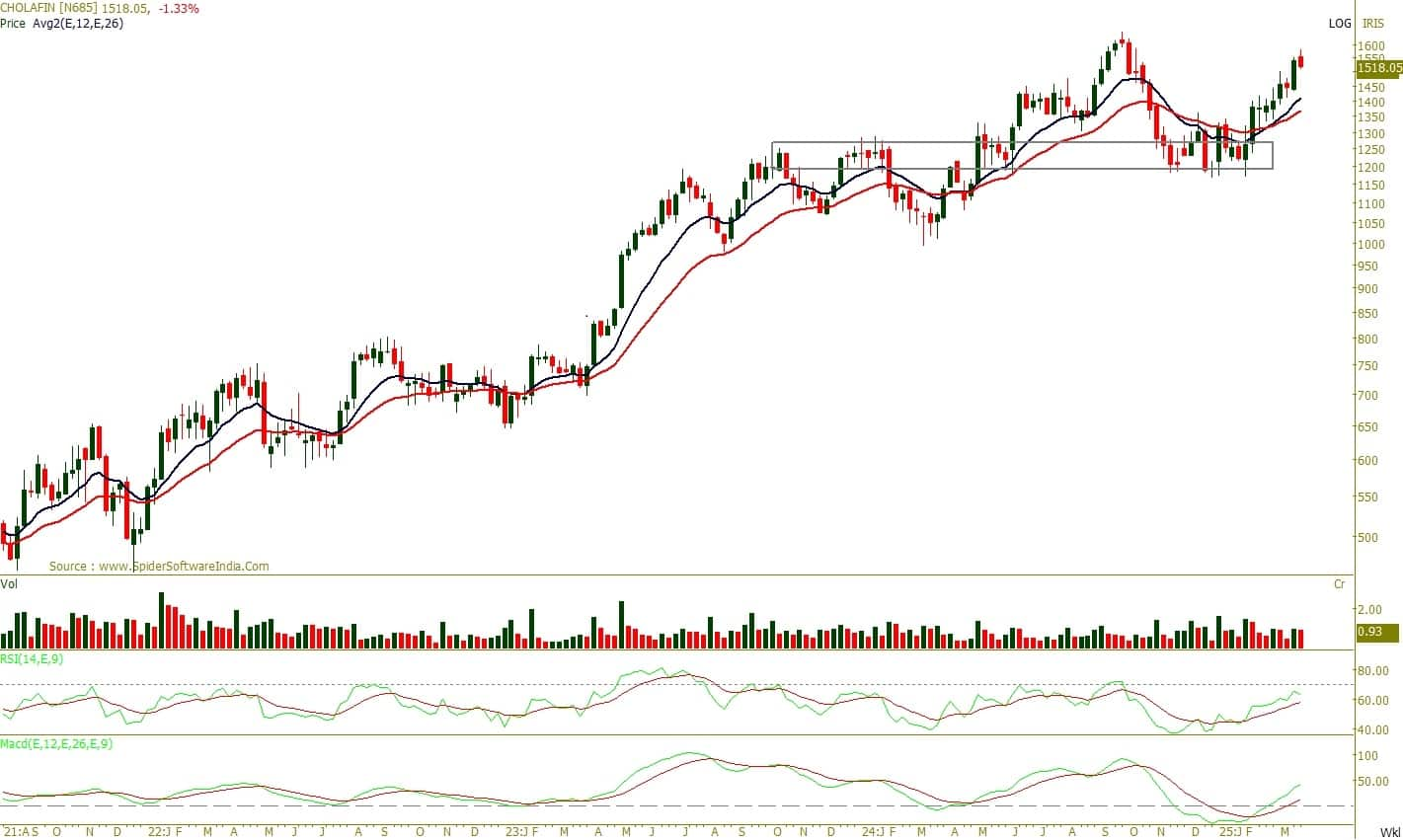

Cholamandalam Investment and Company | CMP: Rs 1,522.25

Cholamandalam Investment has been in a robust bullish uptrend since 2020, forming higher tops and bottoms. It has posted three consecutive bullish monthly closings, sustaining above the 12-month EMA despite market volatility, highlighting strong relative strength. On the weekly scale, the stock has formed a base pattern, reinforcing positive structural development. It remains in an uptrend, trading above key 12- and 26-week EMAs, strengthening the bullish stance. The MACD remains in buy mode, while the RSI at 63 confirms momentum.

Strategy: Buy

Target: Rs 1,776

Stop-Loss: Rs 1,426

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!