The benchmark indices bounced back after a day of correction and recouped all of the previous day's losses on May 23, supported by positive market breadth. A total of 1,580 shares saw buying interest compared to 977 shares that declined on the NSE. The market is expected to continue rangebound trading until the index decisively surpasses and sustains above the high of the month of May. Below are some short-term trading ideas to consider:

Rajesh Palviya, Senior Vice President Research (Head Technical Derivatives) at Axis SecuritiesIndoStar Capital Finance | CMP: Rs 336

On the daily and weekly timeframes, IndoStar Capital Finance is trending higher, forming a series of higher tops and bottoms. Additionally, the stock has confirmed an "Inverse Head & Shoulders" pattern breakout at Rs 330 levels on a closing basis. Rising volumes at the breakout zone signify increased participation.

The stock is trading well above its 20-day, 50-day, 100-day, and 200-day Simple Moving Averages (SMAs), and these averages are also inching up along with rising prices—reconfirming bullish sentiment. The daily, weekly, and monthly RSI (Relative Strength Index) indicate that buying may occur at current levels. The daily and weekly Bollinger Bands buy signal also indicates increased momentum. Investors should consider buying, holding, and accumulating this stock.

Strategy: Buy

Target: Rs 385, Rs 410

Stop-Loss: Rs 310

Cyient | CMP: Rs 1,332.6

On the daily timeframe, Cyient has experienced a trend reversal, confirming a "Double Bottom" formation at Rs 1,255 levels. The 20-day and 50-day positive crossover further signals bullish sentiment. The daily Bollinger Bands buy signal indicates increased momentum. The daily and weekly RSI suggest that buying may occur at current levels. Investors should consider buying, holding, and accumulating this stock.

Strategy: Buy

Target: Rs 1,385, Rs 1,500

Stop-Loss: Rs 1,295

Dhanuka Agritech | CMP: Rs 1,678.5

On the daily and weekly charts, Dhanuka Agritech has decisively surpassed its multiple resistance zone at Rs 1,650, accompanied by huge volumes, indicating strong participation. The stock is trading well above its 20-day, 50-day, 100-day, and 200-day SMAs, and all these averages are inching upward along with rising prices—reaffirming bullish sentiment. The daily, weekly, and monthly RSI is in positive terrain, showing rising strength across all timeframes. Investors should consider buying, holding, and accumulating this stock.

Strategy: Buy

Target: Rs 1,800, Rs 1,930

Stop-Loss: Rs 1,620

Rajesh Bhosale, Technical Analyst at Angel OneSom Distilleries & Breweries | CMP: Rs 152.99

After two years of consolidation, Som Distilleries & Breweries has staged a decisive long-term breakout, backed by a surge in volumes, signaling renewed investor interest. Strengthening the breakout, the RSI has crossed above the 60 mark, indicating strong bullish momentum and the potential for a sustained uptrend. Hence, we recommend buying Som Distilleries & Breweries around Rs 153–Rs 150.

Strategy: Buy

Target: Rs 170

Stop-Loss: Rs 144

Apollo Hospitals Enterprises | CMP: Rs 7,064.5

Following a strong rally in April, Apollo Hospitals Enterprises entered a consolidation phase. It has now broken out of a continuation symmetrical pattern, signaling a potential resumption of the uptrend. Prices are trading above all major moving averages, and momentum oscillators are firmly in the bullish zone, reinforcing the positive outlook and supporting a buy recommendation. Hence, we recommend buying Apollo Hospitals Enterprises around Rs 7,065–Rs 7,040.

Strategy: Buy

Target: Rs 7,400

Stop-Loss: Rs 6,890

Anshul Jain, Head of Research at Lakshmishree InvestmentsTVS Motor Company | CMP: Rs 2,780.6

TVS Motor is forming a 149-day-long Cup and Handle pattern, with a tight right-side consolidation between Rs 2,835–Rs 2,720. Volume patterns in the base are constructive, marked by higher volumes on up days and lower volumes on down days, signaling institutional accumulation. The stock is well-positioned for a breakout, and a decisive move above the Rs 2,850 pivot level is likely to trigger fresh bullish momentum. Post-breakout, the stock can rally towards the Rs 3,100 zone in the coming weeks.

Strategy: Buy

Target: Rs 3,100

Stop-Loss: Rs 2,725

HDFC Life Insurance Company | CMP: Rs 780.4

HDFC Life has broken out of a massive 219-week Inverse Head and Shoulders pattern with an open=low and a strong weekly close. Although the breakout volume wasn’t extraordinary, the base saw consistent accumulation—a pattern common in large-cap moves where volume often picks up on follow-through days. The technical structure now favours bulls, and a sustained move is likely. The stock is a buy at current levels, with dips to Rs 745 offering a good accumulation opportunity.

Strategy: Buy

Target: Rs 900

Stop-Loss: Rs 740

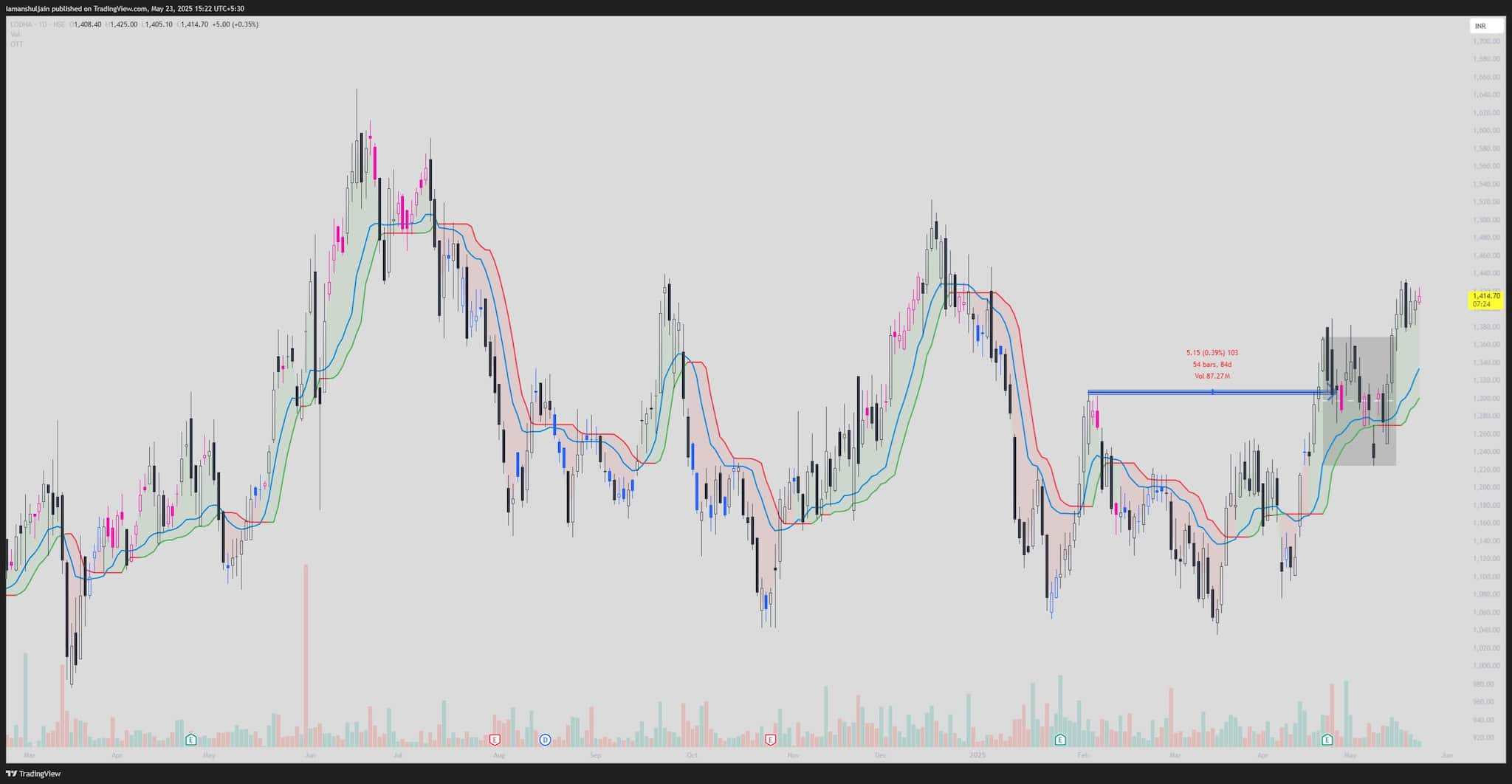

Macrotech Developers | CMP: Rs 1,412.8

Lodha has broken out of a 54-day Double Bottom pattern and is now forming a rare base-on-base-on-base setup, indicating sustained accumulation. The presence of a double base above a previous breakout adds strength to the bullish structure. The triple base breakout is placed at Rs 1,450, and a decisive move above this level will likely trigger a strong uptrend. If volumes support the breakout, the stock can rally towards Rs 1,600 in the near term.

Strategy: Buy

Target: Rs 1,600

Stop-Loss: Rs 1,350

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.