Key equity indices ended almost flat on December 2 after a volatile session as gains in shares of Reliance Industries, Bharti Airtel, Kotak Mahindra Bank and HDFC were offset by losses in HDFC Bank, Tata Consultancy Services, Bajaj Finance and Maruti Suzuki.

Investor risk appetite remained low as lower than expected auto sales, weak core sector output and GDP data raised concerns over the health of the domestic economy. All eyes are now on the RBI's monetary policy meet outcome on December 5.

The BSE Sensex closed 8 points up at 40,802 and the Nifty50 index slipped 8 points to 12,048. Among secondary barometers, the BSE Midcap index lost 0.77 percent while the BSE Smallcap index declined 0.39 percent, underperforming the Sensex.

On the technical front, experts said near-term critical support for Nifty is placed around 13-day exponential moving average whose supporting value for the next trading session is placed around 12,006.

"Correction will get accentuated further if bears manage to push the index below the said average on the closing basis and in such a scenario initial target can be around 11,800. But, breach of this level can easily drag the index further lower towards 11,725," Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory, Chartviewindia.in said.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

According to the pivot charts, key support level for Nifty is placed at 12,002.2, followed by 11,956.2. If the index moves up, key resistance levels to watch out for are 12,115.7 and 12,183.2.

Nifty Bank

Nifty Bank closed 0.23 percent down at 31,871.45. The important pivot level, which will act as crucial support for the index, is placed at 31,719.97, followed by 31,568.53. On the upside, key resistance levels are placed at 32,023.47 and 32,175.53.

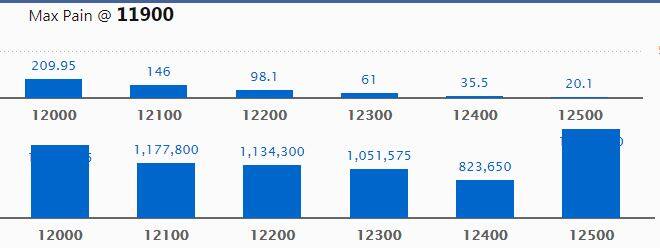

Call options data

Maximum call open interest (OI) of 18.86 lakh contracts was seen at the 12,500 strike price. It will act as a crucial resistance level in the December series.

This is followed by 12,000 strike price, which holds 15.60 lakh contracts in open interest, and 12,100, which has accumulated 11.78 lakh contracts in open interest.

Significant call writing was seen at the 12,100 strike price, which added 1.71 lakh contracts, followed by 12,400 strike price that added 1.32 lakh contracts.

A minor call unwinding was witnessed at 11,700 strike price, which shed 375 contracts.

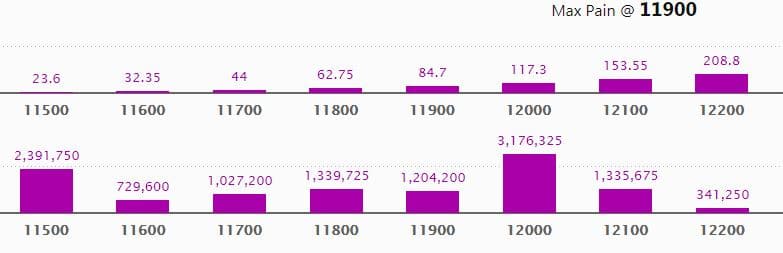

Put options data

Maximum put open interest of 31.76 lakh contracts was seen at 12,000 strike price, which will act as crucial support in the December series.

This is followed by 11,500 strike price, which holds 23.92 lakh contracts in open interest, and 11,800 strike price, which has accumulated 13.4 lakh contracts in open interest.

Put writing was seen at the 12,000 strike price, which added nearly 2.91 lakh contracts, followed by 12,100 strike, which added 2.4 lakh contracts and 11,900 which added 1.76 lakh contracts.

Put unwinding was seen at 12,500 strike price, which shed 46,950 contracts, followed by 12,200 strike which shed 4,050 contracts and 12,600 which shed 3,675 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

57 stocks saw long buildup

Based on open interest (OI) future percentage, here are the top 10 stocks in which long buildup was seen.

No stock saw long unwinding

As per available data, there was no stock that witnessed long unwinding on December 2.

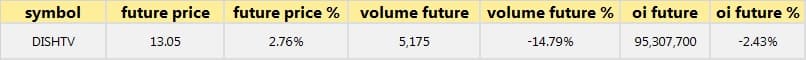

92 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on open interest (OI) future percentage, here are the top 10 stocks in which short build-up was seen.

Only 1 stock witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short covering.

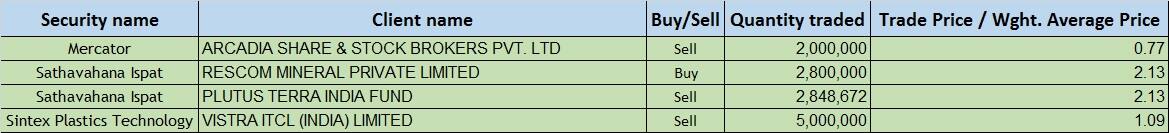

Bulk deals

(For more bulk deals, click here)

Upcoming analyst or board meetings/briefings

The board of Brightcom Group will meet on December 3 to consider and discuss the preferential issue of shares.

The board of Nestle India will meet on December 3 to consider and approve the interim dividend.

The board of Gufic Biosciences will meet on December 3 to consider and approve quarterly results.

The respective boards of Kothari World Finance and Diamines & Chemicals will meet on December 3 for general purposes.

Stocks in the news

Bank of Baroda: The lender is to consider raising capital funds through the issue of capital debt instruments on December 5.

Godrej Properties: The company has acquired 20 percent issued and paid-up share capital of Yujya Developers Private Limited.

NMDC: Total November production was down 10.6 percent at 2.94 MT versus 3.29 MT, while sales remained flat at 2.79 MT, YoY.

Jaypee Infratech: Yes Bank has filed a petition before NCLT Allahabad to initiate the corporate insolvency resolution process against Jaypee Healthcare Limited (a subsidiary of the company).

Haldyn Glass: The company appointed Dhruv Mehta as the secretary & compliance officer.

GIC Housing Finance: The company's non-executive director Sashikala Muralidharan has resigned.

IOC: Parindu K. Bhagat ceased to be an independent director of the company from December 2, 2019.

Shiva Texyarn: CARE Ratings has revised the ratings on the company's long and short-term bank facilities.

FII and DII data

Foreign institutional investors (FIIs) sold shares worth Rs 1,731.33 crore, while domestic institutional investors (DIIs) bought shares of worth Rs 753.99 crore in the Indian equity market on December 2, provisional data available on the NSE showed.

Fund flow

Stock under F&O ban on NSE

There is no stock under the F&O ban for December 3. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!