What’s changed?

The easiest step in a marriage is printing the invitations. The real work of the merger begins now and investors are plagued with doubts.

HDFC Bank’s March earnings seem to have pulled down investor sentiment, not quite meeting the street’s expectations. True, net profit growth of 23 percent was the highest in over two years and loan growth of 20 percent was way above the industry’s low single digits.

Also read: Selloff binge knocks HDFC out of MCap list of top 10 companies in India

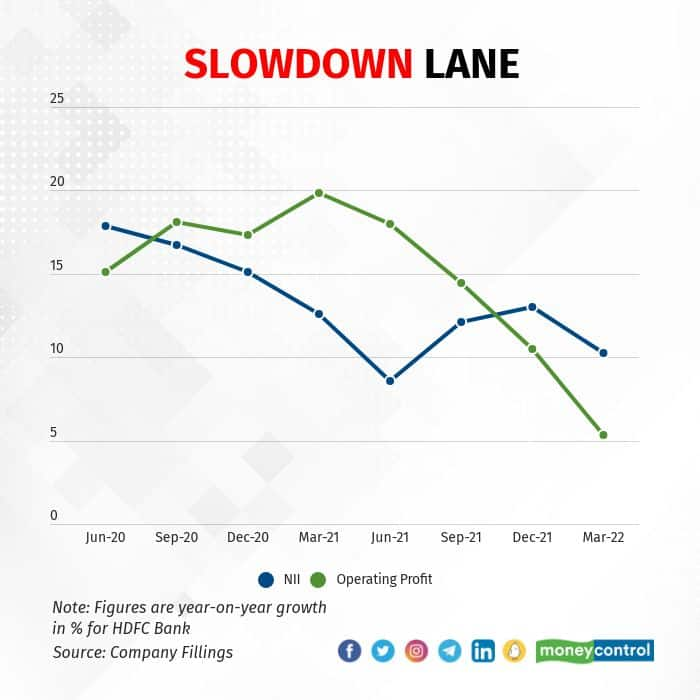

But the bank reported a dull set of operating metrics, including a 10 percent growth in operating profit and core interest income. As the chart shows, operating profit growth has fallen steadily since the pandemic. Record low net interest margin made investors fret more.

Further, the pace of branch network expansion envisaged by the bank would keep operating expenses elevated in the near term. While the cost of acquiring customers may increase, earnings from them may remain under pressure. An elevated cost-to-income ratio along with a shrunken net interest margin does not bode well for the bank.

All this explains why the bank’s shares fell 4.6 percent on April 18 in response to quarterly results released on April 16. However, valuations have been under pressure since the beginning of this month. HDFC Bank shares had started to slip a day after the merger announcement.

Merger pain

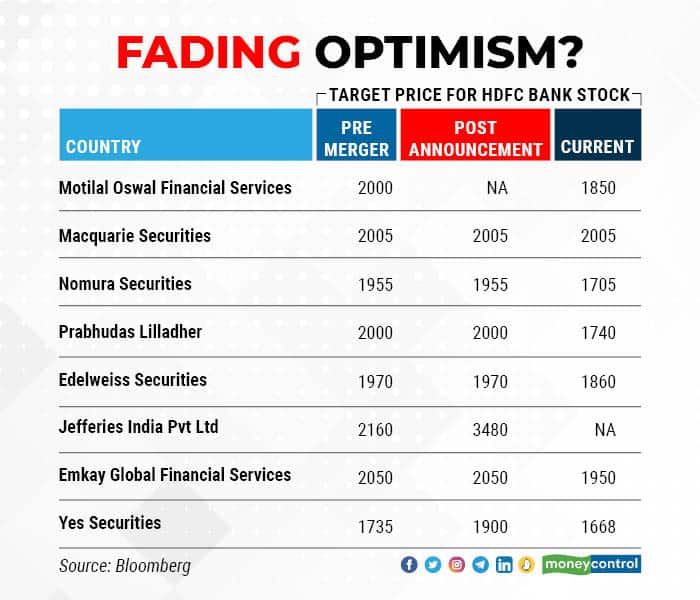

On the merger itself, executives of both lenders have given enough reasons to conclude that the deal is a win-win for both HDFC Bank and HDFC, which is India’s largest mortgage lender. But there are hurdles to be surmounted over the next 12-18 months for the merger to fructify. This has begun to sink in for investors and the initial euphoria of the merger has waned.

Let’s take the regulatory costs associated with the merger. If HDFC Bank swallows HDFC, it would have to maintain cash reserve ratio (CRR) and statutory liquidity ratio (SLR) on the lender’s portfolio from the day the merger takes effect. Analysts estimate the bank would need Rs 70,000-80,000 crore to meet these two regulatory requirements.

Deepak Parekh, chairman of the HDFC Group, has said they expect the regulator to provide more time to meet these requirements. But the Reserve Bank of India could avoid giving forbearance, in which case the bank would have to raise money from the market.

Either way, this is seen as a big drag on profitability for at least two years after the merger. Of course, the bank can build a cushion early on, which would advance the profitability drag by a year. The upshot is that HDFC Bank’s earnings could be under pressure for FY23 and FY24.

Analysts at Prabhudas Lilladher expect return on equity to drop from the current levels. Gaurav Jani, an analyst at the brokerage, said that sustaining margins would be an uphill task for the bank.

“As and when the merger happens, margins would certainly come down because of the low-yielding home loans they would absorb. Also, it is not clear whether HDFC Bank would maintain the developer loan portfolio of HDFC,” he said.

There is also the requirement of priority sector lending for the bank. Macquarie Capital Securities estimates the bank will need an incremental Rs 90,000 crore worth of priority sector lending to meet the norms. The management has said that the bank would buy priority sector lending certificates (PSLC) from the market to meet the requirements. This is an additional cost to the bank and yet another drag on profits.

“These low-yielding portfolios could be a drag on the merged entity’s P&L,” Macquarie analysts wrote in an April 4 note.

Bad loans

HDFC Bank has served as an island of calm during adversity in the banking industry. Its valuation was superior simply because those of its rivals were beaten down. That is because the bank’s balance sheet quality held up when the banking system came under the burden of bad loans during FY16-FY19.

During FY16-FY19, ICICI Bank’s delinquencies had surged to form 6.70 percent of its loan book, and those of Axis Bank had increased to 5.26 percent of its loan book. Public sector banks had reported horrific bad loan ratios, in high double digits. At the same time, HDFC Bank’s bad loans had increased to just 1.36 percent of its loan book. The difference was stark and so was the valuation.

Shares of lenders such as ICICI Bank and Axis Bank had fallen out of favour due to large bad loan piles. However, this is not the case now. ICICI Bank has fixed most of its balance sheet issues and has managed to dismiss the misgivings surrounding its governance. Top management changes in both ICICI Bank and Axis Bank are behind them, giving the much needed stability for investors.

Ergo, the valuation advantage that HDFC Bank enjoyed over its peers has now narrowed. ICICI Bank has been able to bridge the valuation gap to a great extent owing to its cleaned-up balance sheet, expected strong return on equity in the coming years and a favourable governance perception.

The lender’s asset quality may not match that of HDFC Bank yet. But with delinquencies under 4.5 percent of the loan book and the promise of growth, ICICI Bank’s balance sheet has never looked better. A beaten-down valuation has meant that ICICI Bank’s stock was considered cheap with potentially high returns. The bank’s stock has surged 37 percent in the past year while HDFC Bank has languished.

Some high points

Not everything is against HDFC Bank’s valuation. The merger will bring scale and enviable cross-selling opportunities to the bank. This is expected to support growth and bring down operating costs progressively.

At the same time, HDFC Bank’s loan portfolio would rebalance to its retail-heavy former self once HDFC’s book is absorbed. The share of wholesale loans has increased to more than half in the past one year for the bank. The focus on wholesale loans could pay off now as interest rates rise.

HDFC Bank intends to expand retail credit, and its low credit costs compared with those of its peers gives it a valuation edge even today. Analysts expect return on equity of 16-17 percent in the coming years, subject to the merger. That would be a superior ratio compared with those of ICICI Bank and other rivals.

There’s little doubt that the merger would be a drag on profit in the short term, given the regulatory costs attached. But whether this pays off in the long run is something investors are more interested in.

Perhaps that is also why almost every brokerage has a ‘buy’ on the stock. The bank’s high proportion of low-cost current and savings account deposits and sustained low credit costs would continue to give it an edge.

The odds of HDFC Bank retaining its distinguished feature of outsized profitability beyond the merger years, have reduced. Therefore, to get back to its historic valuation multiple of 4.0-4.5 times book value from the current 3 times won’t be easy.

Meanwhile, rivals such as ICICI Bank and Axis Bank are closing this gap, with their stocks trading at 2.3 and 3.3 times their respective book values.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!