The Monetary Policy Committee (MPC) has on October 9 maintained repo rate unchanged at 6.5 percent for the 10th consecutive meeting with 5:1 vote, but unanimously changed the policy stance from 'withdrawal of accommodation' to ‘neutral’, raising the possibility of interest rate cut in the December meeting. This reflects a measured approach from the MPC to balancing inflationary risks and growth prospects.

"The change in stance provides flexibility to the MPC while enabling it to monitor the progress on disinflation which is still incomplete," said RBI Governor Shaktikanta Das as the central bank still sees risks from uncertainties relating to heightened global geo-political risks, financial market volatility, adverse weather events and the recent uptick in global food and metal prices. Hence, the MPC has to remain vigilant of the evolving inflation outlook.

"We think more optimism on inflation despite unchanged forecasts, and all six members voting for neutral suggesting the need for flexibility clearly opens the door to a December cut. We now expect 75bp of cuts through April 2025," Shreya Sodhani, Regional Economist at Barclays said.

The CPI inflation and GDP growth forecast for FY25 remained unchanged 4.5 percent and 7.2 percent, respectively, but revised downward to 4.1 percent from 4.4 percent earlier, and to 7 percent from 7.2 percent earlier for Q2FY25. The central bank has increased its growth and inflation estimates to 7.4 percent from 7.3 percent earlier, and to 4.8 percent from 4.7 percent earlier.

"We also see a good chance that both RBI’s growth projection of 7.2 percent and CPI projection of 4.5 percent will undershoot in this financial year and hence rate cuts are likely to come by starting December," Rahul Bhuskute, CIO at Bharti AXA Life Insurance said.

The market reacted positively to the RBI MPC move of change in policy stance, with the Nifty 50 rising 104 points to 25,118, and the BSE Sensex climbing 281 points to 81,916 at 13:13 hours IST. The reaction in the broader space was quite strong compared to benchmarks on hope that the rate cut cycle will begin soon, following the global banks' move The Nifty Midcap 100 and Smallcap 100 indices rallied 1.3 percent and 1.5 percent respectively, while the volatility dropped below the 14 mark.

"Interestingly, the market's positive reaction, particularly in mid and small-cap stocks, shows a growing sense of optimism. Sectors like power, telecom, and financial services have rallied, perhaps driven by hopes that stable rates could support growth without stoking inflationary pressures in the near term," Sonam Srivastava, Founder and Fund Manager at Wright Research said.

However, according to her, it’s a cautious relief rally. "The potential for inflation to re-emerge keeps risk on the table, meaning both investors and policymakers need to stay vigilant," she said.

Since reaching its peak of Rs 6,246 on September 24, Hero MotoCorp has undergone a sharp correction, with a 13% decline in its stock price. Currently, the price action has stabilised around the previous breakout zone, indicating a potential support level. This support area coincides with the Ichimoku Cloud and the 100-day Exponential Moving Average (DEMA), reinforcing its strength. Additionally, on the hourly chart, the RSI (Relative Strength Index) has shown a hidden bullish divergence, signaling a possible momentum reversal and a favourable entry opportunity. Given these technical signals, we recommend initiating a long position in the Rs 5,500-5,540 range, targeting an upside toward Rs 5,800. A stop-loss should be set around Rs 5,350, based on a daily closing price, to manage risk effectively.

Strategy: Buy

Target: Rs 5,800

Stop-Loss: Rs 5,350

IndusInd Bank | CMP: Rs 1,359.6

Recently, IndusInd Bank has formed a bullish BAT pattern on the daily chart, following a sharp decline from its recent peak of Rs 1,498. In the previous trading session, a Doji candlestick appeared within the prior long red candle, suggesting the possibility of a bullish Harami pattern. This, in conjunction with the bullish BAT pattern, strengthens the case for a potential upward move. From a technical indicator perspective, the RSI has formed a V-shaped recovery near the oversold zone at 30, signaling potential bullish momentum in the coming sessions. Based on these factors, we recommend going long on this stock in the price range of Rs 1,330-1,360, targeting an upside of Rs 1,435. A stop-loss should be set at Rs 1,299, based on a daily close, to effectively manage risk.

Strategy: Buy

Target: Rs 1,435

Stop-Loss: Rs 1,299

HDFC Asset Management Company | CMP: Rs 4,189.5

HDFC AMC has recently experienced a sharp correction, declining by 10% from its peak of Rs 4,540 reached on September 26. This correction has brought the stock down to a key support level. In the most recent trading session, the stock formed a Bullish Piercing candlestick pattern, indicating a potential reversal from a downtrend to an uptrend. The fact that this pattern appeared exactly at the Ichimoku Cloud support adds further strength to the bullish case, as the Cloud is often seen as a significant area of support or resistance.

Additionally, the 100-day EMA is also located around the same level, reinforcing the likelihood of a bullish reversal. The combination of the Piercing candlestick pattern, the Ichimoku Cloud support, and the 100 DEMA creates a confluence of technical signals, pointing toward a potential upward move in the stock. Given these factors, we recommend taking a long position in the stock between the Rs 4,150-4,200 range, with a target price of Rs 4,500. To manage risk, a stop-loss should be placed around Rs 4,050, based on a daily closing price, ensuring protection against further downside.

Strategy: Buy

Target: Rs 4,500

Stop-Loss: Rs 4,050

Vidnyan Sawant, HOD - Research at GEPL CapitalIIFL Securities | CMP: Rs 367.4

On the weekly scale, IIFL Securities has exhibited robust structural development, with changes in polarity observed in March 2024 and July 2024, supporting the continuation of its upward trajectory. The momentum indicator, MACD (Moving Average Convergence Divergence), remains in buy mode and is trending higher, signaling positive price action driven by bullish momentum. Looking ahead, the stock shows potential for an upside target of Rs 428. To manage risk effectively, a stop-loss at Rs 335 on a closing basis is recommended.

Strategy: Buy

Target: Rs 428

Stop-Loss: Rs 335

Federal Bank | CMP: Rs 187.8

On the monthly scale, after breaking out above its 2017 swing high, Federal Bank has consistently maintained its upward trend, staying above the key 12-month and 26-month EMAs. On the weekly chart, the alignment with the higher time-scale price structure indicates a likely continuation of the upward trajectory. The momentum indicator, RSI, is holding above a rising trend line connected from higher bottoms, suggesting a pause in any downward momentum. Looking ahead, the stock has upside potential with a target of Rs 216, while a stop-loss at Rs 175 on a closing basis is recommended to manage risk.

Strategy: Buy

Target: Rs 216

Stop-Loss: Rs 175

Bank of Baroda | CMP: Rs 247

Bank of Baroda has displayed a strong price structure on higher timeframes, consistently maintaining its upward trend. Since March 2024, the stock has traded in a range while holding support at its 50-week EMA. Recently, the RSI has shown a bullish crossover, and since 2021, the stock has experienced strong rebounds from the RSI demand zone, as marked on the charts. The recent uptick in RSI from the same level suggests that momentum is likely to accelerate soon. Looking ahead, there is potential for further upside, with a target of Rs 287. For effective risk management, a stop-loss at Rs 230 on a closing basis is recommended.

Strategy: Buy

Target: Rs 287

Stop-Loss: Rs 230

Rohan Shah, Technical Analyst at Asit C Mehta Investment InterrmediatesAxis Bank | CMP: Rs 1,153

In the last few sessions, private banking stocks have witnessed a sharp sell-off, with a couple of them dropping to key support levels and becoming highly oversold in terms of momentum. Axis Bank is one such stock. Since the inception of its uptrend, from March 2023, it has consistently found support around the 50-week moving average and has resumed its uptrend on multiple occasions. Currently, the stock is positioned near this support, which aligns with a polarity demand zone. Thus, at current levels, the stock offers a favourable risk-reward trade opportunity. Any positive momentum in the counter could push the stock higher, challenging its previous swing high.

Strategy: Buy

Target: Rs 1,230, Rs 1,250

Stop-Loss: Rs 1,100

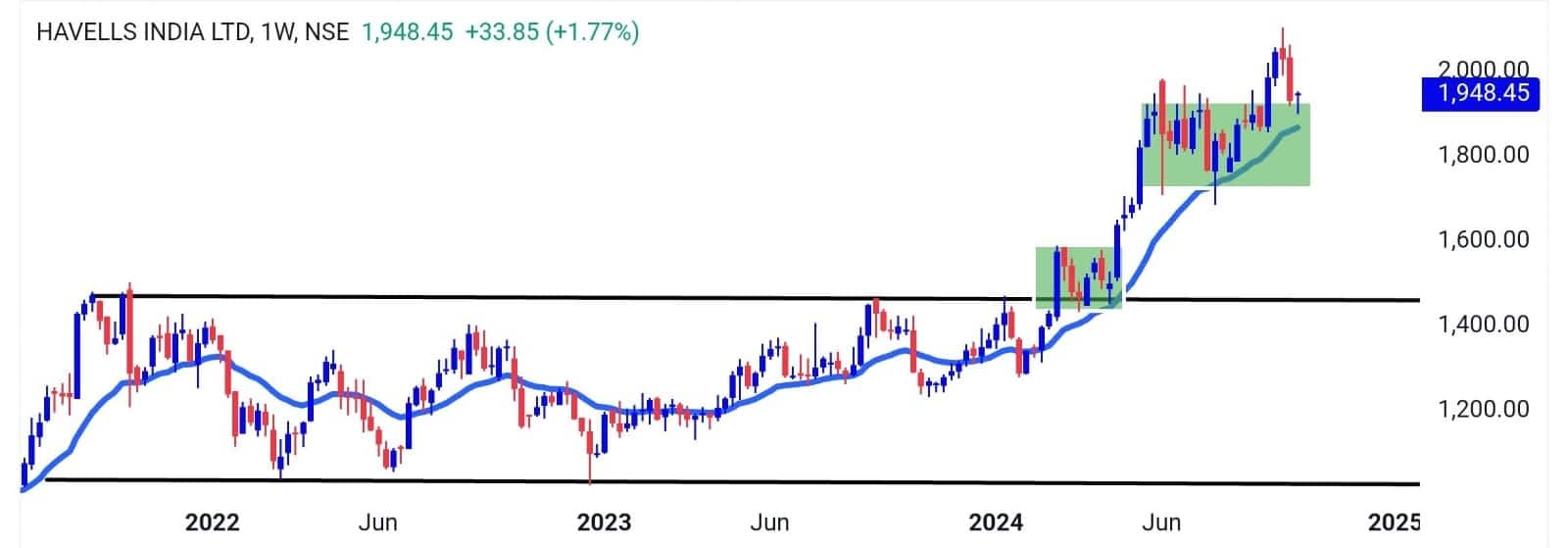

Havells India | CMP: Rs 1,948.5

Havells India has consistently outperformed since registering a breakout from a multi-month corrective pattern. Following this breakout, the stock has formed a Base on Base pattern, indicating accumulation at elevated levels. Recently, the price recorded a breakout from this basing pattern and has rebounded, retesting the neckline, signaling a resumption of the prior trend. Looking ahead, the price has the potential to trend higher towards the Rs 2,070-2,100 levels.

Strategy: Buy

Target: Rs 2,100

Stop-Loss: Rs 1,860

Chandan Taparia, Senior Vice President | Analyst-Derivatives at Motilal Oswal Financial ServicesMahindra and Mahindra | CMP: Rs 3,166

M&M has given a strong consolidation breakout on weekly charts with increasing volumes, indicating strength. The stock has strong support near Rs 2,985 levels and is respecting its 20 WEMA (Weekly EMA).

Strategy: Buy

Target: Rs 3,500

Stop-Loss: Rs 2,985

Samvardhana Motherson International | CMP: Rs 204

Samvardhana Motherson has retested a breakout and shown a strong bounce back. The stock is also holding the 50-DEMA. The momentum indicator RSI is on the verge of a bullish crossover, confirming the strength in the stock.

Strategy: Buy

Target: Rs 230

Stop-Loss: Rs 197

Oberoi Realty | CMP: Rs 1,759.6

Oberoi Realty has formed a Hammer pattern on the daily chart near support, indicating a reversal in the stock. The stock has also negated the lower high-lower low formation after six trading sessions, indicating strength.

Strategy: Buy

Target: Rs 2,000

Stop-Loss: Rs 1,720

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.