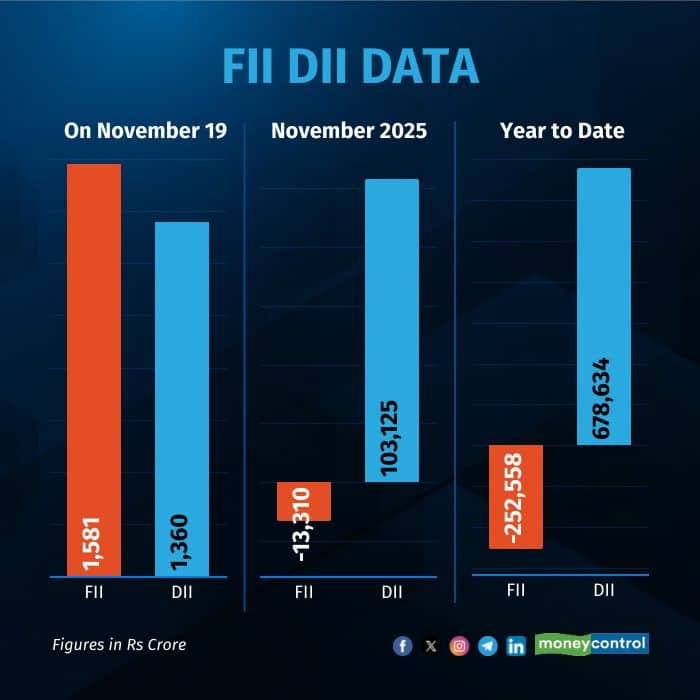

Foreign investors (FIIs/FPIs) turned net buyers of Rs 1581 crore worth of Indian equities on Wednesday. At the same time, domestic institutional investors (DIIs) net bought shares worth Rs 1360 crore, according to provisional exchange data on November 19.

During the session, DIIs purchased shares worth Rs 13,904 crore and sold shares worth Rs 12,544 crore. In contrast, FIIs bought shares worth Rs 14,775 crore, but sold shares totalling Rs 13,194 crore.

For the year so far, FIIs have been net sellers of shares worth Rs 2.53 lakh crore, while DIIs have net bought shares worth Rs 6.79 lakh crore.

Market view

At close, the Sensex was up 513.45 points or 0.61 percent at 85,186.47, and the Nifty was up 142.60 points or 0.55 percent at 26,052.65. Broader indices remained mixed, with BSE Midcap index rising 0.3%, while Small-cap index fell 0.4%. On the sectoral front, IT index rose 3%, PSU Bank index added 1.2%, while media index down 0.3% and realty index down 0.4%.

Biggest Nifty gainers were HCL Technologies, Max Healthcare, Infosys, Wipro, TCS, while losers were TMPV, Coal India, Maruti Suzuki, Adani Ports, Bajaj Finance.

On today's market, Ajit Mishra – SVP, Research, Religare Broking said, "Sectoral performance was mixed: IT and banking stocks outperformed, while realty, energy, and metal counters lagged. In the broader market, the tone remained subdued, with the midcap index ending flat and the small-cap index slipping nearly half a percent."

He added that the rebound was supported primarily by unexpected strength in IT majors after Infosys announced its Rs 18,000-crore share buyback effective November 20, lifting sentiment across the sector. Continued resilience in the banking space also contributed meaningfully to the day’s gains.

"While the banking pack continues to lead, the IT sector—after nearly a year of consolidation—is now showing early signs of a structural reversal. We maintain a positive outlook amid the ongoing consolidation phase and expect the Nifty to attempt fresh highs on a decisive breakout above 26,100. Participants should continue to adopt a selective approach, focusing on sectors displaying strength, with a preference for large-cap and stronger mid-cap names," Mishra added.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.