Stocks of many state-owned banks struggled to reach their all-time highs in the recent rally, even as some gained 50 to 90 percent. While the market capitalisation of most public sector banks is at an all-time high, their share prices have not reached record levels.

For instance, Bank of Baroda’s market cap has risen to Rs 1.03 lakh crore currently. Yet its share price is about 9 percent below its record high of Rs 228.90 on January 23, 2015, when its market cap was Rs 47,901 crore.

Analysts attributed the increase in market cap to fresh shares issued by the government, which injected about Rs 3.12 lakh crore into the banking sector from 2010 to 2019. An additional Rs 22,000 crore was put in since 2020, with no further injections made since 2022.

Derated valuation

The rally in public sector banks began in January 2021, well before the current rally. Since January 1, 2021, the Nifty PSU Bank Index has climbed over 154 percent. However, none of the stocks in the index has reached an all-time high. Three public sector banks – Canara Bank, Indian Bank, and Bank of Baroda – reached a 52-week high during this rally.

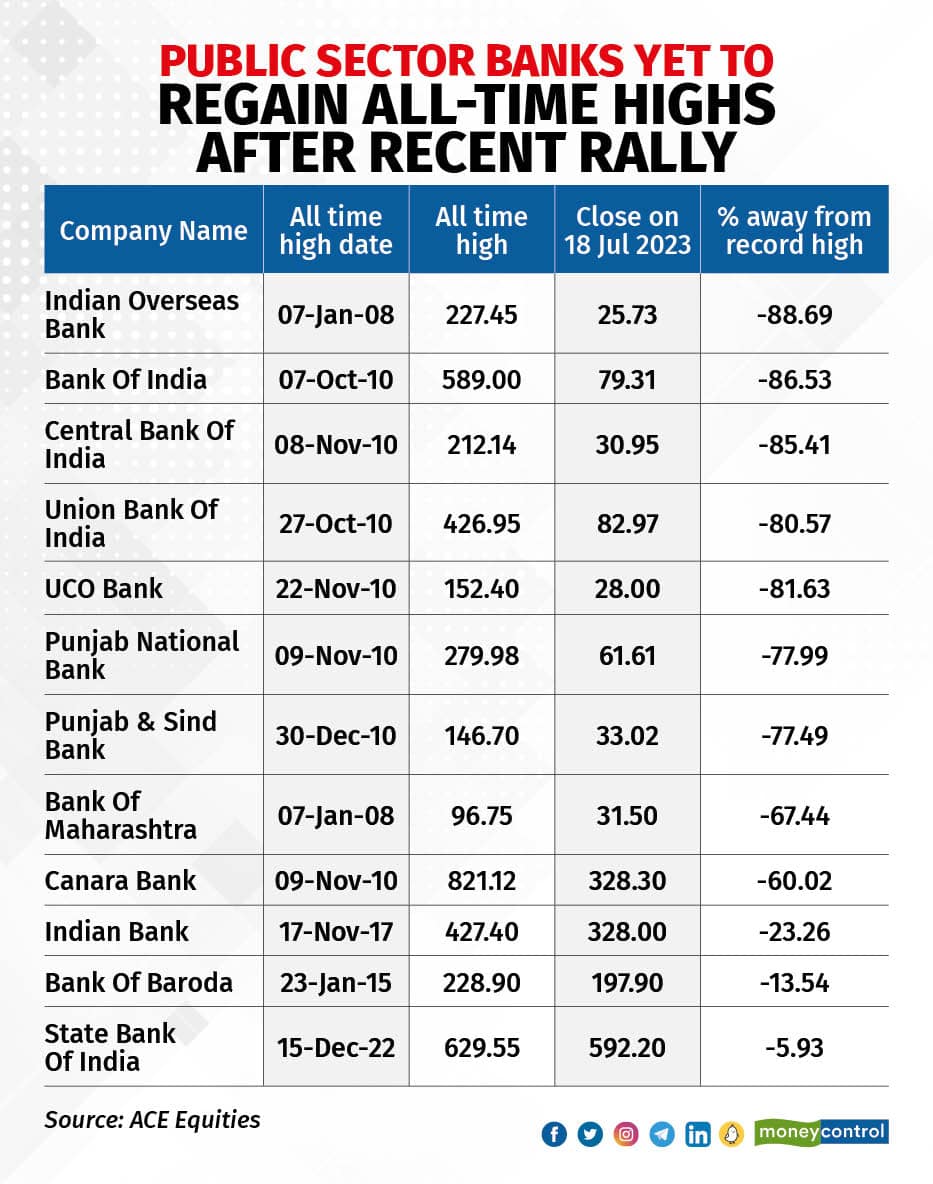

Indian Overseas Bank, Bank of India, Central Bank of India, and Union Bank of India are currently down over 80 percent from their all-time highs. Uco Bank, Punjab National Bank, Punjab & Sind Bank, Bank of Maharashtra, and Canara Bank are 60-78 percent away from their record highs.

Indian Bank is 28 percent away from its record high, while State Bank of India, the country’s most valued state-owned lender, is currently about 6 percent away from its all-time high.

"Lower profitability, higher non-performing assets, and derating on the valuation front led these banks to lose most of their market cap," said Devarsh Vakil, deputy head of retail research at HDFC Securities. "They would have to consistently remain profitable, grow their books, and navigate the new credit cycle without generating a high amount of NPAs for investors to rerate them back to higher valuation multiples, which is a prerequisite for these banks to regain their past all-time highs and trade beyond those levels."

The current rally in the banking sector surpasses the one during the 2007-2010 period of the US recession. Notably, the entire banking sector is thriving at this time. Public sector banks collectively recorded a net profit of Rs 1.05 lakh crore in FY23, with SBI and others reporting their highest-ever earnings. All PSBs posted a decline in both gross and net bad loans, both as a percentage of loans and in absolute terms.

Since March 31, 2022, the market cap of PSBs has increased 43.7 percent to Rs 10.47 lakh crore. In comparison, the market cap of private banks rose 21.7 percent to Rs 26.55 lakh crore.

However, there is some concern over state-owned banks. The Reserve Bank of India said Expected Credit Loss provisioning norms will be implemented for banks in FY24. Although the transition to these norms will occur over five years, analysts said this will dampen the prospects of public sector banks, which generally have lower levels of floating provisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.