The Nifty50 reclaimed its crucial resistance placed at 11,700-11,800 levels, and is well on track to challenge its all-time high placed at 12,103 recorded back in June 2019, ICICIdirect said in a report.

The index which is now trading above crucial short-term and long-term moving averages restored bullish bias. “The ongoing structural improvement makes us believe the index is set to challenge the all-time high of 12,100 in the coming months,” said the note.

“In the process, we do not foresee the index breaching the key support threshold of 11,300. Therefore, dips should be capitalised to accumulate quality stocks amid the Q2FY20 earning season,” it said.

The midcap has formed a strong base on the maturity of price/time-wise correction, as over the past 21-month index retraced 61.8% of preceding 22 months rally.

The slower pace of retracement signifies a robust price structure auguring well for the index to rally 5% from here on and challenge the long term falling trend line at 17000.

ICICIdirect recommends that investors should buy quality midcap stocks as the broader market looks lucrative to participate in the impending technical pullback.

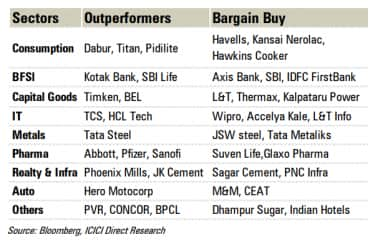

The brokerage firm highlights over 20 stocks under its Bargain buy basket which include names like Havells India, Kansai Nerolac, Hawkins Cooker, Axis Bank, SBI, IDFC First Bank, L&T, Thermax, Kalpataru Power, Wipro, Tata Metaliks, Sagar Cement, CEAT, and Indian Hotels, among others.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.