Indian market rallied over 7 percent in July but after two straight months of consecutive gains, experts feel that August could be a month of consolidation.

The Nifty50 reclaimed 11,300 levels in the last week of July but then bears took control of D-Street and pushed the index towards 11,000 levels towards the close of the month.

The rollover in Nifty is at 77.59 percent, which is in line with its 3-month average of 77.40 percent, whereas rollover in Bank Nifty is at 75.30 percent compared to the average of 79 percent.

“During the July series, FIIs formed long positions in the index futures segment. Their ‘Long Short Ratio’ at the start of the new series is at 66 percent. The weekly options data hints at a probable trading range of 11,000-11,300 in the initial part of the new series,” Sameet Chavan, Chief Analyst Technical and Derivatives at Angel Broking Ltd told Moneycontrol.

“If we combine this with technical observations, ideally the move outside the range of 10,870-11,350 would confirm where markets are heading. But, if we go with the broader degree trend which is upward, the possibility of Nifty heading towards 11,500 is quite high as long as 10,870 is not broken,” he said.

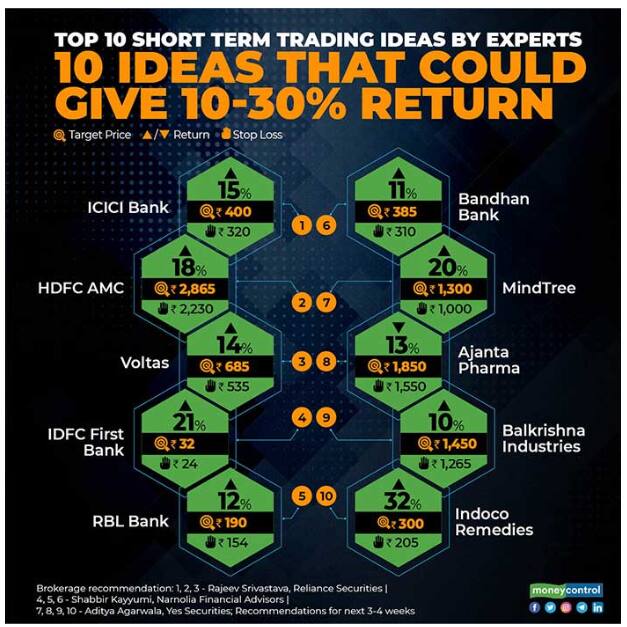

We have collated a list of 10 trading ideas from experts that can give 10-30% returns in the next 3-4 weeks:

Expert: Rajeev Srivastava, Chief Business Officer at Reliance Securities

ICICI Bank: Buy | LTP: Rs 347 | Target: Rs 400 | Stop Loss: Rs 320 | Upside: 15%

ICICI Bank has closed near to its 200-week average support and we have witnessed a bounce back from these levels in the past.

The recent correction post results are a good entry point to accumulate as the risk-reward in favour with a stop loss of Rs 320 levels on the downside being its 55-month average.

The current up move will test its 100-week average placed near Rs 400 levels over the next few months.

HDFC AMC: Buy | LTP: Rs 2,418 | Target: 2,865 | Stop Loss: 2,230 | Upside: 18%

The stock closed near to its long-term support zone on Friday and has witnessed positive pullbacks from current levels on various counts.

RSI has also turned positive on weekly charts which indicates limited weakness in the stock and could give an upward breakout.

This could bring the stock to test the long-term moving average which will also be our target for the next few months.

Voltas: Buy | LTP: Rs 598 | Target: Rs 685 | Stop Loss: Rs 535 | Upside: 14%

The stock formed a double bottom at sub Rs 530 levels with strong volumes and has found good support at 50-day average placed at Rs 525 levels.

The stock has completed its price and time-wise consolidation after a sharp up move, now we expect a fresh move as we expect it to cross the 200-day average.

Its Relative Strength Index has crossed upwards from its lower band of averages and we expect the stock to outperform from current levels.

Expert: Shabbir Kayyumi, Head of Technical Research at Narnolia Financial Advisors Ltd

IDFC First Bank: Buy Around Rs 26.30 | Target: Rs 32 | Stop Loss: Rs 24 | Upside: 21 percent

On the weekly chart, the stock has taken the support of the rising trend line and 10 weekly SMA. Construction of inverted Head & Shoulder (H&S) pattern on the daily chart indicates a pullback on the upside. The momentum indicators and oscillators are in the buy mode on a weekly scale which hints that bulls are still have an upper hand. Based on the above technical structure, one can take a long position in the stock around Rs 26.30 with a stop loss of Rs 24 for the target of Rs 32.

RBL Bank: Buy Around Rs 166 | Target: Rs 190 | Stop Loss: Rs 154 | Upside: 14 percent

Bargain hunting is seen at lower levels in the scrip from where it formed a strong base. Currently, it formed a double bottom on the daily chart along with the positive divergence in RSI which suggest a reversal is around the corner. Indicators and oscillators are also lending support to the price action. Traders can take the entry at Rs 166 levels for the target of Rs 190 while keeping a stop loss of Rs 154 mark.

Scrip spurted from a low of Rs 325-327 after forming dragonfly doji on weekly and Hammer formation on the daily chart. It showed pullback on upside marked the high of Rs 402 and started consolidating in shorter time frame charts. Currently, it is waiting for the breakout on the upside so that it can accelerate buying momentum further. The emerging line of polarity on the daily time frame of the chart is suggesting bullish momentum in the scrip. Indicators and oscillators are also showing a conducive scenario in the coming sessions. So based on the mentioned technical structure one can go long in the scrip around Rs 340 for the target of Rs 385 mark with stop loss of Rs 310.

Expert: Aditya Agarwala, Senior Technical Analyst - Institutional Equities, Yes Securities

MindTree Ltd: Buy | LTP: Rs 1,083 | Target: Rs 1,300 | Stop Loss: Rs 1,000 | Upside 20%

MindTree has resumed its upward journey after breaking out of a triangle pattern on higher volumes. Further, it continues to make higher highs and higher lows confirming the bullishness in the stock.

Further, on the daily chart, the stock has crossed its previous peak on good volumes confirming the continuation of the uptrend.

RSI has moved above the 70-level favouring the bulls. The stock may be bought in the range of Rs 1,080-1,090 for targets of Rs 1,180-1,300, keeping a stop loss below Rs 1,000.

Balkrishna Industries Ltd: Buy | LTP: Rs 1,322 | Target: Rs 1,450 | Stop Loss: Rs 1,265 | Upside 10%

Ajanta Pharma has broken down from an inverted Head & Shoulders pattern and has resumed its uptrend.

Further, on the daily chart, it has broken out from an Ascending Triangle pattern as well, confirming the strong bullishness in the stock.

RSI has moved above 60 makings higher lows indicating strong bullishness. The stock may be bought in the range of Rs 1,620-1,630 for targets of Rs 1,730-1,850, keeping a stop loss below Rs 1,550.

Balkrishna Industries Ltd: Buy | LTP: Rs 1,322 | Target: Rs 1,450 | Stop Loss: Rs 1,265 | Upside 10%

Balkrishna Industries has broken out of a bullish Flag pattern following a long pole.

Further, it has crossed the previous cluster of peaks placed at Rs 1,300 with a successful closing above Rs 1,300 on good volumes confirming bullishness.

Further, RSI has formed a positive divergence that favours the bullish view developing currently. The stock may be bought in the range of Rs 1,320-1,330 for targets of Rs 1,400-1,450, keeping a stop loss below Rs 1,265.

Indoco Remedies Ltd: Buy | LTP: Rs 227 | Target Rs 300 | Stop Loss: Rs 205 | Upside 32%

Indoco Remedies has broken out of a bullish Cup & Handle pattern.

Further, the breakout has been witnessed on massive volumes confirming the bullishness in the stock.

Further, RSI has formed a positive divergence that favours the bullish view developing currently. The stock may be bought in the range of Rs 225-227 for targets of Rs 260-300, keeping a stop loss below Rs 205.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.