Hunting for fresh ideas in volatile market might be tricky, but taking a sneak peek in a portfolio of mutual fund houses might be of some help.

Mutual fund (MF) industry's assets declined to Rs 22.8 lakh crore in December 2018 from Rs 23.4 lakh core in November 2018 on the back of moderation in the flows into equity funds and outflows from liquid funds.

However, assets under management (AUM) were up 5.5 percent for CY18, primarily led by inflows in the liquid, equities, other ETF and balanced categories. Equity mutual funds attracted steady flows, largely due to the participation through systematic investment plans (SIPs).

Inflows into equity funds (including equity-linked saving schemes) declined 21 percent on a month-on-month (MoM) basis to Rs 6,606 crore in December, but flow into systematic investment plans (SIPs) soared to record highs.

SIP inflows remained strong and crossed Rs 8,000 crore for the first time in December 2018, ICICIDirect said in a report. However, the growth in number of SIP additions has slowed down significantly, but in no way, it suggests that retail investors are losing confidence.

Also read - Fund manager survey finds emerging markets favourites against backdrop of slowing growth

Retail flows have been resilient in recent years, which truly speaks volumes of our domestic strength. These inflows have credibly helped fight volatility at times when FIIs were on a selling spree, suggest experts.

“Technology has played a vital role as many SIPs are on auto debit mode from bank accounts. My sense is that retail flows will continue to flow into equities in a disciplined manner,” Amar Ambani, President & Head of Research at YES Securities told Moneycontrol.

“It would take over 10 percent downside from current market levels followed by a lackluster market for a prolonged period for the auto debit SIPs to be turned off. That seems highly unlikely,” he said.

The year saw a notable change in the sector and stock allocation of funds. The weight of defensives increased from 24.3 percent in CY17 to 27.6 percent in CY18. Global Cyclicals’ weight, too, increased 50 bps to 10.7 percent, Motilal Oswal said in a report.

In December 2018, MFs showed interest in utilities, oil & gas, banks and capital goods. These sectors saw a MoM increase in weight. On the other hand, technology, automobiles, healthcare, metals, consumer, telecom and cement saw a MoM decrease in weight, added the report.

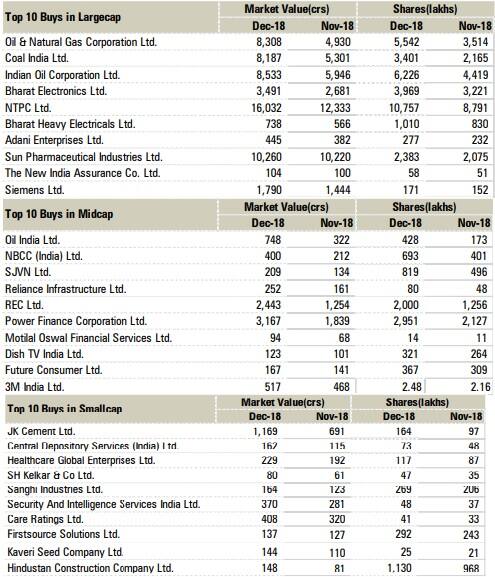

Here's what mutual fund managers bought and sold in December quarter:

ONGC, Coal India, IOC, Bharat Electronics, and NTPC witnessed highest buying interest in the largecap space during December 2018.

In midcaps, stocks like Oil India, NBCC, SJVNL, Reliance Infrastructure, and REC witnessed highest buying during December 2018.

In smallcaps, JK Cement, CDSL, Healthcare Global, SH Kelkar, and Sanghi Industries found favour among fund managers.

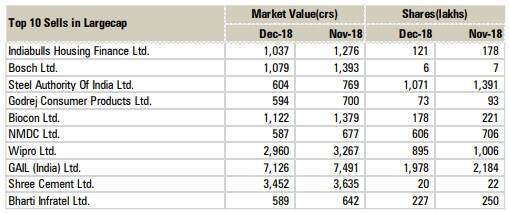

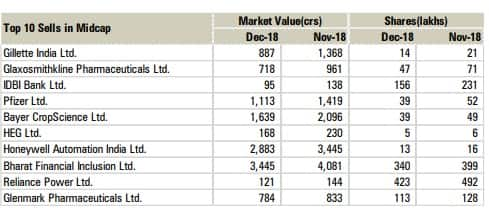

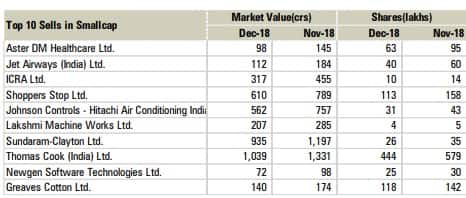

Top stocks which fund managers sold in December:

In the largecap space, selling by AMCs were seen in Indiabulls Housing, Bosch, SAIL, Godrej Consumer and Biocon.

Midcap stocks which saw selling by AMCs were Gillette India, Glaxo Pharma, IDBI Bank, Pfizer and Bayer CropScience.

Small cap stocks that saw selling were Aster DM Healthcare, Jet Airways, ICRA, Shoppers Stop and Johnson Controls - Hitachi Air Conditioning India.

Note: Investors should ideally follow their own research before putting their money and at best the below list could be taken as a reference point to shortlist stocks. It could turn out to be a relatively risky strategy for retail investors if they follow what fund managers buy or sell because the objective, holding period and exposure in the portfolio could be totally different.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.