Foreign institutional investors (FIIs) increased their ownership of BSE200 companies marginally in the March quarter. FIIs bought equities worth Rs 46,900 crore in the quarter ended March 2019 taking their ownership to 24.1 percent compared to 23.6 percent in the December quarter.

FIIs increased their exposure in banks, diversified financials, insurance and oil, gas and consumable fuels while they reduced their exposure in automobiles, metals, capital goods, consumer staples, and consumer durables, according to a report by Kotak Institutional Equities.

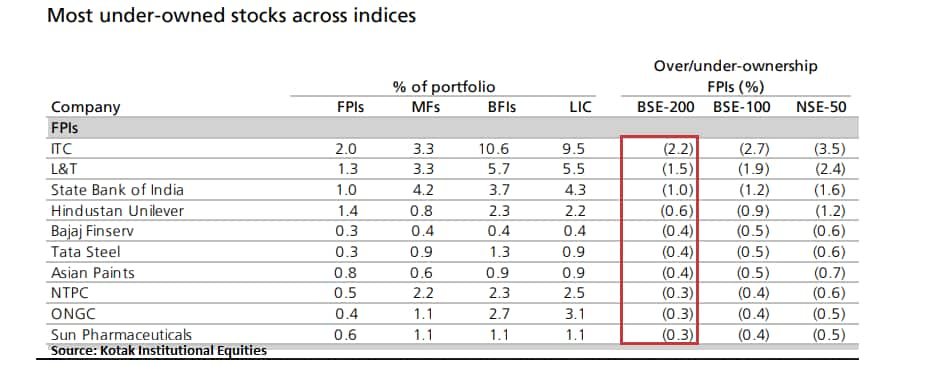

However, there 10 stocks in the BSE 200 index in which are still under-owned in terms of FII ownership. They include ITC, L&T, SBI, Hindustan Unilever, Tata Steel, Asian Paints, ONGC, Sun Pharma, Bajaj Finserv and NTPC.

Experts are of the view that investors should not worry too much on under-ownership of stocks by FIIs as many times it offers potential opportunity for them to top up and increase exposure in them in the future.

“The reasons for under-ownership could differ across sectors and stocks based on fundamentals, sector view and potential earnings growth of individual companies. In some cases like SBI, L&T and Bajaj Finserv, the business prospects seem to be improving and hence they are hitting record highs,” Rusmik Oza Head, of Fundamental Research at Kotak Securities told Moneycontrol.

“The right way to look at stocks would be their valuations and scope of re-rating in them. Many long only FIIs avoid investing in PSU stocks because of the frequent dilution in equity. Hence their ownership could be lower in most PSU stocks due to this approach,” he said.

Table 1: 10 stocks with very low ownership by FIIs.

Domestic Institutional Investors' (DIIs) holding in the BSE 200 index declined to 13.5 percent in the March quarter from 13.9 percent in the December quarter, Kotak Institutional Equities said in a report.

Domestic fund managers added stake in banks, capital goods, Oil & Gas, consumer staples, insurance and hotels stocks while decreasing in diversifies financial services, pharma, automobiles and telecommunications.

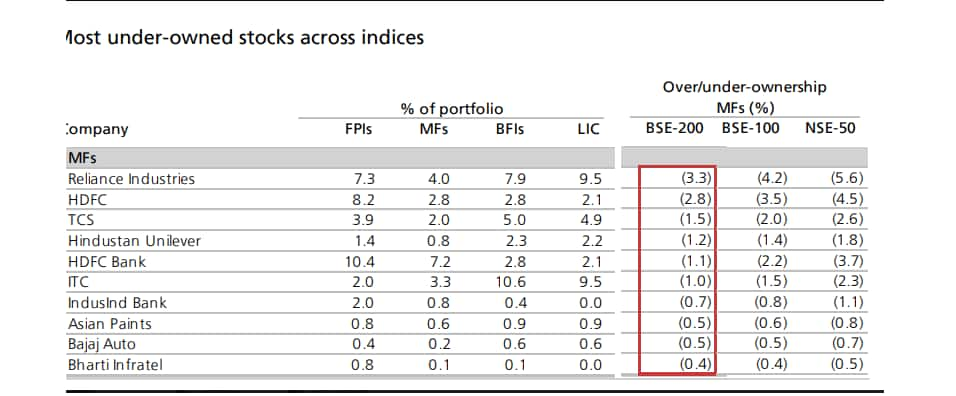

There are about 10 bluechip stocks that are under-owned by fund managers. This includes RIL, HDFC, TCS, HDFC Bank, HUL, ITC, IndusInd Bank, Asian Paints, Bajaj Auto and Bharti Infratel.

Table 2: 10 stocks with very low ownership by DIIs.

Mutual funds performance is monitored and benchmarked to the indices on regular periodicity. Hence they need to consistently churn and try to provide certain alpha over and above the benchmark, say experts.

In the base case, fund managers usually churn out of stocks that are quoting at high valuations or where the upside remains fairly limited to generate alpha.

“We saw a large up move in Nifty stocks in this year so far, that could have been missed by all those who were not holding these blue chips in their portfolio,” Abhijeet Bajpai, co-founder & CEO, Avighna Trades told Moneycontrol.

“Valuations for near to mid-term are not so attractive in Nifty stocks when compared to stocks outside Nifty, so that might be the reason for MFs staying away from these stocks,” he said.

Factors to watch:

Under-ownership of stocks could be used as one method to filter stocks that might be trading at a premium when compared to historical averages; at the same time don’t ignore the fundamentals.

Study the signs why the stocks have come off from highs or are now in the under-owned by FPIs or mutual fund managers. Investors should ignore the factors that are impacting the market for short-term like elections or US-China trade talks, which infused volatility.

The basic premise for an investor is to buy low and sell high, and they should evaluate the valuation of stock for a long-term basis, suggest experts.

“Investors must look at the fundamentals of a company before investing their hard-earned money into stocks. A company’s operational efficiency, top and bottom line growth, margins, working capital requirements, return ratios and debt to equity ratio are some basic factors to check,” Umesh Mehta, Head of Research, SAMCO Securities told Moneycontrol.

“To add to it, an investor must research if the promoters of a company are efficient at running the business and there are no corporate governance issues clouding the company. Furthermore, valuations will also enable investors to decide if the fair value matches the market price,” he said.

Note: The above report is for information only and not generally buy or sell ideas.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!