Nifty traded in the green, with the Information Technology and Metal indices up 1 percent each, while the FMCG, Pharma, and Power indices were up 0.5 percent each. Nifty Bank continued to have sideways momentum, ranging between 44,650 and 45,000 levels.

As of 12.16 pm, the Nifty index was up 0.36 percent or 70.80 points at 19,635.30. The Nifty Bank was down 0.12 percent or 52.35 points at 44,766.95.

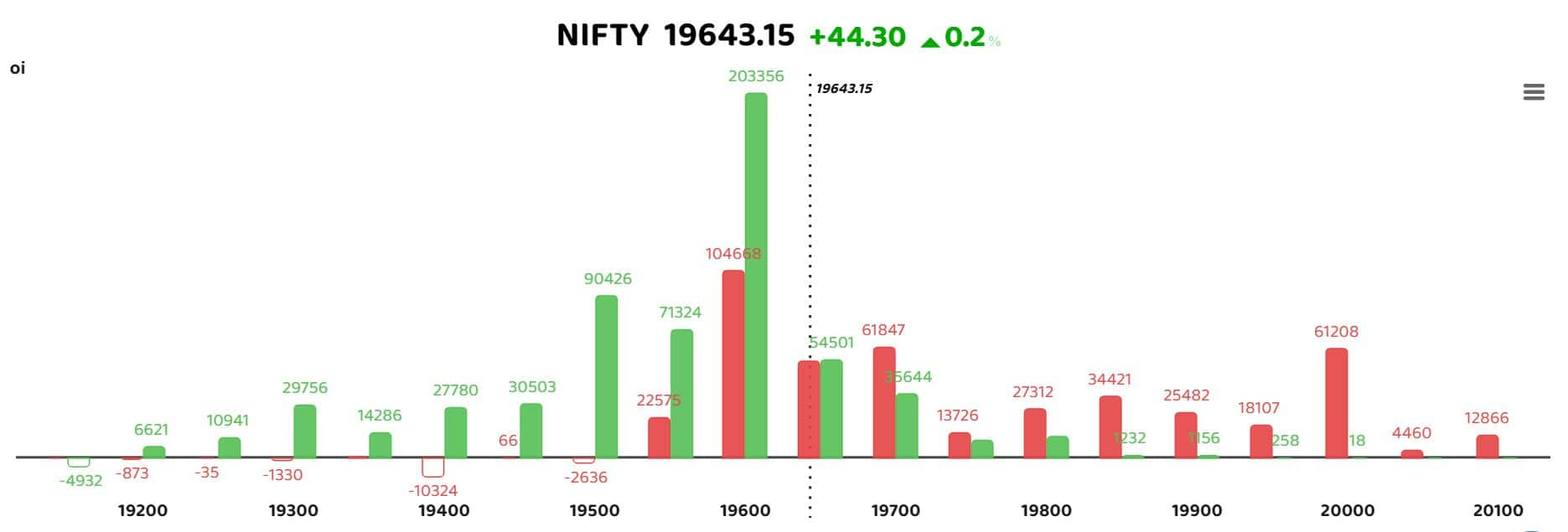

Bars reflect the change in OI during the day. Red bars show call option OI, and green bars show put option OI.

Bars reflect the change in OI during the day. Red bars show call option OI, and green bars show put option OI.

Option data shows that put writers dominate the Nifty charts, with strong support at the 19,500 level. Santosh Pasi, a derivatives trader and analyst, stated, "The NIFTY support level is near 19500-19550, and we expect to see new highs in the coming days."

With a bullish view, he recommends a buy-on-dip strategy for Nifty and Nifty Bank.

For Nifty Bank , Santosh Pasi expects sideways movement between 44,500 and 45,000 for the current weekly expiry.

Axis Securities, in its Mid-Month Derivative report, stated, "The highest CE concentration for July expiry is at 19,600, followed by 20,000 and 19,500, which might act as strong resistance. On the PE side, the highest OI is at 19000 PE, followed by 19,500 and 19,300, which are likely to act as immediate supports during this expiry."

It expects India VIX to remain subdued, mostly in the range of 10.50 to 13.50 for the July Expiry. The Volatility Index (IndiaVIX) is a measure of market expectations for near-term volatility.

Among individual stocks, Bandhan Bank and Godrej Properties saw short build-up. Traders took bullish positions in Mphasis, Wipro, and Indus Towers, among others. RBL Bank saw a massive short covering.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!