Reserve Bank of India (RBI) Governor Shaktikanta Das will announce the first monetary policy of 2023 today after a two-day review amid concerns of further slowdown in economic growth and tight global financial conditions.

The review by the six-member Monetary Policy Committee (MPC) led by Das will likely indicate the course the RBI will adopt in 2023 as it seeks to strike a fine balance between sustaining growth while battling against global spillovers.

This week's monetary policy is seen as crucial as it will be the RBI's first policy stance for the calendar year 2023 and comes exactly one week after Finance Minister Nirmala Sitharaman unveiled the Union Budget 2023-24 in the Parliament on February 1.

Even though the US Federal Reserve is signalling that disinflation has kicked off and the odds of soft-landing in 2023 have increased, the anticipated slowdown in economic growth remains to be a challenge for the rate-setting panel.

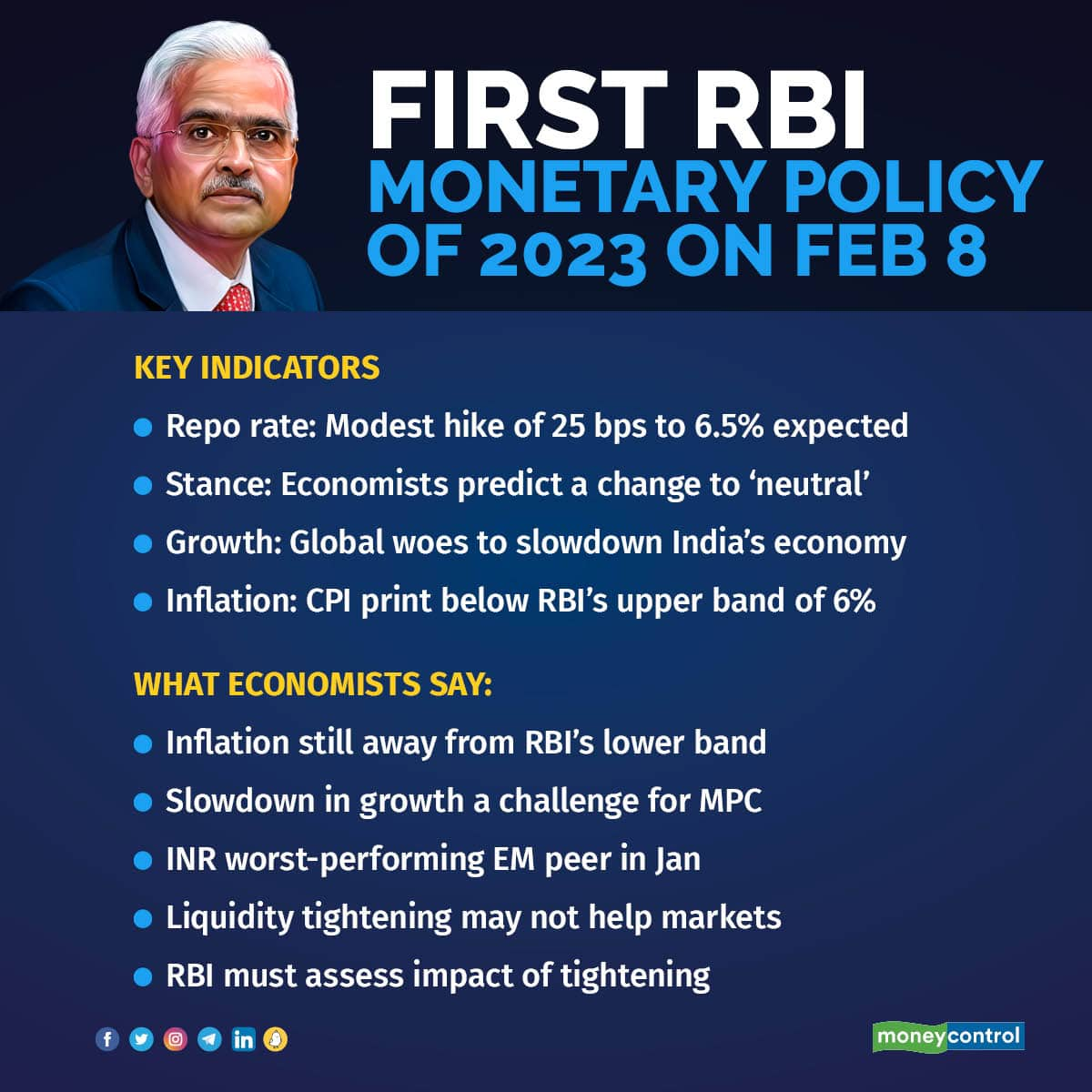

Coming to forecasts, the RBI is expected to raise the main interest rate by a modest 25 basis points (bps) to 6.50 percent before leaving it at that level for the rest of the year, according to economists who participated in a poll conducted by Reuters.

The RBI is expected to then pause, like many other major central banks, waiting for inflation to fall before considering a shift towards a stimulative stance as Asia's third-largest economy slows, as per Reuters.

Experts are divided whether the RBI should change its stance to neutral or persist with its withdrawal of accommodation. At a time when its global peers are still hawkish, experts reckon that the RBI's job has become a little bit harder. Here are the key indicators to watch at the upcoming RBI monetary policy meeting - the last one for fiscal year 2022-23.

Also Read: CPI inflation falls again in December, hits 1-year low of 5.72%

Inflation

Economists expect that retail inflation projection to average 5 percent for fiscal 2023-24 and 4.9 percent for fiscal 2024-25, as per the Reuters poll.

However, India's headline retail inflation rate eased to a one-year low of 5.72 percent in December 2022, falling for the third month in a row. Also, December's consumer price index (CPI) inflation print in came in lower than the upper band of RBI's 2-6 percent mandate.

Sonal Varma, managing director and chief economist at the Japanese securities house Nomura Financial Advisory weighed in on the current economic situation and said that the decline in inflation numbers is a definite positive, but the aggregate inflation basket is still very sticky.

"There is moderation in commodity prices not withstanding china reopening, negative growth in exports, and moderation in industrial production. Forward-looking indicators suggest that the goods component of inflation will also moderate," Varma said in an exclusive interview with CNBC-TV18.

"Inflation is less of an issue for sure, compared to back in December. The details are more mixed, but the forward looking indicators are also positive," she said.

In a research report released in December 2022, Nomura highlighted that 2023 will be a "particularly bumpy" year for India on account of a global slowdown and an uneven domestic recovery.

Also Read: Nomura sees India FY24 GDP growth at 5.1%, RBI cutting repo rate by 75 bps in 2023

Change of stance?

Financial services firm Morgan Stanley recently highlighted in its report that India's budget maintains its fiscal prudence and the inflation trend is moderating, so the RBI is expected to implement a final rate hike in the February policy review and change its stance to neutral.

Nomura's Varma also believes that the stance needs to change to neutral, irrespective of how the MPC has guided the stance with respect to liquidity or rates.

"The argument against that is, if there's a rate hike and change in stance, then it undoes the impact. But ultimately, it is the credibility of MPC itself in terms of what they are guiding. So, I think it's time to pause and assess the impact of tightening done so far," she said.

While speaking to CNBC-TV18, Samiran Chakraborty, India chief economist at Citibank highlighted that the challenge before the RBI is that there is still a durable liquidity surplus of Rs 2.5 lakh crore.

"The RBI might want this number to come down before they can call it neutral. However, with softer growth outlook and relatively lower inflation outlook, there is a possibility that the RBI is biased towards calling it neutral despite the liquidity surplus still being quite elevated," Chakraborty told CNBC-TV18.

Current Account Deficit

India’s current account deficit (CAD) widened to 3 percent of gross domestic product (GDP) last year, recording the biggest external shortfall since 2012 when the nation was on the verge of a balance of payments crisis.

Government data showed India’s CAD widened to $36.4 billion or 4.4 percent of GDP in the third quarter of 2022 from $18.2 billion or 2.2 percent of GDP in the second quarter. This was mostly on the back of surge in commodity prices and the outbreak of the Russia-Ukraine war.

Citibank's Samiran Chakraborty said that the RBI cannot overlook the macro and global issues that may still pose a threat to the economy.

“We are now at 2.2 percent of CAD for next fiscal year. 2.2 percent is still $85 billion of CAD and that means we require $85 billion of flow just to match the balance of payments, which in a year, if global dollar liquidity gets tightened, is not easy. The RBI cannot take its eyes off this issue,'' he told CNBC-TV18.

India witnessed sporadic bouts of portfolio outflows in January which immediately makes the INR almost the worst performing currency in the emerging markets (EM) space during the month, he explained.

''So in some sense, if RBI doesn't stay along with the rest of the central banks, this problem can stay for longer, elevated by tight liquidity and sudden economic shocks,'' he added.

Also Read: India’s current account deficit, now at a decadal high of 3%, may reduce this year

Liquidity

The RBI's monthly bulletin showed that the central bank sold a net of around $50 billion in the spot market last year through November.

Also, India’s foreign exchange reserves rose above a six-month high of $576.76 billion in the week through January 27. The RBI intervened to buy dollars as the rupee stabilised. For the week ending February 3, the rupee fell again due to equity outflow jitters.

Talking about borrowing, Soumya Kanti Ghosh, Group Chief Economic Advisor at State Bank of India told CNBC-TV18 that borrowing numbers are slightly lower than market expectations as fisc is going on its own path of fiscal consolidation.

''There could be a shortfall of Rs 2-2.5 trillion amount of government securities (GSEC) required to be taken out of the market, where the RBI could step in,'' said Ghosh.

''Some sort of liquidity support could be required, because the appetite of borrowing by the insurance companies now may not be as great as last year's. So, I'm not sure whether a continued liquidity tightening could help markets given that inflation is under control,'' he added.

Growth

The Economic Survey 2023 highlighted that India's real GDP is expected to grow by 6.5 percent in 2023-24, while Budget 2023 noted that the nominal GDP growth is assumed at 10.5 percent.

The International Monetary Fund (IMF) expects global growth to slowdown in 2023, but less than what was presumed few months ago, on the back of faster reopening in China and better-than-expected data flow in European markets.

The IMF expects global economic growth to go from 3.4 percent to 2.9 percent this year, which is one full percentage point below long-term global growth average, according to Sajjid Chinoy, Chief India Economist, J.P Morgan.

The biggest challenge for the RBI in the upcoming MPC meeting is the anticipated slowdown in economic growth, according to experts.

A Reuters poll of economists found that there will be an expected slowdown of 6 percent in India's economic growth during fiscal year 2023-24 from an expected 6.7 percent in the current one.

''India’s growth is likely to disappoint at 4.5 percent in 2023 due to global spillovers, prompting 75 basis point of rate cuts in second half of 2023,'' wrote Nomura economists led by Sonal Varma.

Former Chief Statistician Pronab Sen told CNBC-TV18 that the condition of economy is such that we are seeing a decided slowdown in terms of growth and a mild trend towards slowdown in terms of inflation but that’s still iffy.

''Given that, the question that’s going to plague the RBI, will be that they may come under pressure for not supporting revival the growth and that may happen pretty quickly,'' said Sen.

Also Read: What is the bond market reading from the RBI policy?

Overview

In the last monetary policy review in December 2022, the RBI’s Monetary Policy Committee raised the repo rate by 35 bps to 6.25 per cent - which was the fifth consecutive repo rate hike in 2022 alone.

With December's hike, the RBI’s rate-setting panel raised the key policy rate by 225 bps in 2022 to control stubbornly high inflation. Repo is the rate at which the central bank lends short-term funds to banks. One basis point is one-hundredth of a percentage point.

The government has mandated the central bank to keep the inflation rate at 4 percent (+,- 2 percent). But, retail inflation remained above the RBI's comfort level for nearly the entire year. Experts reckon that the February rate hike of a modest 25 bps will be the last of its current rate hike cycle.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.