India's GDP growth may slow down sharply to 5.1 percent in 2023-24 and force the Reserve Bank of India (RBI) to cut the key repo rate by 75 basis points (bps) in the second half of 2023, economists at Nomura have said.

"A crucial question for next year is whether the MPC will cut policy rates when growth disappoints and inflation moderates to around 5 percent but remains above the 4 percent midpoint target. We believe so," Sonal Varma and Aurodeep Nandi wrote in Nomura's macroeconomic outlook report for 2023 released on December 7.

"...in a scenario in which growth significantly disappoints (as we expect), we would expect the timeline to achieve the 4 percent target to be implicitly pushed out, as the appetite for a further growth sacrifice will be limited. Pressure to support growth may also increase ahead of the elections in early 2024," they added.

Nomura expects the RBI's monetary policy committee (MPC) to effect a "shallow easing cycle" by cutting the policy rate by 25 basis points each in August 2023, October 2023, and December 2023 to end 2023 with a repo rate of 5.75 percent.

Nomura's forecast comes even as the Indian central bank earlier in the day raised the repo rate for the fifth time in eight months to 6.25 percent and cut its GDP growth forecast for 2022-23 by 20 basis points to 6.8 percent - 20 basis points higher than 6.6 percent predicted by Nomura.

2023, a bumpy year

Nomura's growth forecast for the next financial year is sharply below most other estimates, with the central bank saying on September 30 in its six-monthly Monetary Policy Report that GDP growth may ease to 6.5 percent in 2023-24.

According to Varma and Nandi, 2023 will be a "particularly bumpy" year for India on account of a global slowdown and an uneven domestic recovery.

Writing in a note following the release of GDP data for the July-September period, which saw growth more than halved to 6.3 percent from 13.5 percent in the first quarter of 2022-23, Varma and Nandi said India's growth cycle had already peaked and a broad-based slowdown was underway.

In its outlook report released on December 7, Nomura said it expected the fall in global growth to "play an outsized role in influencing domestic growth", especially in the first half of 2023.

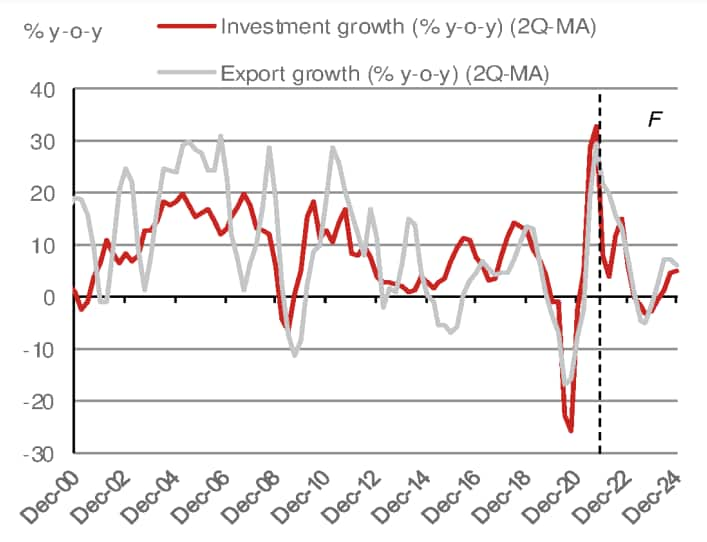

"The private capex upcycle has remained lacklustre, while global uncertainty and tighter financial conditions are likely to weigh on corporate investment plans, resulting in weaker fixed investment growth," Nomura said.

Source: Nomura

Source: Nomura

However, with monetary conditions in India being neutral as opposed to restrictive, Nomura expects demand for housing and private consumption growth to moderate instead of collapsing.

One hike and three cuts?

Weak growth is expected to force the RBI into action, with Nomura foreseeing a quick policy turnaround in 2023.

After the 35 basis point rate hike on December 7, Nomura expects the MPC to increase the repo rate by 25 basis points in February before cutting the rate three times in the second half of 2023.

"...we believe the February hike is a close call, and the RBI could instead choose to pause after the December hike. We believe a pause is impending, as we expect growth to disappoint, the forward inflation path to suggest disinflation and because monetary policy works with long lags."

As with growth, Nomura is not optimistic when it comes to inflation either, with its forecasts not spelling out a durable trend towards the medium-term target of 4 percent because of high food inflation and lower potential growth.

Nomura expects India's headline retail inflation to ease from 6.8 percent in 2022-23 to 5 percent in 2023-24 and 4.9 percent in 2024-25.

The RBI retained its Consumer Price Index (CPI) inflation forecast of 6.7 percent for FY23, though it made a slight 10-basis-point upward adjustment to average inflation for the second half of the financial year.

The central bank forecasts CPI inflation to average 6.6 percent in October-December 2022, 5.9 percent in January-March 2023, 5.0 percent in April-June 2023, and 5.4 percent in July-September 2023.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!