Almost three months after the COVID-19-led national lockdown, life insurance companies are seeing some bright spots in new premium collection. Even though there was a decline in new premiums, the rate of decrease was significantly lower than previous months.

Data from the Insurance Regulatory and Development Authority of India (IRDAI) showed that the private sector industry saw a 1.28 percent year-on-year (YoY) decline in June 2020 new premiums. In May 2020, there was a 28.3 percent decline.

LIC, which saw a 24.3 percent YoY decline in new premiums at Rs 10,211.53 crore in May 2020, saw a 12.7 percent decline in June 2020.

Since the restrictions were lifted in June 2020, there has been a built-up in momentum of policy sales, industry sources said.

“During April and May, bank branches were not able to sell any policy. That was not the case in June and the industry benefited,” said the chief distribution officer of a mid-sized private life insurer.

Overall, the industry saw a 10.5 percent YoY decline in new premiums at Rs 28,868.7 crore in June 2020. For the June quarter (Q1), the life insurance industry saw an 18.6 percent YoY decline in new premiums at Rs 49,335.44 crore.

In May 2020, there was a 25.4 percent YoY decrease in new premiums.

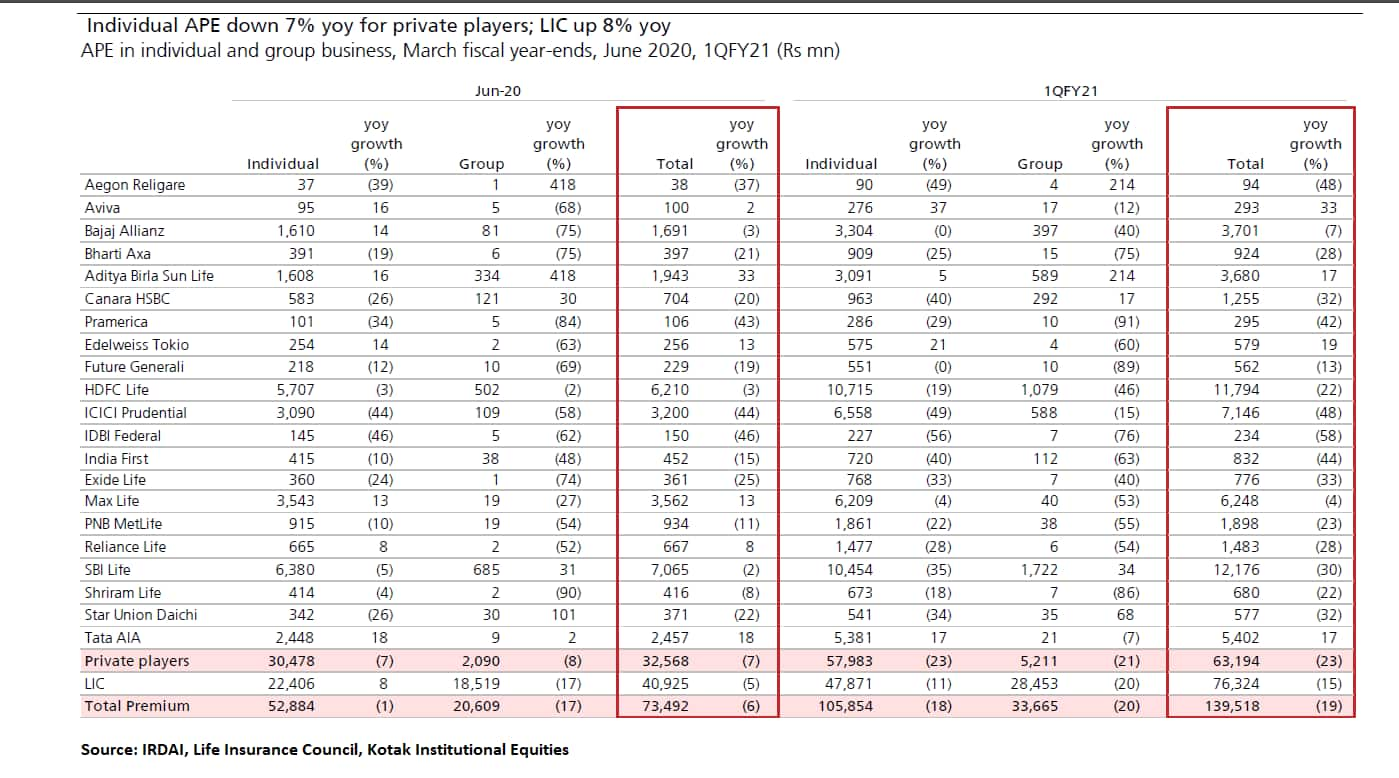

A report by Kotak Institutional Equities said that private life insurers reported 7 percent individual annualised premium equivalent (APE) decline in June 2020.

“Traction in individual protection policies, selective push of non-participating business and uptick in business through digital channels were likely drivers while unit linked insurance product (Ulips) volumes were weak,” said the report.

Among the listed insurers, SBI Life Insurance saw a 14.7 percent YoY growth in new premiums in June 2020, at Rs 1,502.44 crore, making it the largest private life insurer by new premium collection. HDFC Life Insurance saw a 0.9 percent YoY decline in new premiums for June 2020 to Rs 1,346.68 crore.

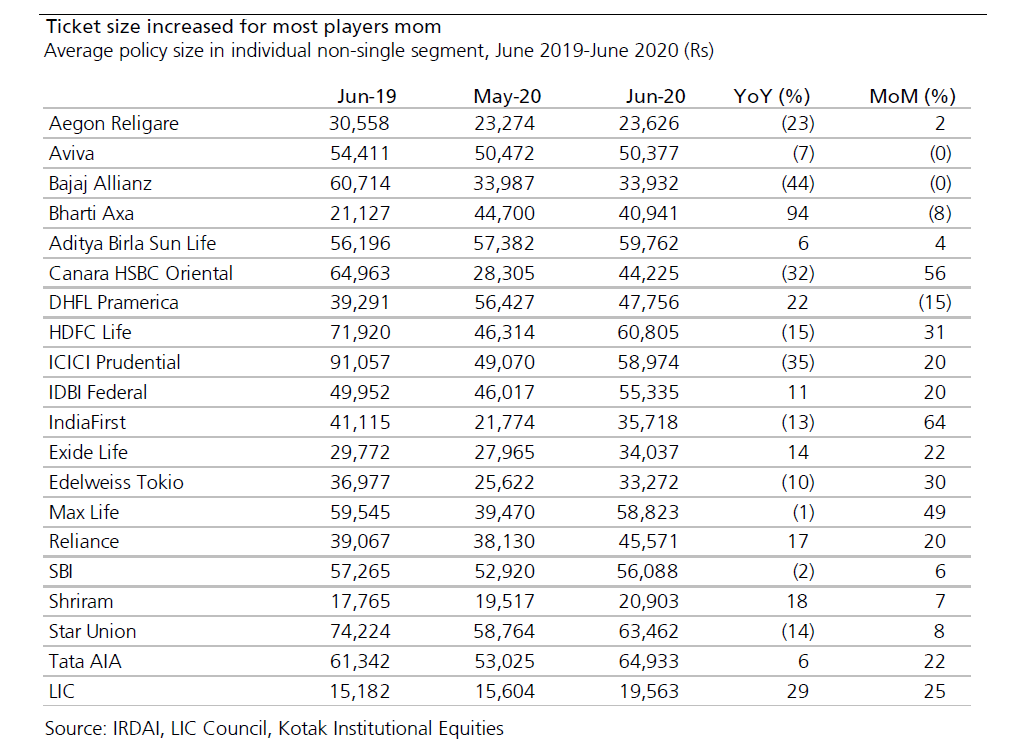

ICICI Prudential Life Insurance, however, saw a 37 percent YoY decline in new premiums to Rs 564.56 crore. The Kotak report said that the insurer saw a higher decline than peers due to a likely slowdown in Ulips, with a 35 percent YoY drop in average ticket size to Rs 58,974 in individual regular business in June.

On the one hand, while bank-led insurance sales have started picking up, the insurance industry is still waiting for the individual agents’ field visits to resume.

Field agents account for 40-45 percent of the total life insurance business every year but the lockdown has made it impossible for them to travel.

“Even though the lockdown has been partially lifted and insurance falls under essential services, agents don’t have access to public transport. Also, resident welfare associations are not allowing entry of agents,” said the head of channel sales at a private insurer.

The June quarter is usually the slowest month as far as life insurance sales are concerned. Policy sales start picking from the onset of the festive season and shows the maximum growth during the fourth quarter.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!