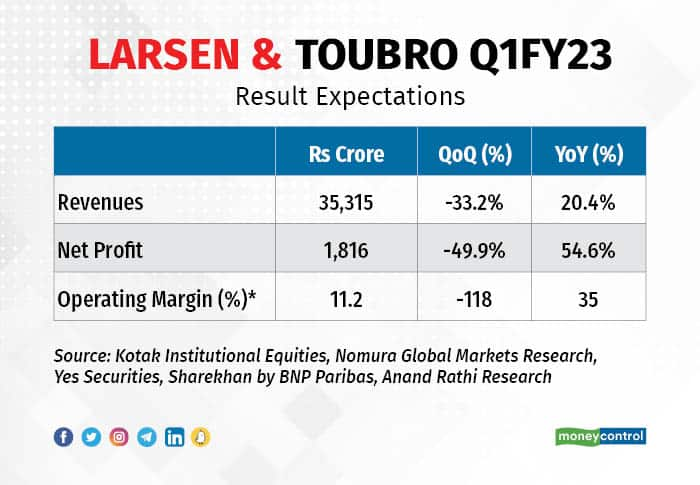

Engineering giant Larsen & Toubro Ltd (L&T) is likely to report a year-on-year growth of 55 percent in its consolidated profit after tax (PAT), while its consolidated revenues are expected to grow of 20.4 percent for the first quarter ended June 2022.

According to a poll of brokerages accessed by Moneycontrol.com, the Mumbai-based company is forecast to achieve a consolidated PAT of Rs 1,816 crore as compared to a PAT of Rs 1,174 crore it registered during the same period last year. Its profit during the previous quarter stood at Rs 3,621 crore.

The revenue for the quarter is seen at Rs 35,012 crore, compared to Rs 29,335 crore recorded during the last year period. The company had recorded consolidated revenue of Rs 52,851 crore during the previous quarter.

The company is likely to declare its results for the first quarter ended June 2022, tomorrow.

The softening of commodity prices, especially steel helped maintain the margins on a yearly basis, and strong execution across projects aided growth in L&T’s EPC (engineering, procurement and construction) revenues during the quarter.

“We expect significant growth traction YoY due to a large opening order book and also from a weak COVID-19 impacted base of Q1FY22”, a report from Nomura Global Markets Research said.

Almost all the brokerages expect strong YoY improvement in core EPC revenues driven by improved construction activity during the quarter.

According to a report from Anand Rathi Research, the revenue from the services vertical are expected to jump 29 percent year on year.

However, the brokerages are of the opinion that the order inflows announced so far by the company are below their expectations but going forward they are optimistic about the pick-up in momentum of order flows. The order inflows for core businesses are expected to be in the range of Rs 22,500 – 23,500 crore during the quarter.

The EBITDA (earnings before interest, tax, depreciation and amortization) margins for the quarter are expected to be flat year on year but likely to decline on a sequential basis due to rise in input costs.

“We build a flat OPM (operating margin) YoY due to increase in input cost particularly for fixed priced contracts but margin would decline QoQ on account of sequential rise in input costs”, a report from Sharekhan by BNP Paribas said.

The level of seasonal working capital build-up will be a key point to watch out for along with the guidance on order flows and execution.

L&T was trading Rs 11.00 higher at Rs 1,778.75 at 1.28 pm on July 25 at The National Stock Exchange. The stock has generated returns of 10.3 percent over last one year and has gained 19 percent during the past one month.

Disclaimer: The views and investment tips of investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.