With a captivating performance, this electronics manufacturing services (EMS) company has managed to leave investors pleasantly surprised, achieving an impressive 60 percent surge in stock price over the past three months. The fervent optimism surrounding Syrma SGS Technology Ltd is firmly rooted in industry tailwinds, buoyed by the company's strong growth potential.

Syrma excels in precise manufacturing for diverse industries such as industrial appliances, automotive, healthcare, consumer products, and IT. Its EMS solutions cover product design, rapid prototyping, assembly, repair, and automated testing. The company also provides full original equipment manufacturer (OEM) support from concept to mass production.

Industry tailwind

India's demand for electronics is set to hit Rs 20 trillion (Rs 20 lakh crore) by FY26, driven by youth aspirations and government efforts for self-reliance. This will boost India's position in the EMS sector, targeting Rs 6 trillion (Rs 6 lakh crore) by 2026 and increasing its contribution from 2.2 percent to 7 percent in the global EMS market, as per Haitong Securities.

Strong manufacturing growth, aided by solid order backlogs and increased localisation, benefits India's EMS sector. This growth is spurred by favourable policies, incentives, and global firms diversifying supply chains to leverage India's strengths, such as a large domestic market, skilled labour, and quality design capabilities.

Analysts believe the 'Make in India' campaign along with the 'China Plus One' strategy has bolstered the order backlog and fortified the pipeline of new business and clients in the EMS sector. Besides, the revised PLI scheme for IT hardware is also seen fuelling growth.

After a robust FY23, the management of Syrma has guided for revenue growth of over 35-40 percent in the medium term, on the back of industry tailwinds and marquee customer additions.

Positives could be visible in the quarter ended June. Syrma reported a growth of 83 percent year-on-year (YoY) in consolidated net profit at Rs 28.52 crore, and earnings before interest, depreciation, and amortisation (EBITDA) stood at Rs 59.02 crore, up 64 percent from last year. The company was able to register a revenue growth of 54 percent to Rs 601.31 crore.

Read more | EMS sector on a roll: Are there more legs to some of the chartbusters?

No concentration risk

With the combined strength and capability of Syrma and SGS Tekniks, the company has a diverse clientele both in the domestic and overseas markets, with about 31 percent export revenue.

"The company captures strong growth with its wide exposure across industries, with no single customer or industry making up more than approximately 10 percent of revenue," pointed out Haitong Securities.

Increasing wallet share

Syrma serves over 200 clients across 24 countries and various sectors. Its top 20 customers witnessed a 26 percent annual growth in wallet share from FY20 to FY22.

In FY23, it onboarded eight to 10 new customers and expects to start production for them by Q4 of FY24.

PhillipCapital anticipates robust revenue expansion for Syrma, driven by new client acquisitions and increased wallet share.

Foray into new industry verticals

Syrma intends to enter new high-growth segments such as aerospace & defence, medical electronics, and LED lighting.

This strategic move, as highlighted by PhillipCapital, is expected to bring in additional revenue, expand the customer base, and enhance order bookings, ensuring a robust revenue outlook.

Read more | Avalon vs Elin – Which EMS stock looks promising, post results?

Growth projection & valuation

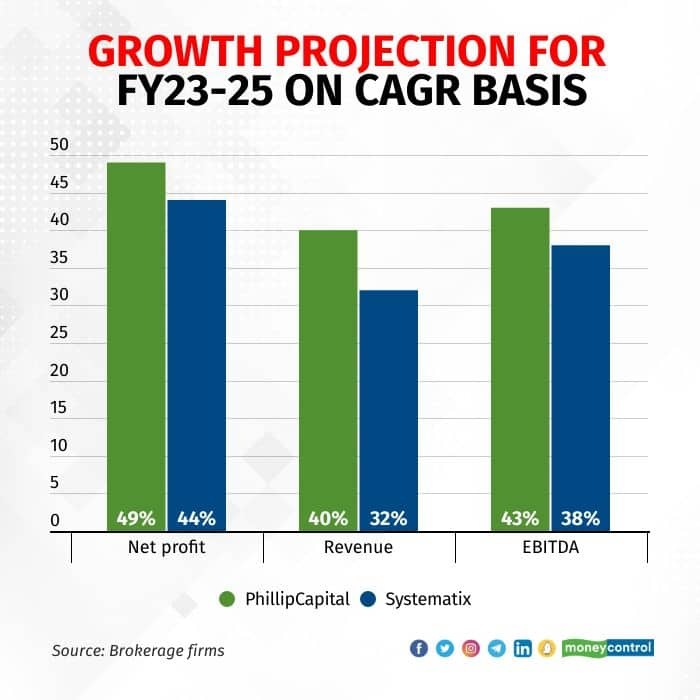

During FY23-25, analysts project revenue to grow between 30 and 40 percent on compounded annual growth rate (CAGR) basis. Meanwhile, they see EBITDA growing at around 44 percent and net profit in the range of 45-50 percent compounded annually during the same period.

Given the robust order backlog of Rs 3,000 crore, Haitong Securities expects Syrma to report a CAGR of 32 percent in revenue and 35 percent in earnings over FY23-26.

The brokerage firm values the stock at 38 times its September 2025 earnings per share (EPS). Besides a strong outlook and management commentary, Haitong Securities’ target price of Rs 555 implies a 20 percent discount to industry leader Dixon Technologies.

PhillipCapital has valued the stock at 40 times its FY25 EPS.

Meanwhile, brokerage firm Systematix sees Return on Equity (RoE) and Return on Invested Capital (RoIC) expanding approximately 550 basis points (bps) to about 13 percent and 21 percent, respectively, in FY25.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.