The benchmark indices rallied more than seven-tenths of a percent on October 6, extending their uptrend for the third straight session, but the market breadth turned negative. A total of 1,614 shares were under pressure, compared to 1,227 advancing shares on the NSE. The improved sentiment may drive the market gradually toward the September high. Below are some short-term trading ideas to consider:

Jigar S Patel, Senior Manager - Equity Research at Anand Rathi

ITI | CMP: Rs 317.45

ITI has witnessed a trendline breakout, supported by the confluence of the 200-day SMA and EMA, signalling renewed strength in price action. The RSI has rebounded from the 40 zone, reflecting improving momentum, while the price closing above the Ichimoku Cloud further reinforces the bullish bias. This alignment of key moving averages, coupled with positive momentum indicators, suggests that the stock is entering a strong technical phase.

Overall, the setup points toward building buying momentum, with the potential for continued upside as long as the price sustains above key support levels, indicating growing confidence among market participants. Traders may consider entering long positions in the Rs 320–310 zone.

Strategy: Buy

Target: Rs 350

Stop-Loss: Rs 290

Hindustan Unilever | CMP: Rs 2,541.8

Hindustan Unilever has witnessed a correction of nearly Rs 300 from its recent high of Rs 2,750 and is currently consolidating near the Rs 2,550 zone. The stock has taken support at the 200-DEMA, which aligns with the 50%–61.8% Fibonacci retracement zone of its prior rally, indicating a strong demand area.

Moreover, the Ichimoku Cloud is providing additional support, further strengthening the underlying bullish setup. From a technical standpoint, both the RSI and MACD are exhibiting early signs of reversal, suggesting that the recent selling pressure may be tapering off and that the stock could be gearing up for a potential rebound in the near term. Traders may consider entering long positions in the Rs 2,550–2,500 zone.

Strategy: Buy

Target: Rs 2,750

Stop-Loss: Rs 2,450

Bajaj Auto | CMP: Rs 8,792

Bajaj Auto has been undergoing a corrective phase in recent times; however, in the last two sessions, the stock has shown signs of stabilization by taking strong support near its 200-day SMA, which also coincides with the Ichimoku Cloud and an upward trendline. This confluence of technical supports indicates that the correction may be nearing completion.

Moreover, the current support zone aligns closely with the 61.8% Fibonacci retracement level of the previous up move, a key area where reversals often occur. Additionally, the RSI has rebounded from the 40 zone, signalling improving momentum and easing selling pressure. Collectively, these factors strengthen the bullish case for a potential upward reversal in the near term. Traders may consider entering long positions in the Rs 8,800–8,700 zone.

Strategy: Buy

Target: Rs 9,250

Stop-Loss: Rs 8,490

Jay Thakkar, Vice President & Head of Derivatives and Quant Research at ICICI Securities

Larsen & Toubro | CMP: Rs 3,737

L&T has provided a breakout from a sideways consolidation, and with that, it has also witnessed an increase in open interest in the futures segment, indicating a long build-up in the stock, which is a positive sign going ahead.

On the options front, the stock has taken off from Rs 3,700 levels, where there were the highest Call writers, and now there is no major hurdle until Rs 3,900 levels. The stock is also trading well above its 20-day VWAP (Volume Weighted Average Price), which is approximately Rs 3,650, so based on these positive signals, there is a favourable risk-reward ratio in the near term. Buy L&T Futures in the range of Rs 3,740–3,770.

Strategy: Buy

Target: Rs 3,900, Rs 3,960

Stop-Loss: Rs 3,650

Bajaj Finance | CMP: Rs 1,008.9

Bajaj Finance has taken good support from where it provided a breakout from the consolidation. This means that it has retested the breakout and reversed up again. It has witnessed an increase in open interest along with the price rise; hence, there is a clear long build-up in the stock, which is a positive signal in the near term. The stock is trading well above its 20-day VWAP level of approximately Rs 1,000, and there is only one hurdle at Rs 1,020, which has the highest Call base. Beyond that, there is likely to be a swift upward move. Buy Bajaj Finance Futures in the range of Rs 1,020–1,010.

Strategy: Buy

Target: Rs 1,050, Rs 1,075

Stop-Loss: Rs 990

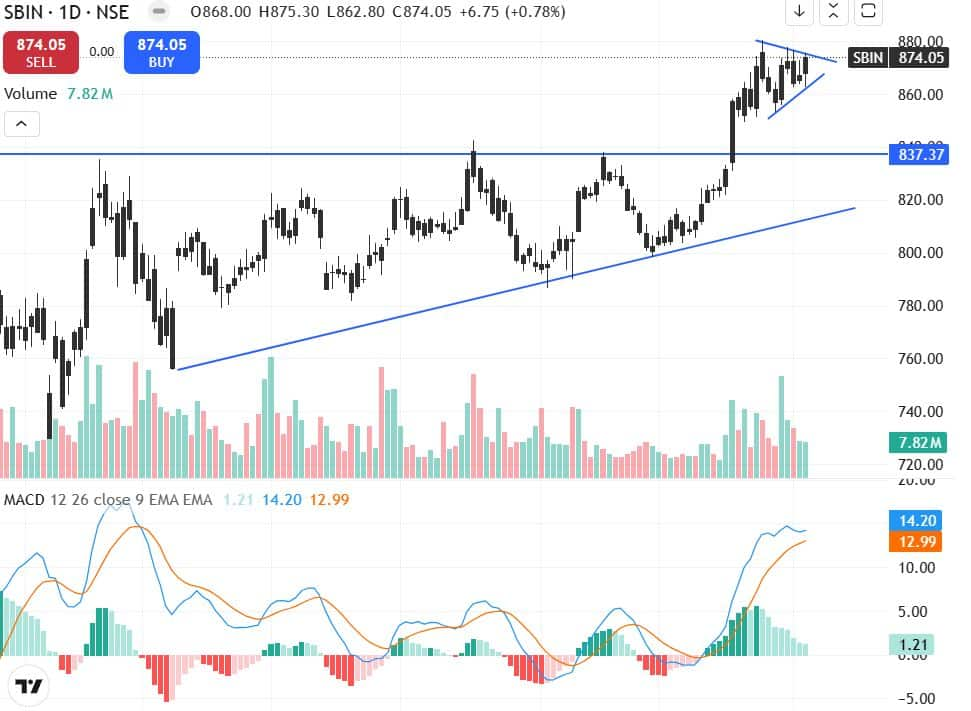

State Bank of India | CMP: Rs 874

SBI has provided a breakout from a large consolidation, which has come with an increase in open interest in the futures segment, clearly indicating a long build-up, which is positive for the stock in the near term. The stock is trading well above its 20-day VWAP level of approximately Rs 850. It has underperformed for quite a long time and is now being accumulated by the bulls, so it is likely to outperform private sector banks.

The PSU banking sector is already outperforming the Bank Nifty, and SBI has the highest weight in the PSU Bank Index. It has the highest Call base at Rs 880; however, it has significant support at lower levels, as from Rs 870 to Rs 800, all the strikes have higher Put base. Buy SBI Futures in the range of Rs 870–880.

Strategy: Buy

Target: Rs 905, Rs 920

Stop-Loss: Rs 845

Vidnyan S Sawant, Head of Research at GEPL Capital

Canara Bank | CMP: Rs 126.76

On the monthly timeframe, Canara Bank has registered a breakout from a large Cup and Handle pattern that had been forming since 2010, indicating a strong long-term structural uptrend. The breakout is accompanied by volume expansion above the 20-week average, reflecting strong investor participation and conviction. Furthermore, the RSI sustaining above 60 across multiple timeframes reinforces the bullish momentum, suggesting the stock is poised for a sustained upward move.

Strategy: Buy

Target: Rs 136

Stop-Loss: Rs 121

National Aluminium Company | CMP: Rs 217.15

On the monthly timeframe, NALCO has broken out of an eight-month consolidation phase with a strong bullish candle, indicating a continuation of its prevailing uptrend. The weekly chart highlights a change in polarity, where the January 2025 resistance has now turned into support, accompanied by a swift recovery from recent declines.

On the daily chart, the stock retraced nine sessions of decline within just four days, underscoring strong underlying momentum. Additionally, rising volumes above the 20-week average and the RSI sustaining above 60 further validate the ongoing bullish sentiment.

Strategy: Buy

Target: Rs 232

Stop-Loss: Rs 208

Bank of Baroda | CMP: Rs 266.6

Bank of Baroda has witnessed a breakout above horizontal resistance, completing an Inverted Head & Shoulders pattern that had been developing since July 2024, indicating strong price action and relative strength. A positive polarity shift, with the April 2025 swing high now acting as support, has spurred renewed buying interest. Moreover, the RSI holding around 62 underscores sustained bullish momentum, suggesting the stock is well-positioned to extend its upward trajectory in the near term.

Strategy: Buy

Target: Rs 282

Stop-Loss: Rs 258

Bharat Electronics | CMP: Rs 413.25

BEL has been in a steady structural uptrend since 2020, maintaining a gradual and consistent upward trajectory. During this phase, each near-term correction has found support at the 26-week and 50-week EMAs, underscoring the strength and health of the ongoing trend. Recently, the stock rebounded from a key support zone, indicating a revival in momentum. With the RSI holding above 60 across multiple timeframes, the positive price structure remains intact, reinforcing the continuation of the bullish trend.

Strategy: Buy

Target: Rs 455

Stop-Loss: Rs 396

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.