Taking Stock | Market ends flat amid volatility; PSU bank, realty drag

On the sectoral front, the Nifty PSU Bank index was down nearly 2 percent, while information techiology, metal, pharma and auto indices lost 0.2-0.88 percent... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 83,459.15 | -519.34 | -0.62% |

| Nifty 50 | 25,597.65 | -165.70 | -0.64% |

| Nifty Bank | 57,827.05 | -274.40 | -0.47% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Titan Company | 3,813.50 | 89.00 | +2.39% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Power Grid Corp | 279.05 | -8.95 | -3.11% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 8332.30 | -9.05 | -0.11% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Metal | 10499.00 | -153.80 | -1.44% |

Domestic equities remained lackluster ahead of US PMI data to be released later in the day and Fed minutes due to be released on Wednesday. Nifty opened positive but see-sawed in a narrow range and finally ended flat with a minor loss of 18 points (-0.1%) at 17,827 levels.

Broader market too was down -0.4%. Majority of the sectors ended in red. FMCG, Consumer Durables, Energy and Infra were marginal gainers.

Investors are cautiously awaiting US Fed’s monetary policy meeting minutes due on Wednesday to gauge its hawkishness. This along with PMI data due today and GDP data later this week would provide cues on interest rate cycle.

Recent CPI data points towards inflation stickiness and thus the need for prolonged high rates by US Fed. Even RBI’s MPC minutes would be released tomorrow and would be keenly eyed. FIIs which had turned net buyers last week after a long time, again became net sellers, denting sentiments.

Nifty ended flat following a volatile trading session. The bias remains negative as it falls back into the descending channel on the daily chart. Besides, the momentum oscillator RSI has entered a bearish crossover.

On the lower end, immediate support is visible at 17,750, below which the selling pressure may increase.

The Nifty opened with gains however as the day progressed selling pressure emerged at higher levels and the Nifty closed in the negative down ~18 points. On the hourly charts we can observe that the key hourly moving averages placed in the zone 17,920 – 17,950 acted as a stiff resistance and the morning bounce fizzled out after reaching this resistance zone.

On the hourly momentum indicator, we can observe a positive divergence developing which is a sign that the selling pressure is weakening. Thus, price and momentum indicator is providing divergent signals and in such a scenario a consolidation is highly likely.

The range of consolidation is likely to be 18,150 – 17,650. In terms of levels, 17,920 – 17,950 shall act as immediate hurdle one while on the downside the 17,650 – 17,600 which coincides with the 61.82% fibonacci retracement level shall act as a crucial support to watch out for form short term perspective.

Markets were extremely range bound with a negative bias as the shutdown of the US markets on Monday prompted investors to take a cautious stance. In fact, the markets have been more or less sluggish to negative over the past few sessions due to factors like rising interest rates, higher inflation, lingering geo-political tensions, and slowing growth.

Technically, the Nifty has formed a bearish candle on daily charts which is broadly negative for the market.

As long as the index is trading below 17,900, the weak sentiment is likely to continue and below the same it could slip till 17,750-17,700. On the flip side, a quick pullback is possible if the market trades above 17,900 and on further appreciation it could move up to 17,950-18,00

Despite opening gains, negative cues from global peers cast a shadow over investor sentiments. Underpinned by inflationary concerns, the market is keenly eyeing the US fed meeting minutes, scheduled to be released tomorrow, for hints on further monetary policy tightening. Risk appetite was further hammered by FIIs turning net sellers and fear of El Niño.

The Bank Nifty index ended on a flat note after a couple of days of brutal selling. The index is now trading at a critical support zone of 40500 and if it manages to stay above this level can witness a pullback rally towards 41,000-41,300 levels.

The mentioned support if breached will lead to further sell-off towards 40,000 where a significant amount of put writing is visible.

Indian rupee ended lower at 82.79 per dollar against previous close of 82.73.

Benchmark indices ended marginally lower in the volatile session on February 21.

At Close, the Sensex was down 18.82 points or 0.03% at 60,672.72, and the Nifty was down 17.90 points or 0.10% at 17,826.70. About 1432 shares have advanced, 1939 shares declined, and 138 shares are unchanged.

NTPC, Britannia Industries, Reliance Industries, Power Grid and Tata Steel were among the top Nifty gainers, while losers included Adani Enterprises, Apollo Hospitals, Coal India, Tata Motors and Bajaj Auto.

On the sectoral front, PSU Bank and Realty down 1 percent each, while selling was also seen in the oil & gas, metal, healthcare and IT names.

BSE midcap and smallcap ended with marginal losses.

Gold prices traded weak on Tuesday, with spot gold prices at Comex were trading lower by 0.50% at USD 1831 per ounce. Gold April future contract at MCX were trading down by 0.33% at Rs 56029 per 10 grams by noon session.

Gold prices traded in choppy range in previous session as traders waited for more macro data to gauge the U.S. Federal Reserve's rate-hike strategy. Investors are now awaiting minutes of the Fed's latest policy meeting due to be released on Wednesday.

The dollar index hovered near recent peak before released of FOMC meeting minutes on Wednesday. If rally in dollar index will extend above its recent high that could negative for gold price.

Comex Spot Gold having strong resistance at USD 1859 per ounce and support at USD 1817 per ounce, fall below this level will extend downside to USD 1805 levels. MCX Gold April future has resistance at Rs 56380 per 10 grams and supports place at Rs 55980/55700 per 10 grams.

-Buy rating, target Rs 98 per share

-SAS adds new capabilities, is a leading player in cockpit assembly market

-Valuations attractive; gains access to largest EV OEM

-EV order book is increasing for Samvardhana Motherson Automotive Systems

Samvardhana Motherson International was quoting at Rs 82.20, up Rs 0.30, or 0.37 percent on the BSE.

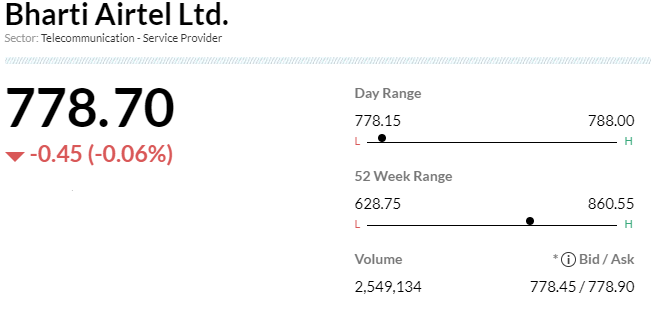

-Overweight rating, target at Rs 860 per share

-Company rolled out higher minimum recharge plans across 2 more circles

-Think these plans could eventually be rolled out Pan-India over coming weeks

-Comapny has been first mover in taking entry-level tariffs higher

-Competition has still not reacted

-Expect this to be 1.3-1.5% accretive to rev of mobile `business or equal, once rolled out

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| Nestle | 18,862.80 | 18,942.80 18,777.55 | -0.42% |

| Bajaj Finance | 6,377.10 | 6,409.00 6,353.00 | -0.5% |

| Reliance | 2,432.45 | 2,446.00 2,412.45 | -0.55% |

| NTPC | 173.15 | 174.20 168.50 | -0.6% |

| ICICI Bank | 854.10 | 859.45 846.70 | -0.62% |

| Axis Bank | 845.00 | 850.35 837.50 | -0.63% |

| Maruti Suzuki | 8,659.65 | 8,717.20 8,642.80 | -0.66% |

| M&M | 1,352.40 | 1,361.85 1,341.30 | -0.69% |

| Power Grid Corp | 217.15 | 218.70 216.00 | -0.71% |

| Kotak Mahindra | 1,730.60 | 1,744.35 1,725.50 | -0.79% |