Smallcap MFs outshine: Top schemes surge up to 12 times in 10 years

Smallcap mutualfunds outperformed largecap and midcap funds with huge margin in the last 10 years. They have a potential to generate relatively higher return if they are held for long term. But they are more volatile than other equity funds

1/10

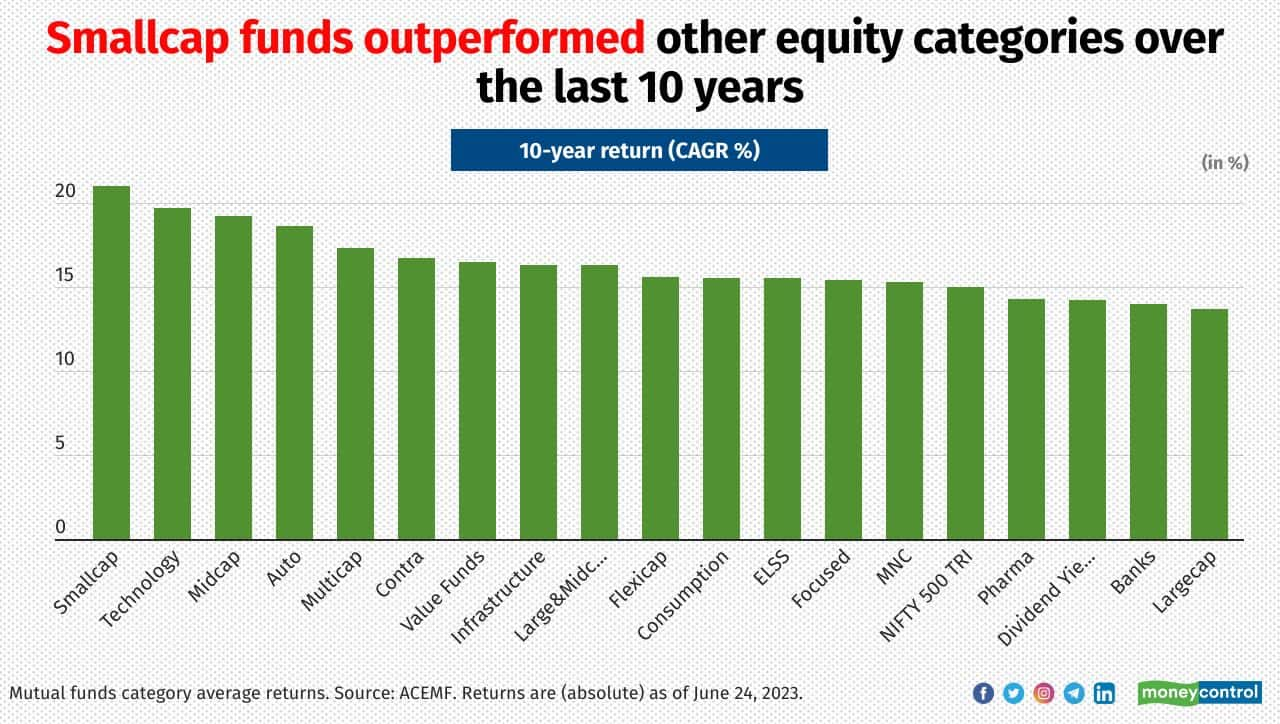

Smallcap funds have delivered handsomely for the patient investor. These schemes delivered a compounded annualised return (CAGR) of 21 percent over the last 10 years, while midcap funds and largecap funds clocked 19 percent and 14 percent, respectively. Meanwhile, the Nifty 500 TRI gave returns of 15 percent during the period. This has attracted more inflows too. Per AMFI data, smallcap equity funds got the highest net-flows among the equity funds categories of about Rs 25,800 crore over the last one year.

2/10

Smallcap funds tend to generate better returns than midcaps and largecaps during an economic recovery, but could underperform in uncertain times. However, smallcap funds have the potential to generate relatively higher returns if they are held long-term. Here are the top smallcap funds that multiplied investors' lump-sum investments up to 12 times over 10 years. Note that past performance is not indicative of future results. (Source: ACEMF).

3/10

Nippon India Small Cap Fund

Fund managers: Samir Rachh and Tejas Sheth

Last 10 year return (CAGR): 27.8%

Fund managers: Samir Rachh and Tejas Sheth

Last 10 year return (CAGR): 27.8%

4/10

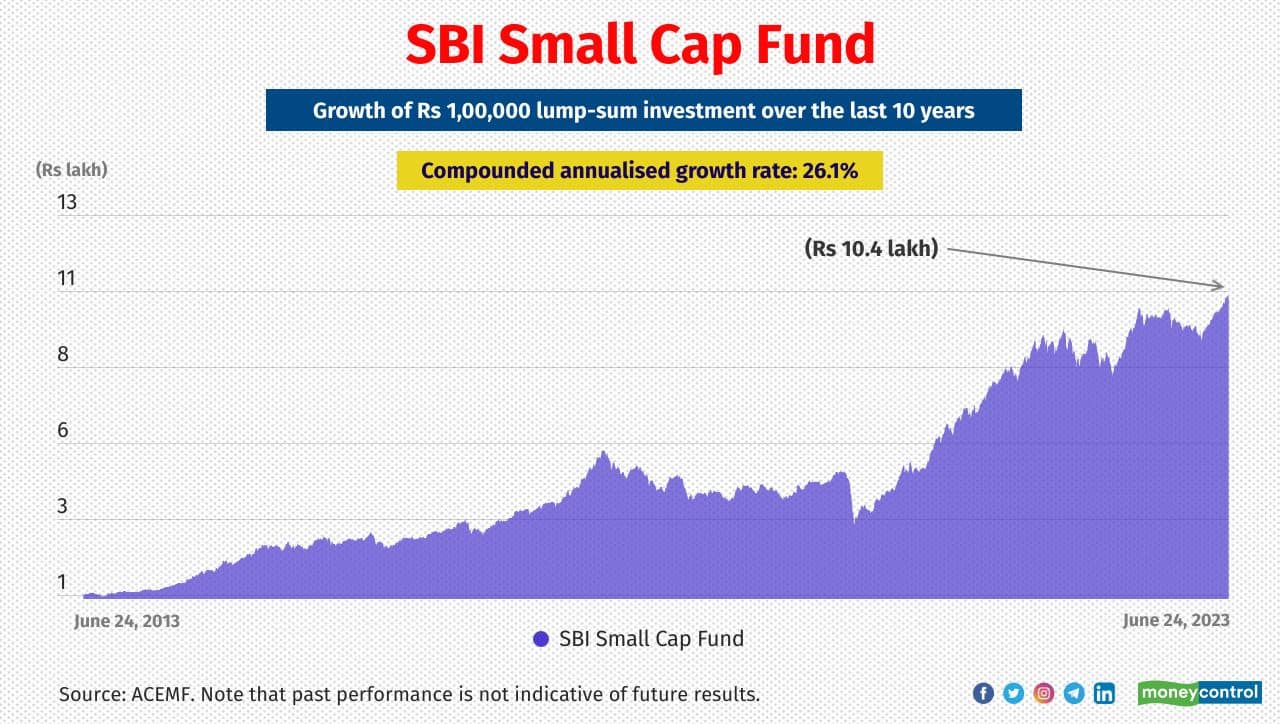

SBI Small Cap Fund

Fund manager: R. Srinivasan

Last 10 year return (CAGR): 26.1%

Also see: Here are the favorite microcap stocks among the smart fund managers – Active MFs, PMSes & AIFs

Fund manager: R. Srinivasan

Last 10 year return (CAGR): 26.1%

Also see: Here are the favorite microcap stocks among the smart fund managers – Active MFs, PMSes & AIFs

5/10

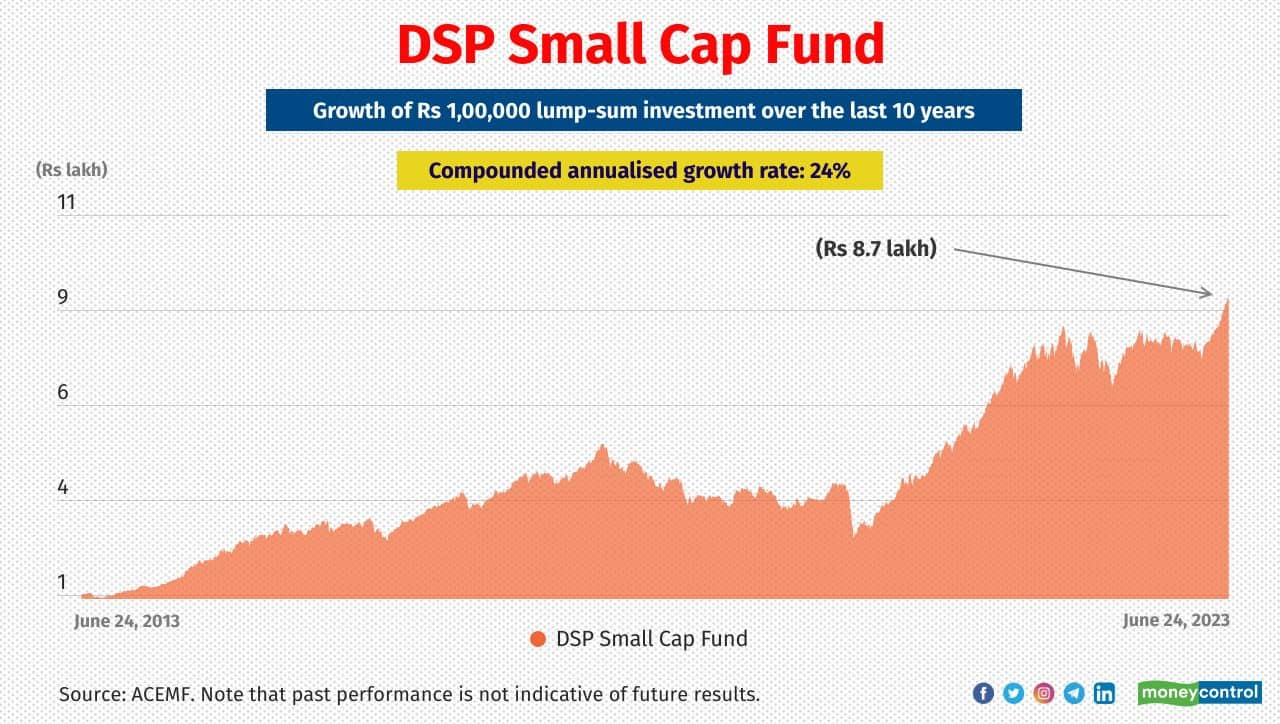

DSP Small Cap Fund

Fund managers: Vinit Sambre, Resham Jain, Abhishek Ghosh and Jay Kothari

Last 10 year return (CAGR): 24%

Fund managers: Vinit Sambre, Resham Jain, Abhishek Ghosh and Jay Kothari

Last 10 year return (CAGR): 24%

6/10

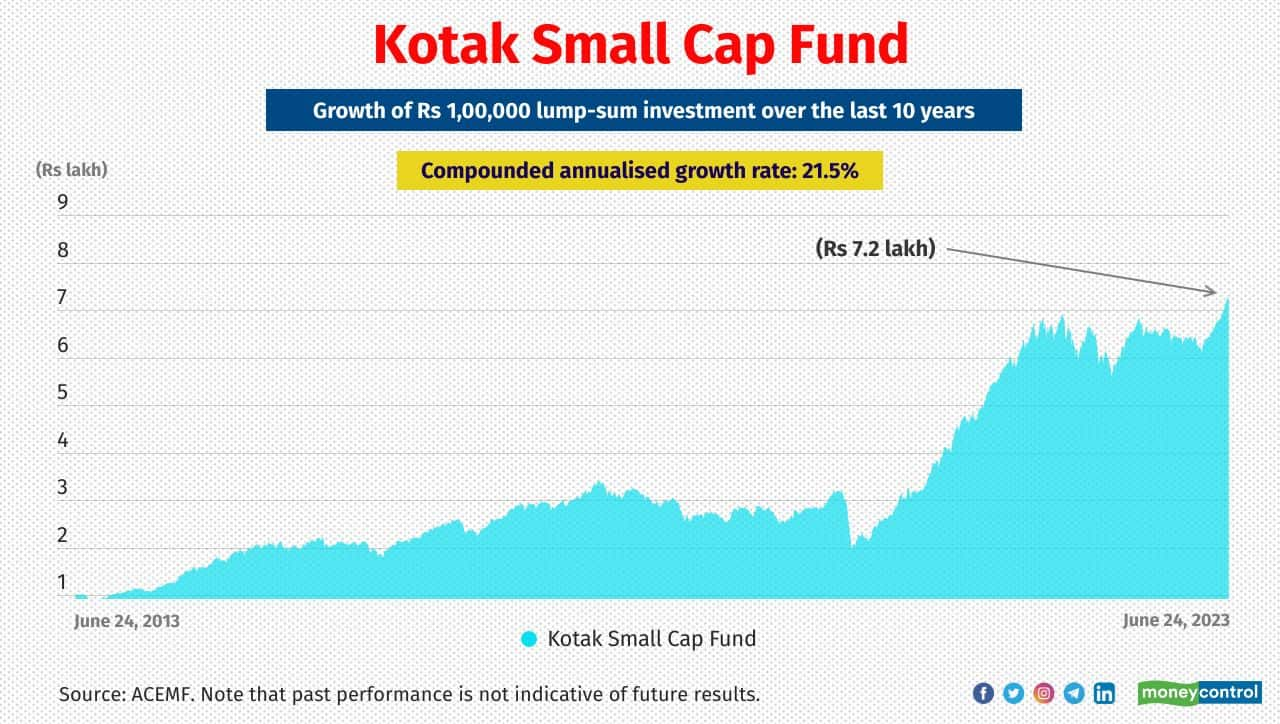

Kotak Small Cap Fund

Fund manager: Pankaj Tibrewal

Last 10 year return (CAGR): 21.5%

Fund manager: Pankaj Tibrewal

Last 10 year return (CAGR): 21.5%

7/10

Franklin India Smaller Cos Fund

Fund managers: R. Janakiraman, Akhil Kalluri and Sandeep Manam

Last 10 year return (CAGR): 21%

Also read: 12 new midcap stocks that PMS fund managers picked in May. Do you own any?

Fund managers: R. Janakiraman, Akhil Kalluri and Sandeep Manam

Last 10 year return (CAGR): 21%

Also read: 12 new midcap stocks that PMS fund managers picked in May. Do you own any?

8/10

Sundaram Small Cap Fund

Fund managers: Ravi Gopalakrishnan and Rohit Seksaria

Last 10 year return (CAGR): 20.2%

Fund managers: Ravi Gopalakrishnan and Rohit Seksaria

Last 10 year return (CAGR): 20.2%

9/10

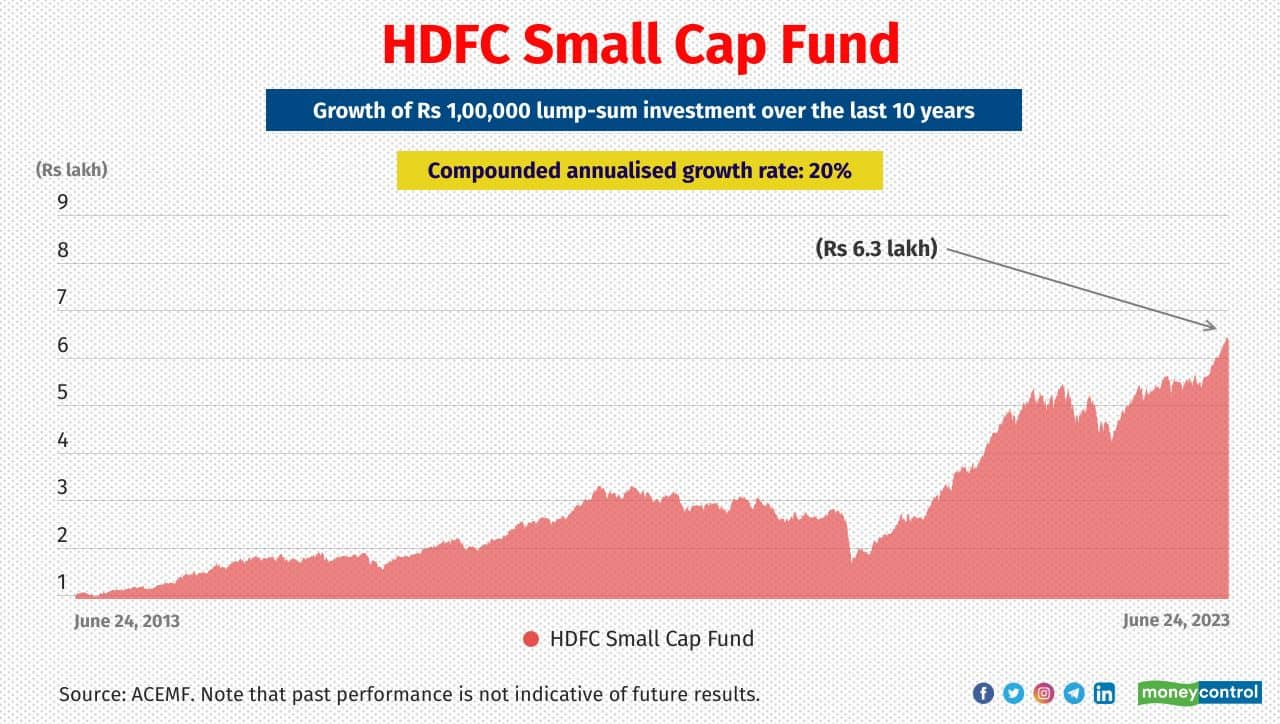

HDFC Small Cap Fund

Fund managers: Chirag Setalvad

Last 10 year return (CAGR): 20%

Also see: Over 1,200% returns in 2 years, but not over yet: MF still hold these multibagger smallcap stocks

Fund managers: Chirag Setalvad

Last 10 year return (CAGR): 20%

Also see: Over 1,200% returns in 2 years, but not over yet: MF still hold these multibagger smallcap stocks

10/10

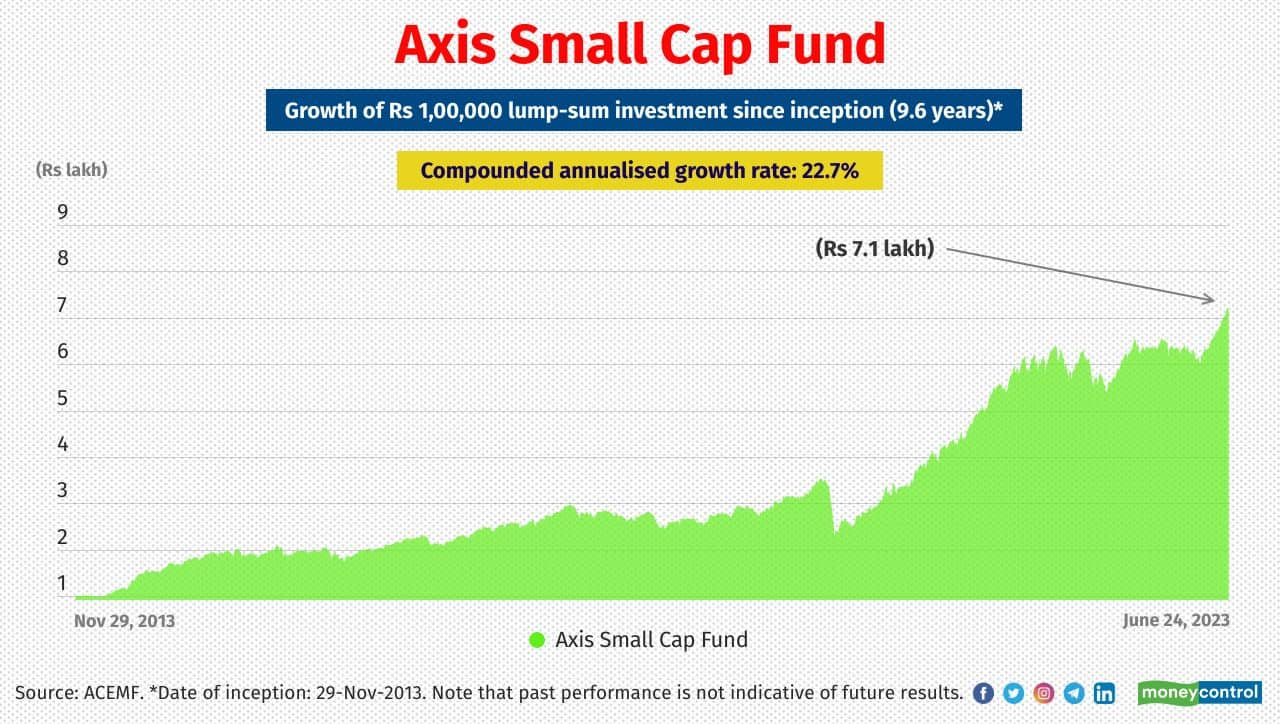

Axis Small Cap Fund

Fund managers: Shreyash Devalkar and Vinayak Jayanath

Return from date of inception of Nov 29, 2013 (CAGR): 22.7%

Also read: Cautious of market highs, these largecap stocks exit MF portfolio

Fund managers: Shreyash Devalkar and Vinayak Jayanath

Return from date of inception of Nov 29, 2013 (CAGR): 22.7%

Also read: Cautious of market highs, these largecap stocks exit MF portfolio

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!