Tulsi Jayakumar

India has voted in a new government decisively. While it remains a moot point whether or not economic issues influenced the electoral outcome, the fact is that the economic challenges facing India are real and need to be taken head-on by the new government.

Improving investments

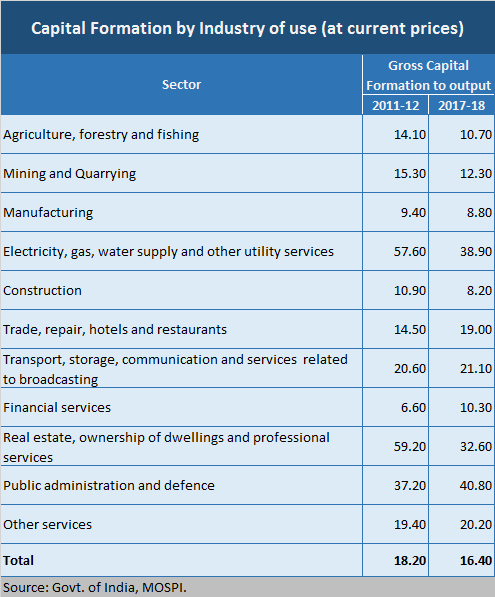

The controversy over the growth numbers notwithstanding, growth requires savings and investment. And India has not witnessed a favourable trend with regard to both. Investment rates, measuring fixed capital formation at the economy level, are down to 28.4 percent in 2017-18 from 34.3 percent in 2011-12. More worrying are the trends with regard to gross capital formation (GCF) at a sectoral level. Table 1 shows that GCF to output ratio is not just lower in employment-intensive sectors like manufacturing and mining, but has been declining over time.

The new government’s challenge will be to improve the investment climate in the economy, lowering policy uncertainties and bottlenecks so as to improve business optimism in the economy, and thereby growth and employment.

Arresting declining savings, increased leverage of households

Equally important is the attention to the savings rate, which has gone down to 30.1 percent in 2017-18 from 33.8 percent in 2011-12. A major source of investment funding in the economy is household saving. Household savings have reduced from 68.2 percent of gross savings in 2011-12 to 56.3 percent in 2017-18. Such a slowdown in the growth rate of the household sector savings has led to a lower growth rate of overall savings, thus jeopardising investment, growth and macro-economic stability.

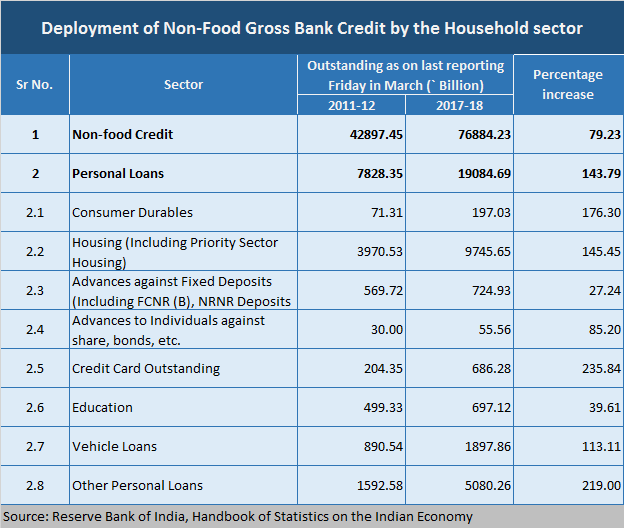

Simultaneously, the increase in household personal loans from organised banking from Rs 7.8 lakh crore in 2011-12 to Rs 19 lakh crore -- by a whopping 143 per cent -- against the backdrop of declining household savings suggests higher leverage of Indian households. Such loans do not account for financial liabilities owed to non-banking financial companies (NBFCs). Such high leverage could be the next big challenge, in addition to the twin debt problem (of corporate India as also that of the financial sector) and act as the major growth disruptor.

Jobs and social security net

The issue of employment generation has remained contentious over the past few years. The last Employment-Unemployment survey in 2016 revealed that only 17 percent of the workforce was employed in the organised sector as salary earners; one-third of the workforce is employed as casual labour. Incidentally, these surveys, as also the Quarterly Economic Surveys, have been discontinued by the Ministry of Labour and Employment.

But even as we await official data on India’s unemployment rate, the challenge is not just to create more jobs, but to improve the quality of employment. The Fifth Employment-Unemployment Survey reveals that 60.6 percent of those available for work got employment for an entire year at the all-India level, while in rural areas, only 52.7 percent got work; 42.1 percent were only partially employed for 6-11 months. The new government’s challenge will be to put in place a national employment policy and announce headline unemployment figures, with clear targets to reduce unemployment.

Cutting the revenue deficit

While the popular concern is about fiscal deficit, an important challenge for the government will be to get revenue deficit under control. In fact, the government may do well to maintain its spending on productive purposes like infrastructure so as to boost aggregate demand even if it means higher short-term fiscal deficit. It has set the revenue deficit target for 2019-20 at 2.2 per cent. To create fiscal space for effective monetary policy by the Reserve Bank of India (RBI), the government will need to reduce revenue deficit to zero.

Improving financial sector health

While growth requires savings and investment, successful intermediation requires a strong financial sector. The banking sector crisis will have to be resolved, especially that of non-performing assets (NPAs) of public sector banks through setting up a loan resolution authority. Going forward, the role of the RBI in ensuring that credit growth is in line with the broad growth rate of the economy becomes critical. The new government will have the challenge of ensuring better coordination between the government and the RBI to achieve broad macroeconomic goals.

A second term of a popular mandate is one that the government can ill-afford to lose. The government will need to pay attention to economic issues above all. The new slogan may very well read: Ab ki baar, arthvyavastha pe prahaar (This time, let there be an attack on the economic system).

(The author is professor of economics and chairperson, Family Managed Business, S P Jain Institute of Management & Research, Mumbai. Views are personal.)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.