The Reserve Bank of India (RBI) may increase the repo rate by 25 basis points on December 7 and then stay on hold in all of 2023, Fitch Ratings has said.

"The RBI has raised rates by a cumulative 190 basis points since the start of the tightening cycle in April 2022, lagging behind the (US) Fed's 350 basis points increases over the same period," Fitch said in the December edition of its Global Economic Outlook report, which was released on December 6.

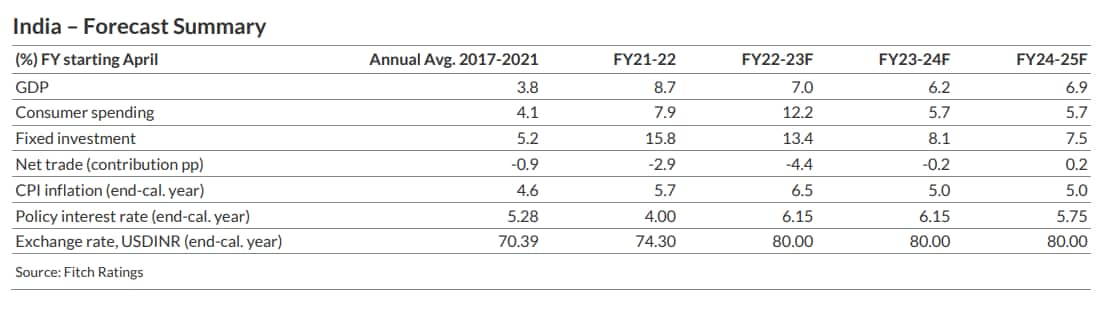

"We now expect the RBI to increase policy rates to 6.15 percent by December and to then hold this rate throughout 2023."

RBI Governor Shaktikanta Das is scheduled to announce the Monetary Policy Committee's (MPC) decision at 10 am on December 7, with economists expecting the rate-setting panel to hike the repo rate by 35 basis points to 6.25 percent.

Also read | In Charts - Movement of key data since RBI's September 30 monetary policy decision

In its Global Economic Outlook report, Fitch retained its GDP growth forecast for India for the current financial year at 7 percent after having lowered it in September. The forecast is in line with the RBI's prediction that the Indian economy will expand by 7 percent in FY23.

"India is shielded to some extent from global economic shocks, given the domestically focused nature of its economy, with consumption and investment making up the bulk of the country's GDP. However, India is not impervious to global developments," Fitch said.

The worldwide economic slowdown is expected to reduce demand for Indian exports and weakness is already evident in recent data – merchandise exports declined for the first time in almost two years including in textiles, petroleum products and engineering goods, it said.

Monetary policy tightening and high inflation also contributed to a slowdown in imports, an easing in personal loan growth and falling purchasing power. Tighter financial market conditions are also weighing on demand for capital goods, which serves as a leading indicator for investment, the ratings agency said.

India's merchandise exports contracted by 17 percent and fell below $30 billion in October–the first time either has happened since February 2021.

While there was no change in India's growth forecast for FY23, Fitch now expects the GDP to grow by 6.2 percent in FY24, 50 basis points lower than it had predicted in September.

The growth forecast for FY25, too, has been cut by 20 basis points to 6.9 percent.

Global GDP outlook lowered

Commenting more broadly on the world economy in its Global Economic Outlook report, Fitch said it had lowered its world GDP forecasts for 2023 due to the tightening of monetary policies and continued deterioration of the Chinese realty sector.

"Taming inflation is proving to be harder than expected as price pressures broaden and become more entrenched. Central bankers are having to take the gloves off. That won't be good for growth," said Brian Coulton, Fitch's chief economist.

Fitch now expects global growth for 2023 at 1.4 percent, down 30 basis points from September.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.