Indian equity markets turned bullish during the month of November as indices recovered their losses from the historical highs achieved during October 2021 and hit fresh highs.

This bullishness is due to the softening inflation, as a result of which the pace of monetary tightening by the central bank will likely ease down.

However, positive changes in macros take time to reflect in the earnings estimates of market analysts, who are waiting for the trend to sustain before reworking their estimates.

Ratings changes come with a time lag vis-a-vis changes in the stock price. Steel stocks had a large run down well before being downgraded. Macro factors are so dynamic that stock prices get affected in the short run, while the rating is done considering the mid-to long-term fundamentals of a stock.

“Markets run six months ahead of fundamentals and had already discounted the negatives before the rating downgrades happened”, said Divam Sharma, Founder, Green Portfolio.

As a result, based on the earnings of Q2FY23 and macro factors, more stocks were downgraded than upgraded in November.

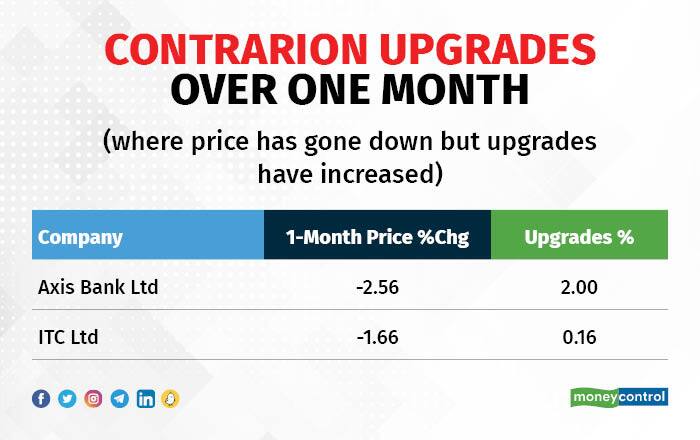

Change over the previous monthAs expected, in spite of recent positive changes in the macro scenario (inflation, bond yields, commodity prices) contrarian downgrades at 9 far outweigh contrarian upgrades, which were just two.

Bharti Airtel witnessed the maximum change in the eyes of analysts as its ‘buy’ calls declined by three from 31 in October. These were converted to two ‘holds’ and one ‘sell’ in November. Experts believe this has more to do with the recent run up in valuations. Also, there are concerns about new customer additions and growth in data traffic, which were key for its performance in the September quarter. However, the stock gained 2.5 percent in November.

The stock price of BPCL jumped 11.5 percent last month in spite of ‘sell’ recommendations increasing from four in October to six in November. The analysts feared a global slowdown would impact the output of crude oil and keep gross refining margins subdued in the near future. But with the softening of crude prices and the Indian economy still on a healthy track, the market’s fears have been allayed and the stock’s price has moved up.

Though the stock of automobile major Tata Motors gained 6.3 percent in November, its ‘buy’ ratings declined by three (to 23), while the number of ‘hold’ calls moved up by one (to six).

HDFC Securities has a ‘sell / reduce’ on Tata Motors due to its weak performance. “While JLR margins lagged expectations, domestic PV (passenger vehicle) and CV (commercial vehicle) margins also declined quarter-on-quarter (QoQ) due to high input costs”, it said.

Despite the best efforts of the management, JLR’s debt has further increased to GBP 8.2 billion from 7.6 billion. JLR has also lowered its EBITDA (earnings before interest, taxes, depreciation, and amortisation) guidance for FY23 and sharply reduced its free cash flow guidance to break-even, from GBP 1 billion earlier.

Tech Mahindra was the lone large-cap IT player that saw its `buy’ calls drop by two last month, from 31 in October to 29. Brokerage firm Motilal Oswal has a ‘neutral’ call on the stock.

“We remain concerned about Tech Mahindra’s weak margins in H1FY23, which makes it unlikely to meet its FY23 exit margin guidance of 14 percent. With increased pressure from an adverse operating leverage in the second half, we expect it to exit FY23 with an EBITDA margin of 13.2 percent, which will make it difficult to deliver a meaningful margin recovery in FY24,’’ it said.

Axis Bank and cigarette major ITC Ltd were the only two Nifty stocks which saw upgrades in their ratings in spite of their stock prices declining 2.6 and 1.7 percent, respectively, in November.

The ‘buy’ calls on Axis Bank increased by one during November to 47, while ‘hold’ calls reduced by one to 3. The stock doesn’t have any ‘sell’ rating.

“The bank has been reporting strong growth in the retail and corporate segments, which, along with MSMEs, would remain the key growth drivers,’’ said analysts at Motilal Oswal. They estimate margins to remain healthy, and expect the cost-to-assets ratio to moderate to ~2 percent by the end of FY25 from the current levels of 2.25 percent. This, coupled with a benign credit cost, would aid RoE (return on equity) expansion.

Like Axis Bank, ITC too doesn’t have any ‘sell’ ratings. The ‘hold’ ratings held steady at two, and there was an addition to its ‘buy’ calls, which now stand at 34.

Experts believe that the marginal decline in stock price might be due to a slight change in perception about the FMCG space as rural demand is still slow and the latest data shows an increase in unemployment, which also impacts the FMCG space.

However, experts remain positive on ITC’s overall growth prospects and market share gains across its businesses.

Change from the previous quarter

The stocks which witnessed price increases last quarter despite the increase in their downgrades from the previous quarter included Cipla, BPCL, Bharti Airtel, JSW Steel, and ITC.

The stock price of pharma major Cipla jumped 6.1 percent during the quarter despite its ‘buy’ ratings declining by four (to 31) in November. The ‘hold’ ratings were up by three (to eight), while the ‘sell’ calls remained unchanged at three.

Despite a strong showing in Q2FY23, the management maintained their 21-22 percent FY23 margin guidance as they expect a seasonally weak 4Q, higher R&D costs, along with a steady US business.

Analysts at JM Financial, who have a ‘hold’ on the stock, said: “We have considered low double-digit growth for the US business (ex-Revlimid) in FY24, and expect the domestic business also to grow likewise”. Given the muted performance of other business segments (SAGA, API, RoW) and stable margin expectations, the management has cut its earnings estimate by three and four percent, respectively, for FY24 and FY25.’’ API stands for active pharmaceutical ingredient (a raw material), SAGA is South Africa, Sub-Saharan Africa and Global Access while RoW is Rest of the world.

BPCL saw its ‘buy’ calls drop to 25 from 28 in the previous quarter, while Bharti Airtel and ITC saw a decline of two `buy’ calls each, with 28 ‘buy’ ratings for Airtel and 34 for ITC.

JSW Steel saw its ‘buy’ ratings drop to 6 in November from 8 in October. Despite this the stock moved positively and gained 7.3 percent during the quarter, primarily due to the abolition of export duty on steel.

However, the overall sentiment towards metal stocks remains weak and it may be a while before the trend reverses.

Geojit Financial Services, which downgraded the rating on JSW Steel to ‘reduce’ after a weak performance in Q2FY23, said, “JSW Steel’s growth is expected to remain muted owing to weak global commodity prices, inflationary pressures, and slowing demand.”

The contrarian upgrades during the quarter were SBI Life Insurance, Hindalco, Tata Consumer Products, and Nestle India.

The stock price of SBI Life Insurance moved down by 5.7 percent relative to the previous quarter, even though one brokerage upgraded its rating from ‘hold’ to ‘buy’. The stock has 34 ‘buy’ ratings, one ‘hold’, and zero ‘sell’ ratings.

The company delivered a strong performance in Q2FY23. SBI Life saw a two percent year-on-year (YoY) fall in APE (annualised premium equivalent), while VNB (value of new business) rose by 24 percent YoY even as margins expanded by more than 6 percent YoY due to an improved product mix.

According to a report by Jefferies, “Segments like non-par savings and protection grew well, but Ulips dragged and the APE from the agency network was weaker, based on which we have trimmed the APE forecast. Between FY22-25, we see the VNB growing at a CAGR of 26 percent, with an 18 percent CAGR in APE.’’ It added that the valuations at 2.2X FY24 EV are attractive and an uptick in premium growth will support the stock. It has a ‘buy’ on the stock.

Hindalco, as expected, did not see much traction compared to the previous quarter due to the overall weakness in the metals space. The stock was down 1.8 percent during the quarter, but still it saw its ‘sell’ ratings drop to zero from 1.

Research firm Nuvama has a ‘buy’ on Hindalco and said in its report that, “Q3FY23 could be a weak quarter amid lower aluminium prices affecting Indian operations, and lower profitability at Novelis (US) due to higher energy costs and lower scrap spread. But we believe Hindalco is pursuing its growth plan while keeping a tight leash on debt, which is a big positive and will aid the stock.”

Year on year change

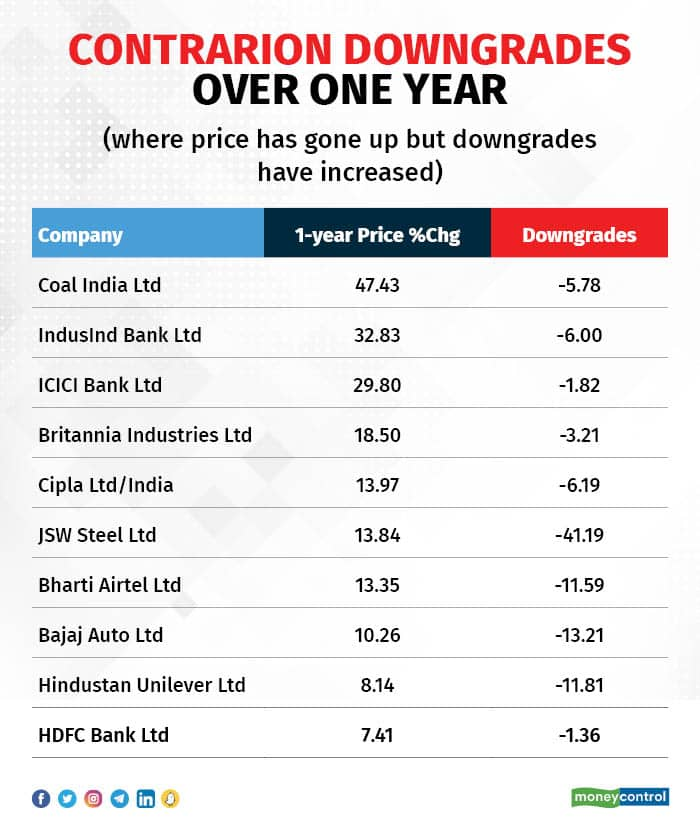

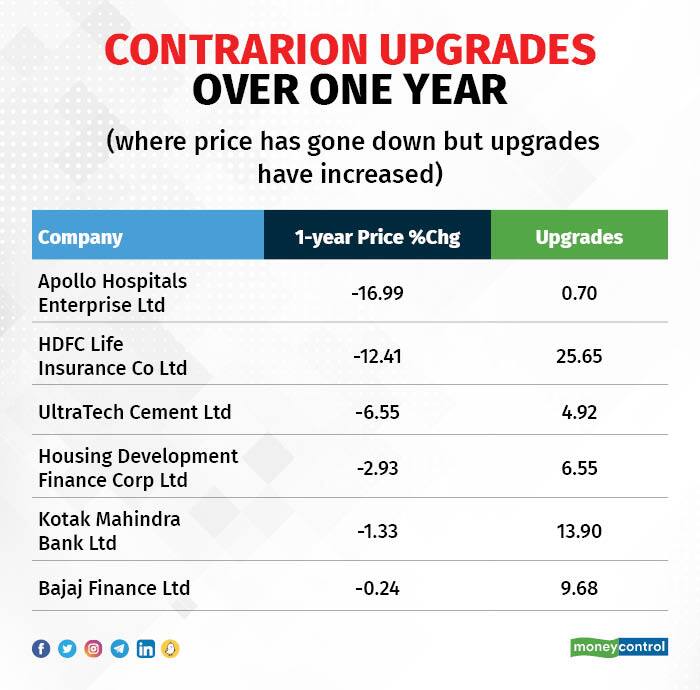

Contrarian downgrades outnumbered the contrarian upgrades 10 to 6 during the 12-month period from December 2021 to November 2022.

The stock of state owned Coal India has had a strong run in the past year, during which it saw its price increase by 47.4 percent. However, analysts have now become wary of its valuations and its future prospects. Hence, it has witnessed its ‘buy’ calls reducing to 18, from 21 a year ago.

The company recorded higher revenue growth and improved margins during the quarter. Experts expect the demand for coal to remain favourable in the short term, because of which stock has witnessed positive investor sentiment.

According to analysts at Geojit Financial Services, “the company’s capital expenditure surged 33 percent YoY in H1FY23 and is expected to increase further in line with its expansion strategy, which may result in higher depreciation and maintenance expenses.’’ This might hamper the bottom-line for some time.

Experts also expect e-auction premiums to fall going forward. E-auctions contributed close to 60 percent of the total EBITDA during the September quarter compared to the three-year average of 20 percent. Internationally as well, coal price may stabilise at lower levels, after surging due to geo-political reasons. Also, delay in the upward revision of prices in fuel supply agreements can impact the prospects of the company.

“Over the near-term, Coal India’s offtake is likely to decline on limited opening stocks and structural limitations to grow output beyond reasonable limits due to mine development and logistical constraints,” said a report from Systematix Research.

Metal stocks have received quite a beating over the past year. Global commodity prices have tanked and demand has suffered due to a slowdown of the global economy. As if this was not enough, problems were compounded by a surge in input costs.

Despite this, JSW Steel saw its price increase by 13.8 percent over the past year and was the top name in the metals space. However, the ‘buy’ calls on the stock reduced from 19 a year ago to 6 as of now.

Banking major IndusInd Bank saw its stock price rise by 32.8 percent compared to a year ago, but also saw its `buy’ calls reduce from 46 to 43 during this period. Three analysts converted their ‘buy’ stance to ‘hold’.

Bajaj Auto also saw its ‘buy’ calls get converted to ‘hold’, which increased its ‘hold’ ratings from 7 to 10. ‘Buy’ calls went down to 31 from 38 a year ago. However, the stock gained 10.2 percent during the past one year.

The company is going through a rough patch due to declining two-wheeler exports and diminishing market share amid stiff competition from other players.

Among the contrarian upgrades, Apollo Hospitals, HDFC Life Insurance, and UltraTech Cement were the top names which saw their prices decline between 6.5-17 percent over the past year despite an increase in ‘buy’ calls for them.

Experts say that the prevailing stock price of Apollo Hospitals does not completely factor in the actual growth prospects in its core healthcare vertical, as well as the incremental growth expected from its pharmacy division.

Disclaimer: The views and investment tips of investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.