A majority of India’s unicorns are sitting on lofty valuations with higher revenue multiples than their global peers, which would make it extremely difficult for companies to raise fresh funds at existing or higher valuations, at a time when startups are battling a slowdown in demand amid a deepening funding winter.

Nearly half of the country’s 107 unicorns that have filed their financial reports for FY22 on average have an LTM (last-twelve-months) revenue multiple of around 30, according to data compiled by Moneycontrol.

The average LTM revenue multiple for Indian startups is higher than most geographies, where such multiples are in the range of 15-20 for high-growth companies, according to investors and bankers Moneycontrol spoke with.

“There is sanity returning on valuations as liquidity tightens across the globe. The last two years cannot be treated as the new normal. Investors are taking adequate time for due diligence, and multiples are correcting across the chart not just for edtech, but also for fintech or SaaS (software-as-a-service firms),” said Swati Murarka, partner at Athera Venture Partners, a venture capital firm.

“For a lot of companies that raised (funds) in the second half of 2020 and 2021 at supernormal valuations, revenue catch-up is required and responsible founders are head-down working towards it,” Murarka added.

The data was collated for 51 unicorns through media reports, regulatory filings, and through intelligence platforms like Tracxn and Venture Intelligence. The data excludes listed unicorns like Zomato, PolicyBazaar, Nykaa, and Paytm.

Revenue multiple is a metric used by investors to gauge the value of equity with respect to the revenue of the company. Startups are typically valued on forward-looking revenue multiples and not on LTMs, where the projected 12-month revenue is considered. But projections are typically made on trailing twelve months.

Slowdown in demand

Moreover, most startups are anticipating slower growth in coming quarters with demand across the board expected to dampen due to macroeconomic headwinds. Startups are thus seen falling short of their revenue projections, which would make it difficult for companies to raise funds in the near term, especially at higher valuations.

For instance, Vedantu, Unacademy, and many other edtech companies raised millions of dollars in 2021 at high valuations. But as things stand, demand for online learning has slowed post the pandemic, with Unacademy expecting about 15 percent growth for 2022 and Vedantu expecting flat growth for the year. Similarly, SaaS companies are expecting a slowdown in demand for their offerings amid recessionary fears in the west.

Also Read: Unacademy to not do cash appraisals in 2023, will instead compensate with stock options

“Revenue has come down significantly across the board for most startups. SaaS, edtech, fintech, which were some of the hottest sectors of the pandemic are witnessing a slowdown in demand,” said a banker who advises startups on valuations requesting anonymity.

“Funding has happened in fintech but that’s because there is lending involved. Pureplay tech-based funding hasn’t happened so far this year at all. So if startups were to raise funds today, they might not be able to raise at their current or higher valuations. But then I think because many unicorns raised large amounts in 2021, they will have a runway and will wait for the markets to get better before they raise a new round,” the banker added.

To be sure, revenue multiple is not the only metric used by investors to value startups.

For different startups, different multiples are used. For example, for a social media company, the lifetime value of a user and the daily active user numbers are considered, for a lending fintech company, the gross loan disbursals are considered, and for a payments firm, the market share is considered. Revenue multiple, however, is among the most important metrics.

In 2021, the Indian startup ecosystem minted a record number of unicorns, on the back of funds pouring into the ecosystem. “Many unicorns weren’t revalued because they did not raise a fresh round. But if somebody would have revalued some of the unicorns, their valuation would have definitely dropped,” said Vikram Gupta, founder, and managing partner at IvyCap Ventures.

“Founders' mindsets are also getting corrected and they are okay to raise funds at the last round’s valuation and sometimes even at a discount from the last round which means investors may have to take a haircut on their prices, based on when and at what valuation they invested,” Gupta added.

More from the data

The data further showed that the median LTM revenue multiple for the 51 unicorns is around 20, with a few unicorns having an LTM revenue multiple of more than 100. Neobanking platform for MSMEs (micro, small, and medium enterprises), Open Financial Technologies had the highest LTM revenue multiple of 138.54, while BigBasket, which was acquired by the Tata group in 2021, had the lowest revenue multiple of 1.72, according to the data.

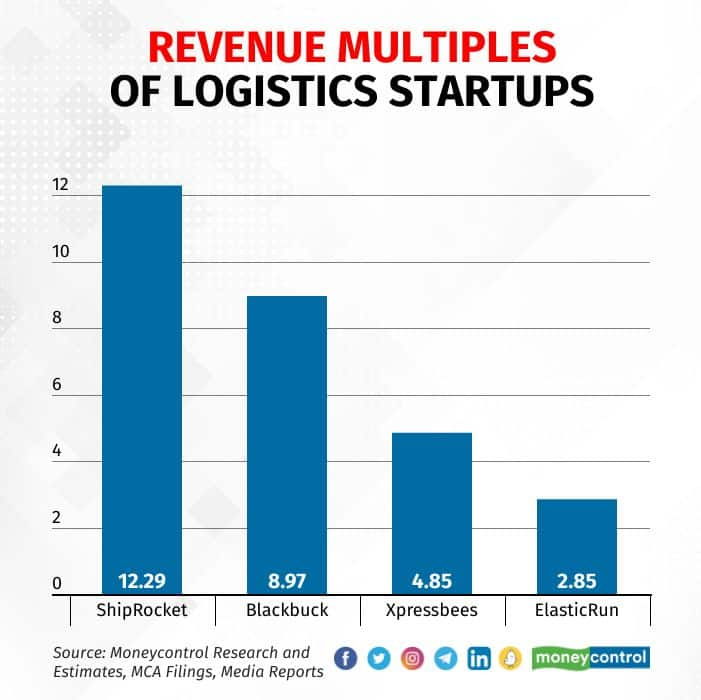

The numbers show that logistics companies, on average, had the lowest revenue multiple. There were four logistics unicorns in the data set—ShipRocket, XpressBees, ElasticRun, and BlackBuck—and their average LTM revenue multiple was 7.23, with ShipRocket having the highest multiple of 12.29 and ElasticRun having the lowest of 2.85.

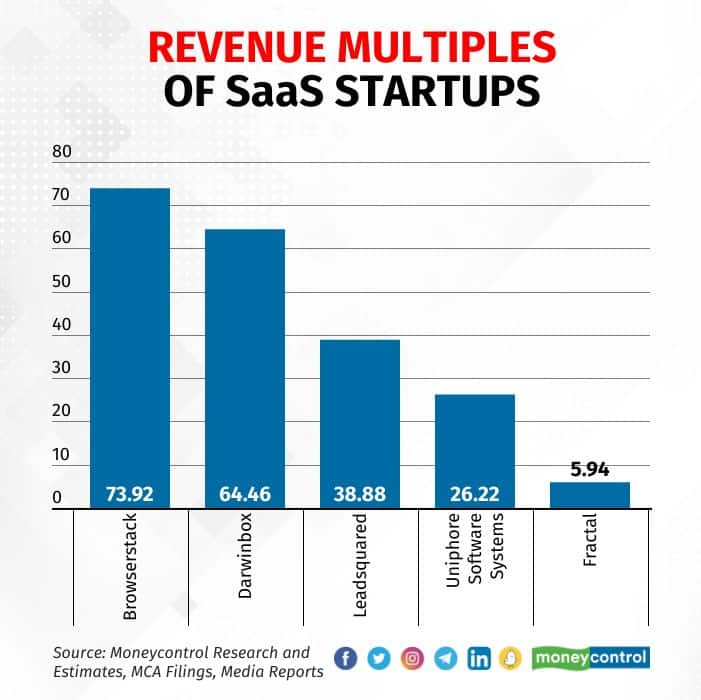

SaaS companies, meanwhile, had an average revenue multiple of more than 40, the highest.

Five of the 51 companies on the list were SaaS companies. These five—Leadsquared, Fractal Analytics, Uniphore Software Systems, DarwinBox, and BrowserStack—had an LTM revenue multiple of around 42 on average. BrowserStack, a software-testing platform valued at $4 billion as on March 31, 2022, had the highest revenue multiple of more than 75, while Fractal Analytics had a multiple of about 6.

Five of the 51 companies on the list were SaaS companies. These five—Leadsquared, Fractal Analytics, Uniphore Software Systems, DarwinBox, and BrowserStack—had an LTM revenue multiple of around 42 on average. BrowserStack, a software-testing platform valued at $4 billion as on March 31, 2022, had the highest revenue multiple of more than 75, while Fractal Analytics had a multiple of about 6.

“SaaS businesses are very strong businesses... The gross margins in a SaaS business can even go up to 90 percent,” said Gupta of IvyCap Ventures. That kind of return explains why people keep putting money into such companies, he said.

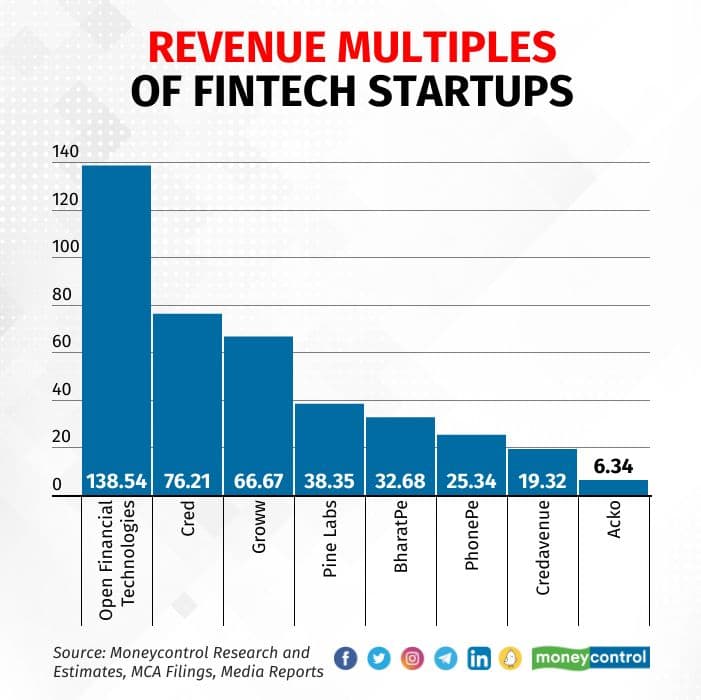

Besides SaaS, fintech unicorns, too, had high revenue multiples. In the data set, there were eight fintech unicorns—OneCard, PhonePe, BharatPe, Pine Labs, Groww, Acko, Open, and Cred—and the average LTM revenue multiple of these companies was a little over 38. While Open had the highest multiple of 138.54, Acko had the lowest of 6.34, the data showed. PhonePe and BharatPe had revenue multiples of 25 and 33, respectively, much higher than their listed peer Paytm’s revenue multiple of 6.8 as of March 2022.

Besides SaaS, fintech unicorns, too, had high revenue multiples. In the data set, there were eight fintech unicorns—OneCard, PhonePe, BharatPe, Pine Labs, Groww, Acko, Open, and Cred—and the average LTM revenue multiple of these companies was a little over 38. While Open had the highest multiple of 138.54, Acko had the lowest of 6.34, the data showed. PhonePe and BharatPe had revenue multiples of 25 and 33, respectively, much higher than their listed peer Paytm’s revenue multiple of 6.8 as of March 2022.

“In a private market, the loss on a down round would come out of shareholders, which includes the promoter and earlier investors. There is assurance also, in a way. The complication of a down round ensures that the value does not fall, which doesn't happen in the public market,” said Anirudh Damani, managing partner at Artha Venture Fund, an early-stage VC that has backed at least four fintech startups.

Damani also said that unlike private markets, which typically include long-term investors, public markets do not value long-term innovations. Public markets rather value their financial metrics every quarter. Private market investors, hence, tend to give a higher value even to loss-making companies based on their long-term innovation plans.

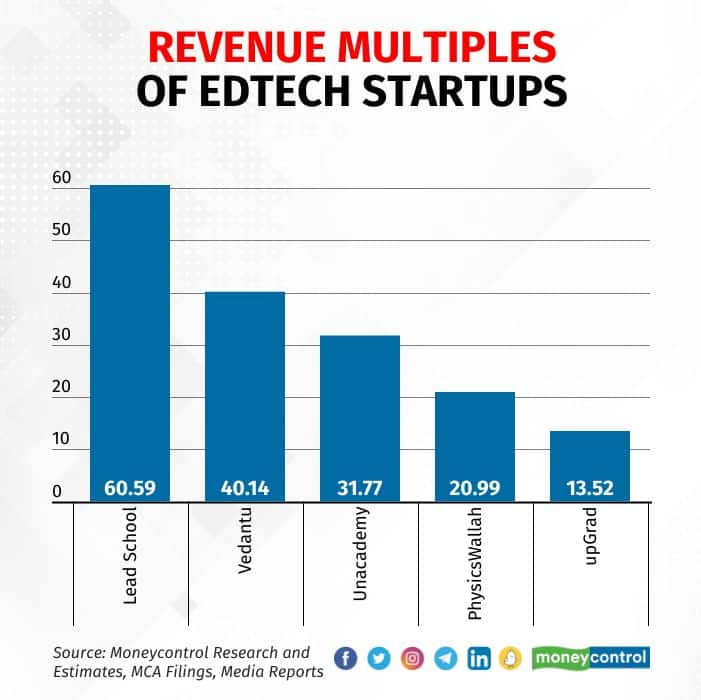

Other than fintech and SaaS companies, valuations of edtech firms were among the highest. There were five edtech unicorns in the data set and the average LTM revenue multiple was a little over 33, with LEAD School having the highest revenue multiple of over 60. On the other hand, upGrad had the lowest revenue multiple of a little over 13.

When the Covid-19 pandemic hit the expectation was that every child would be taking classes online and that schools would not reopen. “Now that has happened, we (investors) are revalidating the thesis in the first place,” Damani said.

“Secondly, if you add up all the market share expectations by all these companies together, it is more than the market itself,” he added. Damani’s Artha Venture Fund has invested in at least two early-stage edtech companies.

The fillip that technology companies got because of the stay-at-home Covid-19 restrictions in FY21 or the first year of the pandemic continued in FY22, with the second wave hitting the country in April 2021. Most edtechs, thus, recorded strong revenue growth during the year.

Fundraising to become difficult

Given that growth is expected to stumble in the coming quarters, fundraising, especially at such lofty valuations, will be difficult for startups, in particular for those who have a high burn rate and limited runway left, according to industry observers.

“Companies will need to significantly cut down expenses this year if they want to survive this funding winter and slowdown in demand. I don’t see any other way. Startups won’t raise funds at down rounds for sure,” said a partner at one of India’s most prolific private market investors, requesting anonymity. A fundraise where the post-money valuation is at a discount to that of the last funding round.

“In India, down rounds have never happened. Here founders’ egos are more inflated than valuations. So founders will do everything that is required to stay alive at the current valuation. If there’s no growth, they will focus on profitability, but won’t settle for down rounds I feel,” the investor added.

Moreover, investors now have public market benchmarks for technology companies. For instance, PhonePe has a listed peer in Paytm, Acko has a listed peer in Policybazaar, and Zomato in Swiggy. All the companies, Paytm, Zomato, Policybazaar, Delhivery, and Nykaa among others, have been trading well below their private market valuations.

“Now an investor knows how much the public markets are willing to give for companies,” said another banker, requesting anonymity.

“Because Zomato is well below its private market valuation, investors will have a benchmark for Swiggy. So Swiggy’s revenue or other metrics need to be much better than Zomato if the company has to list on its current value or higher than its current valuation,” the banker added.

Meanwhile, investors, including the most bullish ones that have been aggressively pouring money into India, have scaled down investments this year already. In January, funding to Indian startups dropped to a five-year low, and Tiger Global and Sequoia Capital, which have backed 38 and 31 of India’s 107 unicorns, respectively, did not participate in a single funding round, even at early stages, Moneycontrol reported.

Also read: Tiger Global closes zero India startup deals in January for first time in 2 years

Investors are also seen shifting their bets towards more fundamentally strong companies. In January, Moneycontrol reported how VCs would prefer investing in ‘cockroaches’ over unicorns this year.

The term cockroach is used to describe a startup that has the ability to survive during periods of funding slowdowns through tighter cost controls.

“If the fundamentals are solid, there is capital available albeit with comprehensive due diligence. Most startups, including unicorns, are taking a prudent approach to cut costs and reduce burn to increase their runway expecting to raise in a better liquidity environment,” Murarka of Athera Venture Partners said.

As startups battle the slowdown in demand amid a cash crunch, many might need to raise funds in the coming quarters. But given the lofty valuations, unicorns are sitting on, they might have to settle for flat and down rounds, and, for that, as the above-quoted investor said, they will have to fight their egos. When a company raises a new round of funding at the same valuation as its last fundraise, it refers to a flat round.

“A few cases of flat/down rounds may happen where there is a cash crunch combined with overpriced last-round valuations unjustified by business metrics,” Murarka of Athera said.

[This is the first of a two-part series from Moneycontrol on data of 51 unicorns who have filed their results for FY22.]

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.