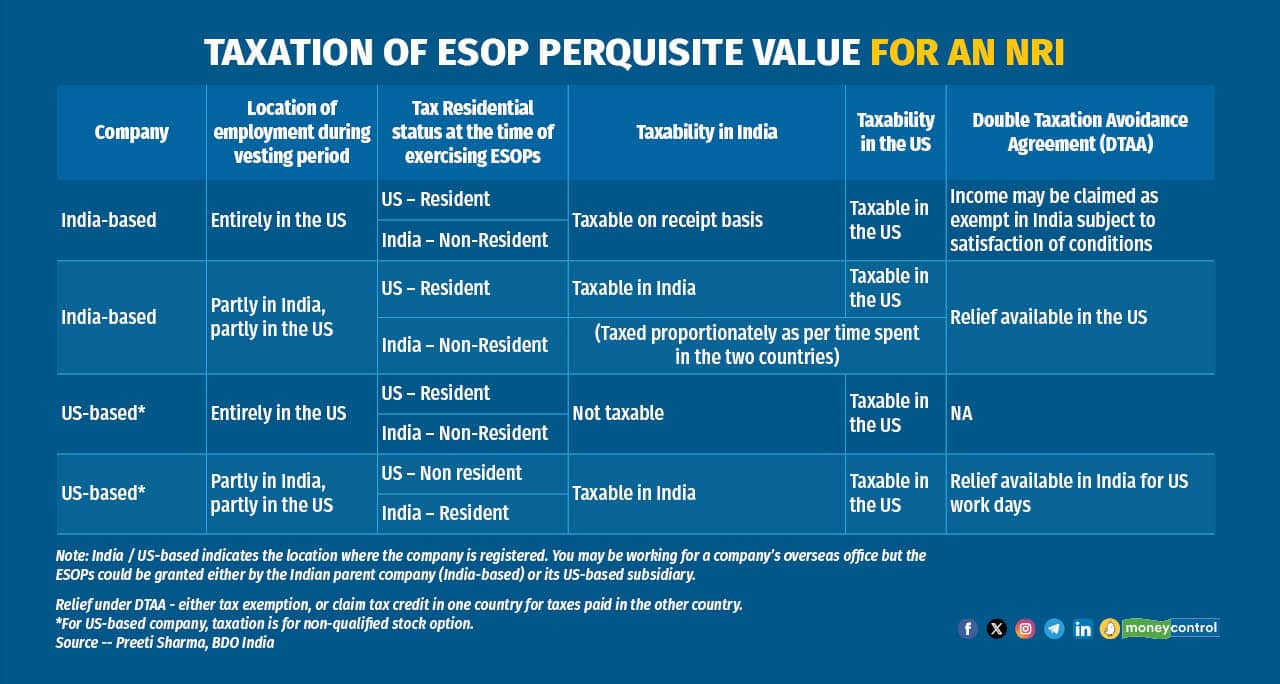

Taxation matters can be complex and more so, when they involve more than one country. If you are an Indian resident holding the ESOPs or employee stock ownership plans of an Indian company as part of your compensation package, the taxation of such ESOPS is clearly laid out under Indian tax laws. You get taxed at two stages – one, when you exercise your right under the ESOP to buy the shares and two, when you sell these shares. At the first stage, you get taxed on the perquisite value at your income tax slab rate. At the second stage, you get taxed on the capital gains, if any (see graphic).

Also read: All you wanted to know about ESOPsThe taxation of ESOPs, however, gets complex if you are an NRI (non-resident Indian). Do you, then, get taxed based on the taxation rules of India or of the other country?

“ESOP taxation depends on the rules of the country (India, in case of an India-based company) in which the ESOPs are granted/ exercised and the shares are sold, along with the country of residence of the taxpayer,” says Preeti Sharma, Partner, Global Employer Services, BDO India.

Elaborating further on her point, she says that if a person has resided in more than one country during the vesting period (period from grant date until the point in time you can start exercising the ESOP), the perquisite value (taxable value) of ESOPs at the time of exercise may be allocated proportionately to these countries. Additionally, what also matters is whether at the time of exercising the ESOPs, the person is a tax resident of India or the other country. (see graphic)

Note that, there can be situations where an individual becomes a tax resident of two countries (based on the conditions fulfilled as per the tax laws). In that case, a ‘tie-breaker test’ is applied to establish the individual’s primary place of residence – either India or the other country - for tax purposes.

Also read: Made millions via ESOPs when your startup listed? Here’s how you must invest the jackpot smartlyTaxation when ESOPs are exercisedHere are two simplified examples to understand how all these factors may work together to impact the taxation of ESOPs for an NRI. (see graphic)

Let’s suppose Mr X is working at the India office of an Indian company. He has been given ESOPs. Later he is transferred to the overseas office of this company. Once the vesting period (partly spent in India, and partly in the other country) is over, Mr X exercises the ESOPs (buys his company’s shares). How will he be taxed?

According to Sharma, a part of the perquisite value that relates to the period of employment in India (India-sourced income) will be taxable in India and the rest (non-India-sourced/ global income) will be taxable in the other country. So, if half of the vesting period was spent in India, then 50 percent of the perquisite value will be offered for taxation in India. This is how Mr X will be taxed if he is not a tax resident of India at the time of exercise.

But, if Mr X happens to be a tax resident of India at the time of exercise, then the entire perquisite value will be offered for taxation in India. However, he can claim credit in India for taxes paid in the other country on the gains relating to the employment period in India.

Now, let’s take a slightly modified version of the above example. Suppose Ms Y has been working in the overseas office of an Indian company (right from the start) and she is granted ESOPs by the Indian parent company. Once the vesting period is over, she exercises the ESOPs. Then, how will she be taxed?

Akhil Chandna, Partner, Grant Thornton Bharat LLP says, that Ms Y will be taxed as per the laws of the other country – which is where employment is being exercised. In addition, if she also qualifies as a tax resident of India, she will be taxable in India too on this income (all of which is global income). She can, however, claim foreign tax credit in India.

Note that, someone residing in another country, can still be a tax resident of India, especially in their initial years of shift from India to the other country. With time, the person is likely to become a tax resident of the other country where he / she is normally residing.

Also read: MC Explains: How is an ESOP different from RSU and ESPPTaxation on sale of sharesRegarding, the taxation of capital gains, Chandna says, “Capital gain from the sale of shares of an Indian company is always considered as India sourced income and is, therefore, taxable in India.” This is irrespective of the person’s residential status. But he says, that this income may also have to be offered for taxation in the other country as per the DTAA (double taxation avoidance agreement) or as per that country’s tax laws, whichever is applicable (see graphic). Simply put, what this means is, that depending on the DTAA or the other country’s tax rules (if no DTAA exists), the person may either get tax exemption or be able to claim tax credit for the capital gains tax paid. (see graphic)

Venkat Krishnamurthy, Managing Partner, V Ramaratnam and Company gives two examples to provide more clarity on this. In case of the US-India DTAA, the capital gain will be taxed in both the countries. However, tax credit can be claimed in the country in which the person is resident.

In case of the Singapore-India DTAA, for shares acquired before April 1, 2017 (that is, when exercise date falls before April 1, 2017), capital gains will be taxed only in the country where the person is resident. However, for shares acquired after April 2017 (when exercise date falls after April 1,2017), the capital gains may be taxed in the source country (that is, where the company is resident).

Finally, what happens if there is no DTAA between India and the other country? According to Sharma, Indian tax laws still provide relief to its tax residents on doubly taxed income in the form of tax credit for taxes paid in the other country. However, such credit is available only on the income sourced from the other country.

Other tricky areasHowever, claiming tax credit or tax exemption may not be that straightforward. The timing of taxation of ESOPs may vary from country to country – for example, taxation in India at the time of exercise of ESOP versus, taxation in another country only at the time of sale of shares. “Given that the taxes on the same income shall be paid in different years, the person will face practical challenges in claiming relief from double taxation,” says Sharma.

Also, what happens if you continue holding the shares (instead of selling them) even after your return to India? No capital gains tax will apply. But, if you are holding the shares of a foreign company, you will have to declare them under schedule FA in your income tax returns as these are a foreign asset. Ameet Patel, Partner, Manohar Chowdhry & Associates says, “At the time of declaration, you need to be clear on what you are mentioning as the cost of acquisition of these shares. This is important because later when you sell these shares, the cost of acquisition taken for the purpose of calculating capital gain must match with the cost of acquisition declared earlier.”

Finally, though not a taxation issue, an NRI will also have to deal with the matter of repatriation of funds received from the sale of shares. “Funds can be repatriated only if permissible under FEMA,” says Sharma. Rules under FEMA or the Foreign Exchange Management Act govern how money can be repatriated from India to another country.

Given the complexities involved in taxation of ESOPs for NRIs, it’s best that professional advice be sought on this.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.